Social Security's 2034 Funding Gap: What Congress Must Do To Avoid Benefit Reductions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Social Security's 2034 Funding Gap: A Looming Crisis and Congress's Crucial Role

The looming Social Security funding crisis is no longer a distant threat. By 2034, the Social Security Administration (SSA) projects the trust funds will be depleted, leading to potential benefit reductions for millions of retirees and disabled Americans unless Congress acts decisively. This isn't just a numbers game; it's a matter of ensuring the financial security of millions who depend on these vital benefits.

The projected shortfall stems from a confluence of factors: an aging population, increasing life expectancy, and a declining worker-to-beneficiary ratio. These demographic shifts put immense pressure on the system's ability to meet its obligations. The longer Congress delays addressing the issue, the more drastic the necessary measures will become.

Understanding the 2034 Deadline and its Implications

The 2034 deadline doesn't signify a complete collapse of Social Security. Even after the trust funds are depleted, the SSA will still be able to pay out a portion of scheduled benefits – an estimated 80% – using incoming payroll taxes. However, this 20% reduction would represent a significant blow to the financial well-being of millions of seniors and disabled individuals already struggling with rising healthcare costs and inflation. This potential cut could force many into poverty or severely limit their access to essential resources.

Potential Solutions: A Multi-Pronged Approach

Congress has several options to address this funding gap, and a combination of strategies is likely necessary for a sustainable solution. These include:

-

Raising the Full Retirement Age: Gradually increasing the age at which individuals can receive full retirement benefits could significantly reduce long-term liabilities. This approach, however, needs careful consideration to avoid disproportionately impacting lower-income workers who often have shorter lifespans and less opportunity for savings.

-

Increasing the Taxable Wage Base: Currently, Social Security taxes only apply to earnings up to a certain limit. Raising this cap would bring more high-income earners into the system, boosting revenue. This measure would require a careful balance to avoid unduly burdening higher earners.

-

Modifying COLA Adjustments: The annual cost-of-living adjustment (COLA) helps ensure benefits keep pace with inflation. While crucial for maintaining purchasing power, adjustments to the COLA calculation could potentially moderate benefit growth. This approach warrants thorough analysis to avoid undermining the purchasing power of benefits.

-

Cutting Benefits for Wealthier Recipients: This controversial proposal suggests reducing benefits for higher-income retirees. Implementing such a policy would require careful consideration of equity and potential unintended consequences. Defining "wealthier recipients" accurately and fairly would also be critical.

The Urgency of Congressional Action

The longer Congress procrastinates, the more difficult the necessary solutions will become. Delaying action could lead to more drastic benefit cuts or tax increases down the line. Furthermore, a sudden and significant reduction in benefits in 2034 would create substantial economic and social upheaval.

What You Can Do:

Contact your elected officials and urge them to prioritize finding a sustainable solution for Social Security's long-term solvency. Your voice matters in shaping the future of this crucial social safety net. Learn more about Social Security's financial health and the proposed solutions by visiting the Social Security Administration website . Staying informed and engaged is crucial to ensuring the long-term viability of this vital program for future generations.

This is not merely a political issue; it's a matter of ensuring economic security for millions of Americans. Congress must act decisively and responsibly to prevent a crisis that would impact countless families and the nation's economy as a whole.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Social Security's 2034 Funding Gap: What Congress Must Do To Avoid Benefit Reductions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Humanitarian Crisis In Gaza 11 Killed Seeking Aid Rescue Teams Say

Jun 20, 2025

Humanitarian Crisis In Gaza 11 Killed Seeking Aid Rescue Teams Say

Jun 20, 2025 -

Trade Update In Depth Look At Rossi Marchment And Romanov Deals

Jun 20, 2025

Trade Update In Depth Look At Rossi Marchment And Romanov Deals

Jun 20, 2025 -

Breaking Los Angeles Lakers Sale Confirmed Details Of The Historic Deal

Jun 20, 2025

Breaking Los Angeles Lakers Sale Confirmed Details Of The Historic Deal

Jun 20, 2025 -

Navigating Change Liberty Adapts To Life Without Leonie Fiebich

Jun 20, 2025

Navigating Change Liberty Adapts To Life Without Leonie Fiebich

Jun 20, 2025 -

Juneteenth Celebrations Scaled Back A Global Overview

Jun 20, 2025

Juneteenth Celebrations Scaled Back A Global Overview

Jun 20, 2025

Latest Posts

-

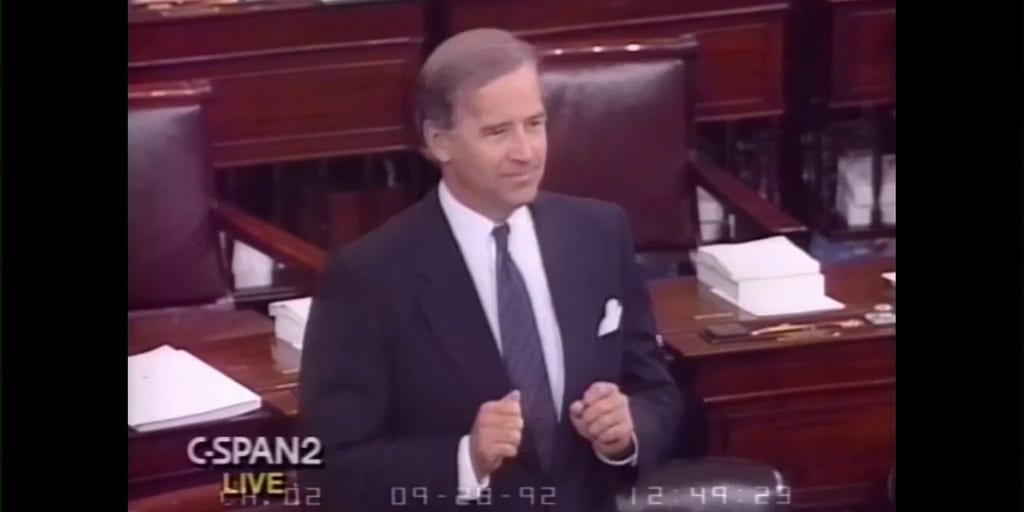

Thirty Years Later Examining Bidens 1992 Crime Concerns In Washington D C

Aug 18, 2025

Thirty Years Later Examining Bidens 1992 Crime Concerns In Washington D C

Aug 18, 2025 -

Us China Tensions Flare The Role Of A Hong Kong Media Mogul

Aug 18, 2025

Us China Tensions Flare The Role Of A Hong Kong Media Mogul

Aug 18, 2025 -

What The No Ceasfire No Deal Summit Means For The Us Russia And Ukraine

Aug 18, 2025

What The No Ceasfire No Deal Summit Means For The Us Russia And Ukraine

Aug 18, 2025 -

Delta Blues Culture Preserving Heritage In A Mississippi Town

Aug 18, 2025

Delta Blues Culture Preserving Heritage In A Mississippi Town

Aug 18, 2025 -

Americans Abandon Trump Cnn Data Pinpoints The Decisive Factor

Aug 18, 2025

Americans Abandon Trump Cnn Data Pinpoints The Decisive Factor

Aug 18, 2025