Social Security's 2034 Funding Gap: A Looming Threat To Retirees

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Social Security's 2034 Funding Gap: A Looming Threat to Retirees

Introduction: The looming threat of a Social Security funding gap in 2034 casts a long shadow over the retirement plans of millions of Americans. While the program isn't expected to become insolvent, the projected shortfall signifies a potential 20% cut in benefits unless Congress acts. This article delves into the intricacies of this impending crisis, exploring its causes, potential consequences, and the possible solutions being debated.

Understanding the 2034 Social Security Funding Gap:

The Social Security Administration (SSA) projects that the Social Security Trust Fund will be depleted by 2034. This doesn't mean Social Security will disappear; however, it means the incoming payroll taxes will only cover approximately 80% of scheduled benefits. This translates to a potential 20% across-the-board reduction in benefits for all recipients. This isn't a sudden collapse, but a gradual erosion of benefits that could severely impact retirees' financial security.

Causes of the Funding Gap:

Several factors contribute to this projected shortfall:

- Aging Population: The US population is aging, meaning more people are collecting benefits while fewer are contributing through payroll taxes. This demographic shift puts immense pressure on the system.

- Increased Life Expectancy: People are living longer, leading to longer periods of benefit receipt and increased overall payouts.

- Declining Birth Rates: Lower birth rates mean a smaller workforce to support a growing number of retirees.

- Economic Slowdowns: Periods of economic recession reduce payroll tax revenue, further straining the system.

Potential Consequences of the Funding Gap:

A 20% reduction in Social Security benefits could have devastating consequences for millions of retirees:

- Increased Poverty Rates: Many retirees rely heavily on Social Security for their income. A benefit cut could push many below the poverty line.

- Reduced Standard of Living: Even for those not pushed into poverty, a significant benefit reduction would drastically impact their quality of life and ability to afford healthcare, housing, and other necessities.

- Strain on Family Members: Reduced Social Security benefits could place an increased burden on family members to support aging relatives.

Proposed Solutions and Current Debates:

Several solutions are being debated to address the funding gap, including:

- Raising the Full Retirement Age: Gradually increasing the age at which individuals can receive full benefits.

- Increasing the Social Security Tax Rate: Slightly raising the payroll tax rate for both employers and employees.

- Raising the Social Security Taxable Wage Base: Increasing the amount of earnings subject to Social Security taxes.

- Benefit Reductions (as projected): While this is the most likely outcome without Congressional action, it's the least desirable option for retirees.

- Cutting other government spending: Though controversial, reallocating funds from other areas to shore up Social Security is also being discussed.

What You Can Do:

While the future of Social Security remains uncertain, there are steps individuals can take to prepare:

- Save Aggressively for Retirement: Relying solely on Social Security is risky. Diversifying your retirement savings through 401(k)s, IRAs, and other investments is crucial.

- Stay Informed: Keep abreast of developments regarding Social Security reform and potential legislative changes. Engage with your elected officials to express your concerns.

- Plan for Potential Benefit Reductions: Develop a realistic retirement budget that accounts for potential benefit cuts.

Conclusion:

The 2034 Social Security funding gap poses a serious threat to the financial security of millions of retirees. While the system is not expected to collapse, significant action is needed to prevent substantial benefit reductions. Understanding the issue, engaging in the debate, and proactively planning for retirement are essential steps in navigating this critical challenge. Contact your representatives in Congress to voice your concerns and advocate for solutions that protect the future of Social Security. The time to act is now.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Social Security's 2034 Funding Gap: A Looming Threat To Retirees. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Key Witness Testimony Video Evidence In The Kohberger Case

Jun 20, 2025

Key Witness Testimony Video Evidence In The Kohberger Case

Jun 20, 2025 -

Is Trumps Gift Announcement A Distraction From Worsening Global Issues

Jun 20, 2025

Is Trumps Gift Announcement A Distraction From Worsening Global Issues

Jun 20, 2025 -

Ntsbs Rare Safety Bulletin Highlights Boeing 737 Max Engine Risks

Jun 20, 2025

Ntsbs Rare Safety Bulletin Highlights Boeing 737 Max Engine Risks

Jun 20, 2025 -

Silence Broken Michael Proctor Comments On Karen Read Retrial Verdict

Jun 20, 2025

Silence Broken Michael Proctor Comments On Karen Read Retrial Verdict

Jun 20, 2025 -

Maria Bartiromo Shares False Trump Post A Viral Hoax Debunked

Jun 20, 2025

Maria Bartiromo Shares False Trump Post A Viral Hoax Debunked

Jun 20, 2025

Latest Posts

-

The Gilded Age Exploring Berthas Moral Triumph And Personal Loss

Aug 18, 2025

The Gilded Age Exploring Berthas Moral Triumph And Personal Loss

Aug 18, 2025 -

Spike Lees Work Celebrated At The Smithsonian A Look Back And Forward

Aug 18, 2025

Spike Lees Work Celebrated At The Smithsonian A Look Back And Forward

Aug 18, 2025 -

Paul Krugman On Trumps Immigration Policies A Critique Of Its Fundamental Flaw

Aug 18, 2025

Paul Krugman On Trumps Immigration Policies A Critique Of Its Fundamental Flaw

Aug 18, 2025 -

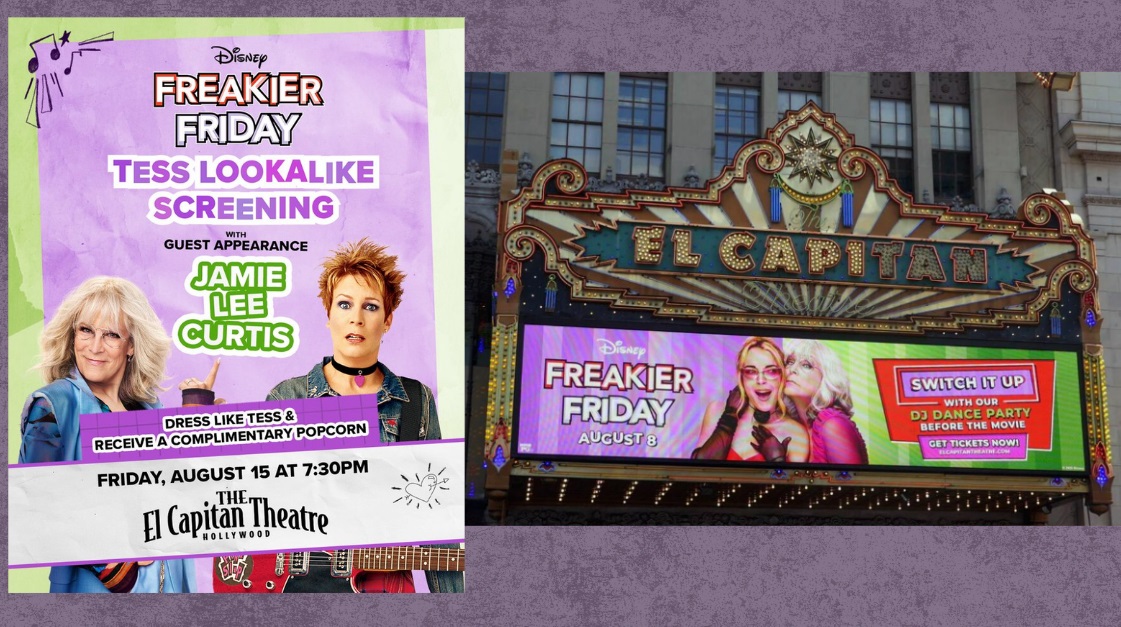

Experience Freakier Friday Fan Event At The El Capitan Theatre

Aug 18, 2025

Experience Freakier Friday Fan Event At The El Capitan Theatre

Aug 18, 2025 -

Public Opinion Shift Cnns Data Shows Americans Abandoning Trump

Aug 18, 2025

Public Opinion Shift Cnns Data Shows Americans Abandoning Trump

Aug 18, 2025