Social Security's 2034 Cliff: What Congress Must Do To Avoid Benefit Reductions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Social Security's 2034 Cliff: What Congress Must Do to Avoid Benefit Reductions

The looming crisis facing Social Security is no longer a distant threat. By 2034, the Social Security Trust Fund is projected to be depleted, triggering automatic benefit reductions for millions of retirees, survivors, and disabled Americans. This isn't just a fiscal concern; it's a potential social and economic catastrophe. The question isn't if Congress needs to act, but how and when.

The 2034 Deadline: Understanding the Imminent Threat

The Social Security Administration (SSA) has consistently warned about the impending insolvency of the trust fund. Current projections indicate that without Congressional intervention, benefits will be cut by approximately 20%. This means retirees could see a significant drop in their monthly payments, impacting their ability to afford basic necessities like food, housing, and healthcare. This reduction would disproportionately affect lower-income retirees who rely heavily on Social Security for their financial security.

Why is Social Security Facing This Crisis?

Several factors contribute to the impending shortfall:

- Aging Population: The U.S. population is aging, leading to a higher ratio of retirees receiving benefits to workers contributing to the system.

- Declining Birth Rates: Lower birth rates mean fewer workers entering the workforce to support the growing number of retirees.

- Increased Life Expectancy: People are living longer, drawing benefits for a longer period.

- Economic Slowdowns: Periods of economic recession reduce payroll tax revenues, impacting the fund's solvency.

What Can Congress Do to Prevent Benefit Cuts?

Congress has several options to address the looming crisis. These options generally fall into two categories: increasing revenue and reducing expenditures. A comprehensive solution likely requires a combination of both.

Increasing Revenue:

- Raising the Full Retirement Age: Gradually increasing the age at which individuals can receive full retirement benefits.

- Increasing the Social Security Taxable Wage Base: Expanding the amount of earnings subject to Social Security taxes. Currently, there's a cap on annual earnings subject to the tax.

- Raising the Social Security Tax Rate: Increasing the percentage of earnings that are taxed for Social Security.

Reducing Expenditures:

- Modifying the COLA Calculation: Changing the formula used to calculate the annual cost-of-living adjustment (COLA) for benefits. The current formula may overestimate inflation.

- Benefit Adjustments for Higher Earners: Implementing changes to the benefit calculation formula that gradually reduce benefits for higher earners.

The Political Challenges Ahead

Finding a bipartisan solution will be incredibly challenging. Each of the proposed solutions has its supporters and detractors, and reaching a consensus in a politically polarized climate will require significant compromise and negotiation. The urgency of the situation demands immediate action, however, to avoid a last-minute scramble that could lead to even more drastic measures.

The Importance of Public Engagement

The future of Social Security is a matter of vital importance to all Americans. Citizens should contact their elected officials, urging them to prioritize finding a sustainable solution to prevent benefit reductions. Understanding the issues and engaging in informed discussions is crucial to ensuring the long-term viability of this crucial social safety net.

Call to Action: Learn more about Social Security reform proposals and contact your representatives in Congress to share your concerns and advocate for a responsible solution. Visit the Social Security Administration website () for more information. The time to act is now. The future of Social Security, and the financial security of millions, hangs in the balance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Social Security's 2034 Cliff: What Congress Must Do To Avoid Benefit Reductions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Death Toll Rises Kyivs Ongoing Search After Night Of Attacks

Jun 20, 2025

Death Toll Rises Kyivs Ongoing Search After Night Of Attacks

Jun 20, 2025 -

Job Corps Termination A Looming Housing Crisis For Thousands Of Young Adults

Jun 20, 2025

Job Corps Termination A Looming Housing Crisis For Thousands Of Young Adults

Jun 20, 2025 -

Investigation Launched After Patient Eats Breakfast Three Days Post Mortem At Nhs Trust

Jun 20, 2025

Investigation Launched After Patient Eats Breakfast Three Days Post Mortem At Nhs Trust

Jun 20, 2025 -

New Witness Testimony In Kohberger Case Police Video Shows Potential Eyewitness Account

Jun 20, 2025

New Witness Testimony In Kohberger Case Police Video Shows Potential Eyewitness Account

Jun 20, 2025 -

Uk Heatwave Temperatures To Exceed 30 C

Jun 20, 2025

Uk Heatwave Temperatures To Exceed 30 C

Jun 20, 2025

Latest Posts

-

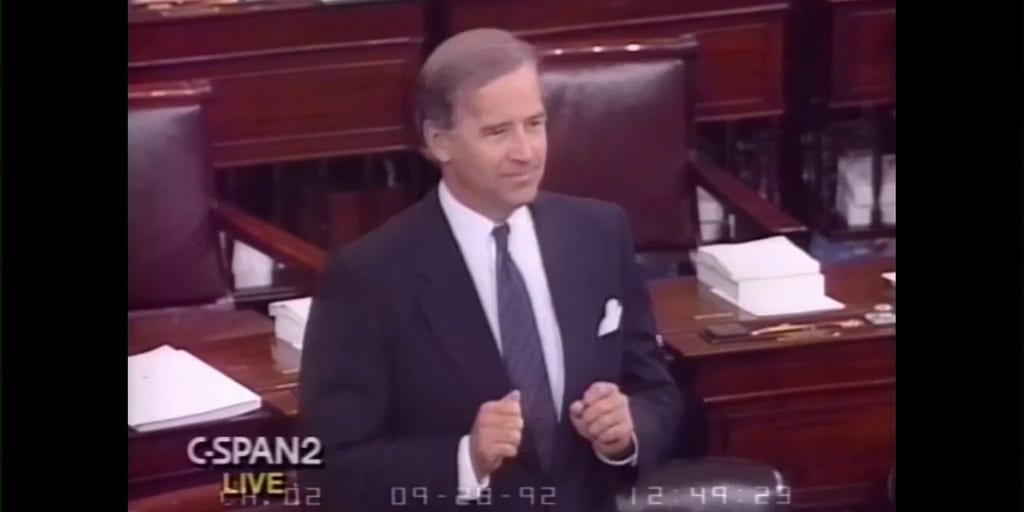

Thirty Years Later Examining Bidens 1992 Crime Concerns In Washington D C

Aug 18, 2025

Thirty Years Later Examining Bidens 1992 Crime Concerns In Washington D C

Aug 18, 2025 -

Us China Tensions Flare The Role Of A Hong Kong Media Mogul

Aug 18, 2025

Us China Tensions Flare The Role Of A Hong Kong Media Mogul

Aug 18, 2025 -

What The No Ceasfire No Deal Summit Means For The Us Russia And Ukraine

Aug 18, 2025

What The No Ceasfire No Deal Summit Means For The Us Russia And Ukraine

Aug 18, 2025 -

Delta Blues Culture Preserving Heritage In A Mississippi Town

Aug 18, 2025

Delta Blues Culture Preserving Heritage In A Mississippi Town

Aug 18, 2025 -

Americans Abandon Trump Cnn Data Pinpoints The Decisive Factor

Aug 18, 2025

Americans Abandon Trump Cnn Data Pinpoints The Decisive Factor

Aug 18, 2025