Social Security Future Uncertain: 2034 Payment Solvency At Risk

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Social Security Future Uncertain: 2034 Payment Solvency at Risk

The future of Social Security, a cornerstone of retirement security for millions of Americans, hangs in the balance. A looming crisis threatens the program's solvency, with projections indicating a potential inability to meet full benefit payments as early as 2034. This isn't a distant threat; it's a rapidly approaching reality demanding immediate attention and proactive solutions.

The Ticking Clock: Understanding the 2034 Deadline

The Social Security Administration (SSA) projects that by 2034, the Social Security trust funds will be depleted. This doesn't mean the program will immediately disappear. However, without legislative action, it means the SSA will only be able to pay approximately 80% of scheduled benefits. This substantial cut would drastically impact retirees already relying on Social Security for a significant portion of their income. The potential reduction in benefits would disproportionately affect lower-income retirees who depend on Social Security the most.

Why is Social Security Facing this Crisis?

Several factors contribute to the projected shortfall:

- Aging Population: The U.S. population is aging, leading to a growing number of retirees drawing benefits while the number of working-age individuals contributing to the system remains relatively static. This demographic shift creates a significant imbalance between inflows and outflows.

- Increased Life Expectancy: People are living longer, meaning they receive benefits for an extended period, further straining the system's resources.

- Declining Birth Rates: Lower birth rates translate to fewer workers contributing to the system in the future.

Potential Solutions: A Necessary Debate

Addressing this looming crisis requires a multifaceted approach, and the debate over potential solutions is already underway. Some of the options being considered include:

- Raising the Full Retirement Age: Gradually increasing the age at which individuals can receive full retirement benefits could help alleviate the burden on the system.

- Increasing the Social Security Tax Rate: A slight increase in the tax rate levied on earnings could generate more revenue for the Social Security trust funds.

- Increasing the Social Security Taxable Maximum: Currently, only earnings up to a certain amount are subject to Social Security taxes. Raising this maximum could broaden the tax base and increase revenue.

- Benefit Reductions: While unpopular, reducing benefits across the board or targeting specific groups could help maintain solvency. This option, however, would likely face significant political opposition.

What Can You Do?

While the ultimate solution rests with lawmakers, understanding the issue and engaging in informed discussions is crucial. Here's what you can do:

- Stay informed: Follow news and updates on Social Security reform proposals.

- Contact your representatives: Let your elected officials know your concerns about the future of Social Security and urge them to find a sustainable solution.

- Plan for retirement: Regardless of legislative changes, planning for retirement through diverse savings and investment strategies is essential.

The Road Ahead: A Call for Action

The 2034 deadline is not an inevitability. With proactive and comprehensive legislative action, the Social Security system can be secured for future generations. However, inaction will lead to significant consequences for millions of Americans. The time to act is now. The future of Social Security, and the financial well-being of countless retirees, depends on it. Learn more about the specifics of the proposed solutions by visiting the official website of the Social Security Administration ().

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Social Security Future Uncertain: 2034 Payment Solvency At Risk. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Is Donald Trumps New Phone Ad A Marketing Disaster

Jun 20, 2025

Is Donald Trumps New Phone Ad A Marketing Disaster

Jun 20, 2025 -

Venus And Serena Williams Podcast A New Voice In Sports

Jun 20, 2025

Venus And Serena Williams Podcast A New Voice In Sports

Jun 20, 2025 -

Four Pivotal Elements Shaping Game 6 Of The 2025 Nba Finals

Jun 20, 2025

Four Pivotal Elements Shaping Game 6 Of The 2025 Nba Finals

Jun 20, 2025 -

2025 Nba Finals Game 6 Expert Same Game Parlay Sgp Bets Thunder Vs Pacers

Jun 20, 2025

2025 Nba Finals Game 6 Expert Same Game Parlay Sgp Bets Thunder Vs Pacers

Jun 20, 2025 -

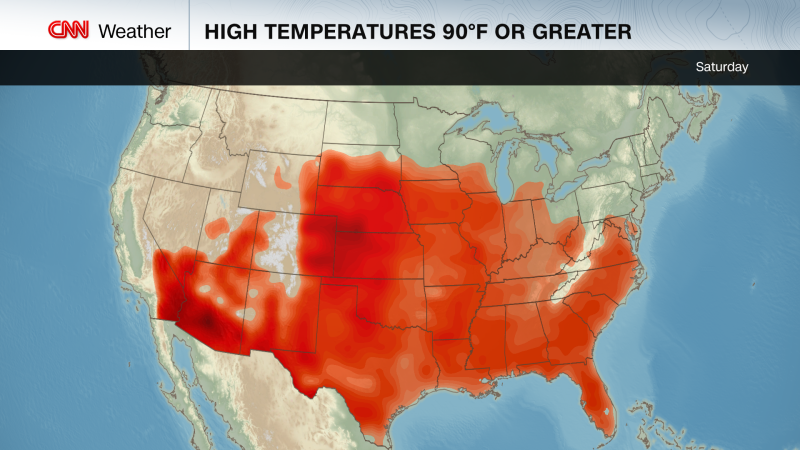

East Coast Heatwave Intensifies Dangerous Heat Dome Looms

Jun 20, 2025

East Coast Heatwave Intensifies Dangerous Heat Dome Looms

Jun 20, 2025

Latest Posts

-

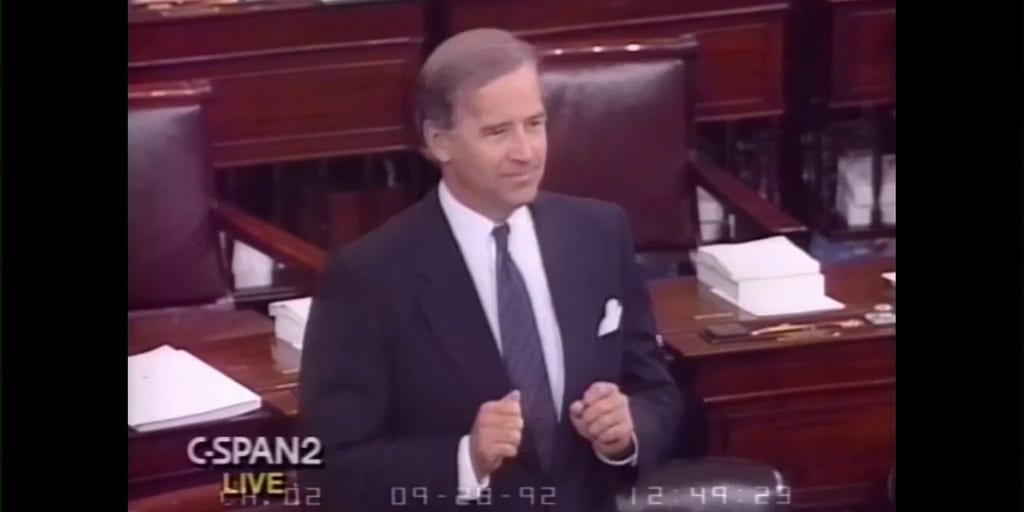

Thirty Years Later Examining Bidens 1992 Crime Concerns In Washington D C

Aug 18, 2025

Thirty Years Later Examining Bidens 1992 Crime Concerns In Washington D C

Aug 18, 2025 -

Us China Tensions Flare The Role Of A Hong Kong Media Mogul

Aug 18, 2025

Us China Tensions Flare The Role Of A Hong Kong Media Mogul

Aug 18, 2025 -

What The No Ceasfire No Deal Summit Means For The Us Russia And Ukraine

Aug 18, 2025

What The No Ceasfire No Deal Summit Means For The Us Russia And Ukraine

Aug 18, 2025 -

Delta Blues Culture Preserving Heritage In A Mississippi Town

Aug 18, 2025

Delta Blues Culture Preserving Heritage In A Mississippi Town

Aug 18, 2025 -

Americans Abandon Trump Cnn Data Pinpoints The Decisive Factor

Aug 18, 2025

Americans Abandon Trump Cnn Data Pinpoints The Decisive Factor

Aug 18, 2025