Social Security Funding Crisis: 2034 Benefit Cuts Looming

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Social Security Funding Crisis: 2034 Benefit Cuts Looming – What You Need To Know

The looming Social Security funding crisis is a topic dominating headlines and causing anxiety for millions of Americans. With the Social Security Trust Fund projected to be depleted by 2034, the possibility of benefit cuts is a very real concern. Understanding the current situation, potential solutions, and how it impacts you is crucial.

The Ticking Clock: Understanding the Social Security Funding Gap

The Social Security Administration (SSA) has clearly stated that without Congressional action, the Social Security Trust Fund will be unable to pay 100% of scheduled benefits beginning in 2034. This doesn't mean Social Security will disappear entirely; rather, benefits could be cut by an estimated 20% across the board. This dramatic reduction would significantly impact the retirement plans of millions of seniors and retirees who rely on these crucial benefits.

The shortfall stems from a combination of factors:

- Increasing Life Expectancy: People are living longer, drawing benefits for a greater number of years.

- Declining Birth Rates: A smaller workforce is supporting a growing number of retirees.

- Economic Shifts: Changes in the workforce and income inequality have impacted the overall contribution levels.

These issues create a perfect storm, threatening the long-term solvency of the system.

Potential Solutions: A Political Tightrope Walk

Addressing the Social Security funding crisis requires navigating complex political landscapes. Several solutions have been proposed, each with its pros and cons:

- Raising the Retirement Age: Gradually increasing the full retirement age could delay benefit payouts, extending the life of the trust fund. However, this disproportionately affects lower-income workers who often have less healthy life expectancy.

- Increasing the Taxable Wage Base: Currently, Social Security taxes only apply to earnings below a certain threshold. Raising this cap would increase revenue. However, this could be seen as a tax increase on higher earners.

- Modifying Benefit Formulas: Adjusting the formulas used to calculate benefits could help manage payouts. This could involve reducing the rate at which benefits increase with inflation or modifying COLAs (Cost of Living Adjustments).

- Cutting Benefits: As mentioned earlier, this is the most drastic option and could significantly impact retirees.

What Can You Do? Preparing for Potential Benefit Cuts

While the future of Social Security remains uncertain, proactive planning is essential. Here are some steps you can take:

- Maximize Your Savings: Supplementing Social Security with personal savings and investments is vital. Consider retirement accounts like 401(k)s and IRAs.

- Delay Retirement (If Possible): Delaying retirement, even by a few years, can significantly increase your benefit amount.

- Stay Informed: Keep abreast of legislative developments concerning Social Security. Engage with your elected officials and express your concerns.

- Explore Supplemental Income Sources: Consider part-time work or other sources of income to offset potential benefit reductions.

The Future of Social Security: A Call to Action

The Social Security funding crisis is a serious issue demanding immediate attention. The potential for benefit cuts in 2034 highlights the urgency of finding sustainable solutions. Understanding the problem, exploring potential solutions, and actively engaging in the discussion is crucial for protecting the future of this vital safety net for millions of Americans. It's time to contact your representatives and demand action. The future of Social Security, and the retirement security of millions, depends on it. Learn more by visiting the official Social Security Administration website: .

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Social Security Funding Crisis: 2034 Benefit Cuts Looming. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

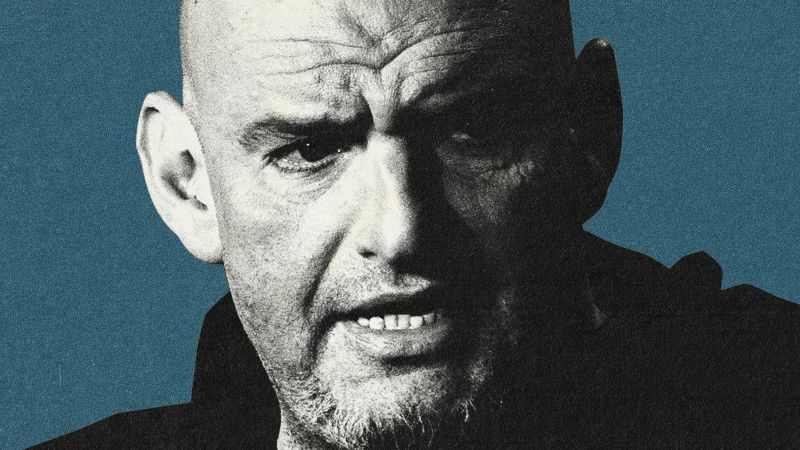

Senator Fetterman Faces Democratic Backlash After Party Critiques

Jun 20, 2025

Senator Fetterman Faces Democratic Backlash After Party Critiques

Jun 20, 2025 -

Win Big Best Same Game Parlays For Thunder Vs Pacers Nba Finals Game 6 2025

Jun 20, 2025

Win Big Best Same Game Parlays For Thunder Vs Pacers Nba Finals Game 6 2025

Jun 20, 2025 -

Karen Read Case Lead Investigator Michael Proctor Speaks Out In Exclusive Tv Interview

Jun 20, 2025

Karen Read Case Lead Investigator Michael Proctor Speaks Out In Exclusive Tv Interview

Jun 20, 2025 -

Juneteenth 2024 A Summary Of The Days News

Jun 20, 2025

Juneteenth 2024 A Summary Of The Days News

Jun 20, 2025 -

Analysis Trumps Gift Announcement And Its Implications For Global Politics

Jun 20, 2025

Analysis Trumps Gift Announcement And Its Implications For Global Politics

Jun 20, 2025

Latest Posts

-

Dev The Future Of Bot And Booster Mitigation In 2025

Aug 17, 2025

Dev The Future Of Bot And Booster Mitigation In 2025

Aug 17, 2025 -

Orixs Keita Nakagawa Two Run Homer Extends Buffaloes Lead

Aug 17, 2025

Orixs Keita Nakagawa Two Run Homer Extends Buffaloes Lead

Aug 17, 2025 -

Topshops High Street Return Challenges And Opportunities

Aug 17, 2025

Topshops High Street Return Challenges And Opportunities

Aug 17, 2025 -

Denmark Train Accident Tanker Collision Causes Derailment One Death

Aug 17, 2025

Denmark Train Accident Tanker Collision Causes Derailment One Death

Aug 17, 2025 -

Game Tying Blast Nakagawas Ninth Homer Leads Orix Buffaloes

Aug 17, 2025

Game Tying Blast Nakagawas Ninth Homer Leads Orix Buffaloes

Aug 17, 2025