Social Security Benefits At Risk: The 2034 Funding Shortfall And Potential Solutions

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Social Security Benefits at Risk: Navigating the 2034 Funding Shortfall

The looming Social Security crisis: Millions of Americans rely on Social Security benefits for their retirement security. However, a significant funding shortfall is projected by 2034, raising concerns about benefit cuts and the future of this vital social safety net. Understanding the problem and exploring potential solutions is crucial for securing the financial well-being of current and future retirees.

The 2034 Cliff: Understanding the Funding Gap

The Social Security Administration (SSA) projects that by 2034, the Social Security trust funds will be unable to pay 100% of scheduled benefits without significant changes. This doesn't mean the system will collapse overnight, but it does mean a potential reduction in benefits – possibly around 20% – unless Congress acts. This shortfall stems from several factors, including:

- Aging Population: The baby boomer generation is entering retirement, increasing the number of beneficiaries drawing benefits.

- Declining Birth Rate: A lower birth rate means fewer workers contributing to the system.

- Increased Life Expectancy: People are living longer, drawing benefits for an extended period.

These demographic shifts, combined with economic fluctuations, create a significant strain on the system's ability to meet its obligations. The looming 2034 deadline isn't a sudden crisis; it's the culmination of long-term trends.

Potential Solutions: A Complex Equation

Addressing the Social Security funding shortfall requires a multifaceted approach, and numerous proposals have been put forward. These generally fall into several categories:

1. Increasing Revenue:

- Raising the Full Retirement Age: Gradually increasing the age at which individuals can receive full retirement benefits.

- Increasing the Taxable Wage Base: Expanding the amount of earnings subject to Social Security taxes.

- Raising the Social Security Tax Rate: Slightly increasing the percentage of earnings contributed to Social Security.

2. Reducing Expenditures:

- Modifying COLA Adjustments: Adjusting the annual cost-of-living adjustment (COLA) formula to better reflect actual inflation.

- Means Testing: Restricting benefits for higher-income retirees. This remains a politically contentious issue.

3. Other Reforms:

- Investing Excess Funds: Strategically investing a portion of the surplus funds to generate additional revenue. This requires careful consideration and risk management.

- Raising the Earnings Cap: Eliminating or raising the limit on earnings subject to Social Security taxes. This impacts high-income earners.

Navigating the Political Landscape:

Reaching a consensus on solutions is challenging. Different political parties and interest groups advocate for various approaches, often with conflicting priorities. The debate often centers on the balance between protecting benefits for current retirees and ensuring the long-term solvency of the system for future generations. Understanding the various proposals and their potential impact is crucial for informed civic engagement.

What You Can Do:

Staying informed about the ongoing discussions and advocating for policies that protect Social Security are crucial steps. You can contact your elected officials to express your concerns and support proposed solutions. Furthermore, planning for your retirement beyond Social Security is essential, considering diverse saving and investment strategies. For more detailed information, visit the Social Security Administration website .

Conclusion:

The Social Security funding shortfall poses a significant challenge to the nation's retirement system. Addressing this issue requires a balanced and comprehensive approach involving both revenue increases and expenditure adjustments. Open dialogue, informed debate, and decisive action are necessary to ensure the long-term viability of Social Security and protect the retirement security of millions of Americans.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Social Security Benefits At Risk: The 2034 Funding Shortfall And Potential Solutions. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Parliamentary Pest Control Cats Out Other Solutions In

Jun 20, 2025

Parliamentary Pest Control Cats Out Other Solutions In

Jun 20, 2025 -

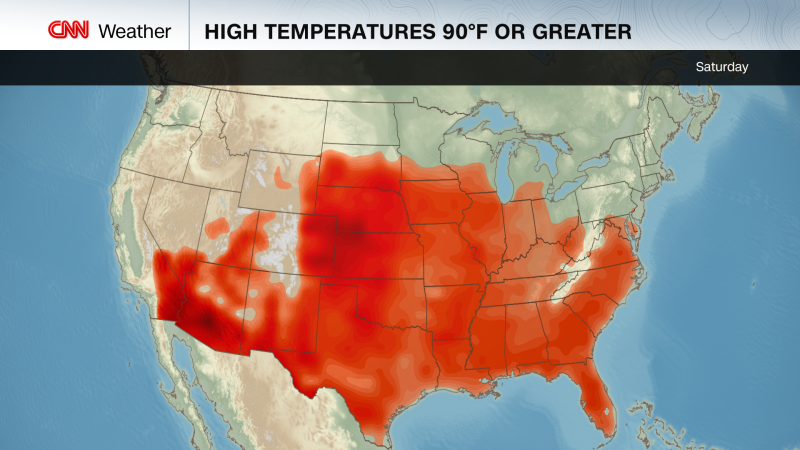

Record Breaking Heat Expected As Heat Dome Blankets The East

Jun 20, 2025

Record Breaking Heat Expected As Heat Dome Blankets The East

Jun 20, 2025 -

Pest Control Plan Parliament Rules Out Use Of Cats

Jun 20, 2025

Pest Control Plan Parliament Rules Out Use Of Cats

Jun 20, 2025 -

Understanding Gender Affirming Care Types Benefits And Potential Risks

Jun 20, 2025

Understanding Gender Affirming Care Types Benefits And Potential Risks

Jun 20, 2025 -

Is Notting Hill Carnival At Risk Exploring The Challenges Ahead

Jun 20, 2025

Is Notting Hill Carnival At Risk Exploring The Challenges Ahead

Jun 20, 2025

Latest Posts

-

Dev The Future Of Bot And Booster Mitigation In 2025

Aug 17, 2025

Dev The Future Of Bot And Booster Mitigation In 2025

Aug 17, 2025 -

Orixs Keita Nakagawa Two Run Homer Extends Buffaloes Lead

Aug 17, 2025

Orixs Keita Nakagawa Two Run Homer Extends Buffaloes Lead

Aug 17, 2025 -

Topshops High Street Return Challenges And Opportunities

Aug 17, 2025

Topshops High Street Return Challenges And Opportunities

Aug 17, 2025 -

Denmark Train Accident Tanker Collision Causes Derailment One Death

Aug 17, 2025

Denmark Train Accident Tanker Collision Causes Derailment One Death

Aug 17, 2025 -

Game Tying Blast Nakagawas Ninth Homer Leads Orix Buffaloes

Aug 17, 2025

Game Tying Blast Nakagawas Ninth Homer Leads Orix Buffaloes

Aug 17, 2025