Social Security Benefits At Risk: 2034 Payment Shortfall

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Social Security Benefits at Risk: The Looming 2034 Payment Shortfall and What You Need to Know

The looming threat of a Social Security shortfall in 2034 is causing widespread concern among retirees and future beneficiaries. The program, a cornerstone of retirement security for millions of Americans, faces a significant financial challenge unless Congress acts. Understanding this potential crisis is crucial for anyone planning for their retirement.

The Problem: A Growing Gap Between Income and Expenses

The Social Security Administration (SSA) projects that the Social Security trust funds will be depleted by 2034. This doesn't mean Social Security will disappear entirely. However, it does mean that without legislative changes, the SSA will only be able to pay approximately 80% of scheduled benefits. This significant reduction in payments could have devastating consequences for millions relying on Social Security for their retirement income.

The shortfall stems from a widening gap between the amount of money coming into the system (through payroll taxes) and the amount going out (in benefits). Several factors contribute to this imbalance:

- Aging Population: The US is experiencing an aging population, meaning a larger proportion of the population is receiving benefits while a smaller proportion is contributing through payroll taxes.

- Increased Life Expectancy: People are living longer, which increases the amount of time they receive Social Security benefits.

- Declining Birth Rate: A lower birth rate means fewer workers are entering the workforce to contribute to the system.

What's Being Done (or Not Done): Political Gridlock and Proposed Solutions

The issue of Social Security reform has become highly politicized. Finding common ground between different political viewpoints has proven incredibly difficult. While various solutions have been proposed, no significant legislative action has been taken to address the looming shortfall. Proposed solutions often include:

- Raising the Full Retirement Age: Gradually increasing the age at which individuals can receive full retirement benefits.

- Raising the Taxable Earnings Base: Increasing the amount of earnings subject to Social Security taxes.

- Cutting Benefits: Reducing the amount of benefits paid to retirees. This is generally the most controversial option.

- Increasing Payroll Taxes: Raising the percentage of earnings contributed to Social Security.

What You Can Do: Planning for Uncertainty

While the future of Social Security remains uncertain, proactive planning is essential. Here are some steps you can take:

- Maximize Your Savings: Supplement your potential Social Security benefits with robust personal savings and investments. Consider a diversified portfolio tailored to your risk tolerance and retirement goals. Learn more about (external link).

- Understand Your Benefits: Use the SSA's website ( (external link)) to estimate your future Social Security benefits and understand how different claiming strategies might affect your payout.

- Stay Informed: Keep up-to-date on the latest developments regarding Social Security reform by following reputable news sources and engaging with organizations dedicated to retirement planning.

- Contact Your Representatives: Let your elected officials know your concerns about the Social Security shortfall and encourage them to seek bipartisan solutions.

The Bottom Line: A Call to Action

The 2034 Social Security payment shortfall is a serious issue that requires immediate attention. While uncertainty remains, individuals can mitigate the potential impact by planning ahead and engaging in the political process. Understanding the challenges and taking proactive steps now will help secure your financial future. Don't wait – start planning today.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Social Security Benefits At Risk: 2034 Payment Shortfall. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

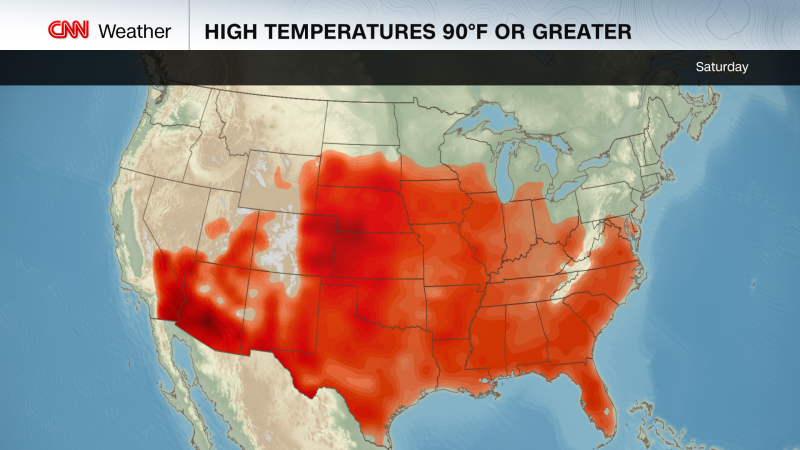

Record Breaking Heat East Coast Braces For Even Higher Temperatures

Jun 20, 2025

Record Breaking Heat East Coast Braces For Even Higher Temperatures

Jun 20, 2025 -

Donald Trumps Criticism Of Obamas Iran Deal A Haunting Reminder

Jun 20, 2025

Donald Trumps Criticism Of Obamas Iran Deal A Haunting Reminder

Jun 20, 2025 -

Is Notting Hill Carnivals Future In Peril Financial Challenges Mount

Jun 20, 2025

Is Notting Hill Carnivals Future In Peril Financial Challenges Mount

Jun 20, 2025 -

Minnesota Wild Trade Predictions Whos Moving Besides Marco Rossi

Jun 20, 2025

Minnesota Wild Trade Predictions Whos Moving Besides Marco Rossi

Jun 20, 2025 -

Leonie Fiebichs Exit How Liberty Will Adapt

Jun 20, 2025

Leonie Fiebichs Exit How Liberty Will Adapt

Jun 20, 2025

Latest Posts

-

Bidens 1992 Warning On Dc Crime Dont Stop At A Stoplight

Aug 18, 2025

Bidens 1992 Warning On Dc Crime Dont Stop At A Stoplight

Aug 18, 2025 -

Hong Kong Media Executive A Flashpoint In Us China Relations

Aug 18, 2025

Hong Kong Media Executive A Flashpoint In Us China Relations

Aug 18, 2025 -

1992 Bidens Stark Prediction On Rampant Crime In Washington D C

Aug 18, 2025

1992 Bidens Stark Prediction On Rampant Crime In Washington D C

Aug 18, 2025 -

No Ceasfire No Deal Assessing The Geopolitical Consequences Of The Recent Summit

Aug 18, 2025

No Ceasfire No Deal Assessing The Geopolitical Consequences Of The Recent Summit

Aug 18, 2025 -

Cruise Ship Life A Nurses Story Of Full Time Travel And Adventure

Aug 18, 2025

Cruise Ship Life A Nurses Story Of Full Time Travel And Adventure

Aug 18, 2025