Social Security At Risk: Potential Benefit Reductions In 2034

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Social Security at Risk: Potential Benefit Reductions Loom in 2034

The looming threat of Social Security benefit reductions in 2034 has sparked widespread concern among retirees and future beneficiaries. The program, a cornerstone of retirement security for millions of Americans, faces a significant funding shortfall, prompting urgent calls for reform and sparking debate about the future of this vital safety net.

The Social Security Administration (SSA) projects that the trust funds supporting retirement benefits will be depleted by 2034. This doesn't mean Social Security will disappear entirely, but it does mean significant changes are likely unless Congress acts. Without legislative action, benefits could face an across-the-board cut of approximately 20%. This dramatic reduction would severely impact the financial well-being of millions of seniors already struggling with rising healthcare costs and inflation.

What's Causing the Social Security Funding Crisis?

Several factors contribute to the projected shortfall:

- Increasing Life Expectancy: Americans are living longer, meaning they draw benefits for a longer period. This increased longevity, while positive, places a greater strain on the system's resources.

- Declining Birth Rates: A smaller workforce supporting a growing number of retirees creates an imbalance in the system's inflow and outflow of funds.

- Economic Slowdowns: Periods of economic recession impact payroll tax revenue, which is the primary source of funding for Social Security.

Potential Solutions and the Ongoing Debate:

The debate surrounding Social Security reform is complex and involves numerous proposed solutions, each with its own set of pros and cons. These include:

- Raising the Full Retirement Age: Gradually increasing the age at which individuals can receive full retirement benefits could help alleviate the financial strain.

- Increasing the Taxable Earnings Base: Expanding the amount of earnings subject to Social Security taxes could generate additional revenue.

- Cutting Benefits: While drastic, a reduction in benefits is a potential, though unpopular, solution. Targeted benefit reductions for higher earners are often discussed as an alternative to across-the-board cuts.

- Investing Social Security Trust Funds: Some proposals suggest investing a portion of the trust funds in the stock market to generate higher returns, although this carries inherent risks.

These are just a few of the proposals being considered. The complexity of the issue necessitates a multifaceted approach, and the optimal solution likely involves a combination of strategies. The political landscape further complicates matters, with differing opinions among lawmakers on the best course of action.

What Can You Do?

While the future of Social Security remains uncertain, understanding the challenges and potential solutions is crucial. Stay informed about the ongoing debate and consider contacting your elected officials to express your concerns and opinions. You can also explore resources like the SSA website () for accurate and up-to-date information about Social Security benefits and projections. Planning for your retirement, including exploring supplemental retirement savings options, is also vital.

The Bottom Line:

The potential for Social Security benefit reductions in 2034 is a serious concern. Understanding the causes and potential solutions is essential for everyone, particularly those nearing retirement age or planning for their future. Active engagement in the political process and proactive retirement planning are crucial steps in navigating this uncertain landscape. The future of Social Security depends on informed citizens and proactive legislative action.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Social Security At Risk: Potential Benefit Reductions In 2034. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Wnba Libertys Lineup Change Impact Of Jones And Fiebichs Absence

Jun 20, 2025

Wnba Libertys Lineup Change Impact Of Jones And Fiebichs Absence

Jun 20, 2025 -

Exclusive Lead Investigator Breaks Silence On Karen Read Murder Case

Jun 20, 2025

Exclusive Lead Investigator Breaks Silence On Karen Read Murder Case

Jun 20, 2025 -

Scandal At Nhs Trust Post Mortem Breakfast Raises Serious Questions

Jun 20, 2025

Scandal At Nhs Trust Post Mortem Breakfast Raises Serious Questions

Jun 20, 2025 -

Job Corps Cuts Threaten Thousands Of At Risk American Youth

Jun 20, 2025

Job Corps Cuts Threaten Thousands Of At Risk American Youth

Jun 20, 2025 -

Karen Read Case Video Apology From Dismissed State Trooper

Jun 20, 2025

Karen Read Case Video Apology From Dismissed State Trooper

Jun 20, 2025

Latest Posts

-

Fallout From Pam Bondis Firing Of Top Doj Ethics Adviser

Aug 18, 2025

Fallout From Pam Bondis Firing Of Top Doj Ethics Adviser

Aug 18, 2025 -

Dev Effective Techniques For Detecting And Banning Bots In 2025

Aug 18, 2025

Dev Effective Techniques For Detecting And Banning Bots In 2025

Aug 18, 2025 -

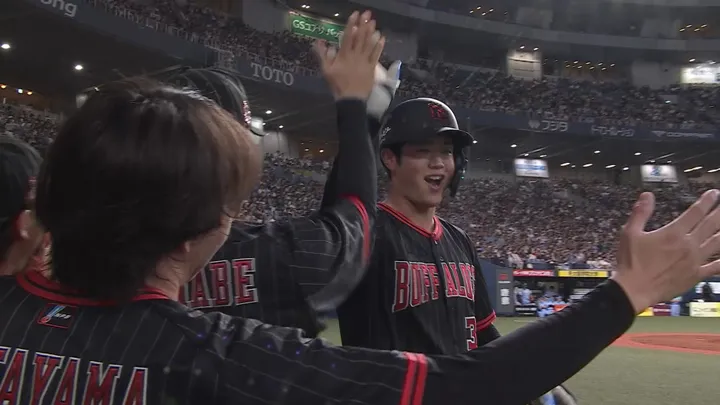

Dramatic Grand Slam Ota Brings Team Within Two Runs

Aug 18, 2025

Dramatic Grand Slam Ota Brings Team Within Two Runs

Aug 18, 2025 -

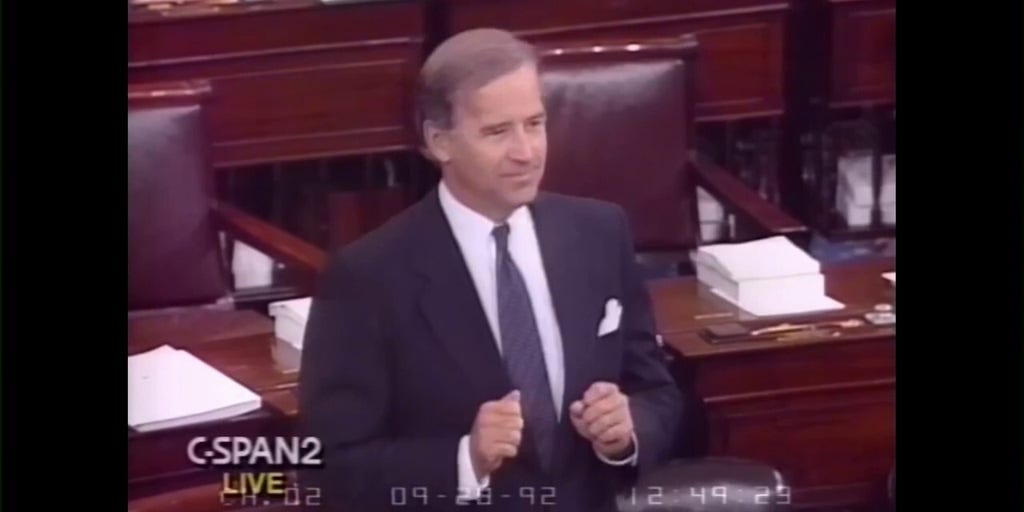

Thirty Years Later Examining Bidens 1992 Prediction On Washington D C Crime

Aug 18, 2025

Thirty Years Later Examining Bidens 1992 Prediction On Washington D C Crime

Aug 18, 2025 -

Geopolitical Showdown How A Hong Kong Media Figure Became A Focal Point

Aug 18, 2025

Geopolitical Showdown How A Hong Kong Media Figure Became A Focal Point

Aug 18, 2025