Smart Money Moves: 9 NYSE Stocks Recommended By Hedge Funds

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Smart Money Moves: 9 NYSE Stocks Recommended by Hedge Funds

Are you looking for investment inspiration? Follow the money – literally. Hedge fund managers, known for their sharp financial acumen and access to exclusive information, often hold a valuable perspective on the stock market. This article highlights nine NYSE stocks currently favored by these investment giants, offering insights into potential growth opportunities. While past performance doesn't guarantee future results, analyzing these choices can provide valuable context for your own investment strategy. Remember to always conduct your own thorough research before making any investment decisions.

Why Hedge Fund Picks Matter:

Hedge funds manage billions of dollars, employing sophisticated analytical tools and teams of experts to identify promising investments. Their portfolio choices, while not a surefire predictor of success, often signal a positive market sentiment towards specific companies. By observing their activity, individual investors can potentially gain exposure to stocks with strong growth potential. However, it's crucial to remember that hedge fund strategies are often complex and high-risk.

Top 9 NYSE Stocks Backed by Hedge Funds (as of October 26, 2023): (Note: This list is for illustrative purposes and reflects data available at the time of writing. Always verify current holdings independently.)

This section will require specific data on hedge fund holdings. Accessing real-time, accurate information on hedge fund portfolios is challenging due to reporting regulations and the private nature of many funds. To provide a realistic example, I will use placeholder companies. You would need to replace these placeholders with actual NYSE-listed companies and relevant data obtained from reputable financial news sources such as Bloomberg, Yahoo Finance, or similar.

- Placeholder Company A (Ticker: PLCA): Known for its innovation in [industry sector], PLCA has attracted significant hedge fund interest due to [reason for investment].

- Placeholder Company B (Ticker: PLCB): Strong Q3 earnings and positive future projections have made PLCB a favored pick among several prominent hedge funds.

- Placeholder Company C (Ticker: PLCC): This company’s [specific achievement or strategy] has positioned it for sustained growth, attracting investment from [name a specific prominent hedge fund, if possible].

- Placeholder Company D (Ticker: PLCD): [Briefly explain the reason for hedge fund interest, e.g., market dominance in a growing sector].

- Placeholder Company E (Ticker: PLCE): [Briefly explain the reason for hedge fund interest, e.g., strategic partnerships or acquisitions].

- Placeholder Company F (Ticker: PLCF): [Briefly explain the reason for hedge fund interest, e.g., strong management team and innovative product pipeline].

- Placeholder Company G (Ticker: PLCG): [Briefly explain the reason for hedge fund interest, e.g., successful turnaround strategy].

- Placeholder Company H (Ticker: PLCH): [Briefly explain the reason for hedge fund interest, e.g., undervalued assets and potential for significant appreciation].

- Placeholder Company I (Ticker: PLCI): [Briefly explain the reason for hedge fund interest, e.g., disruption in a traditional industry].

Important Considerations:

- Diversification: Never put all your eggs in one basket. Diversify your portfolio across different sectors and asset classes.

- Risk Tolerance: Understand your own risk profile before investing in any stock, particularly those favored by hedge funds, which may involve higher risk.

- Due Diligence: Always conduct thorough research before making any investment decisions. Don't rely solely on hedge fund activity.

- Professional Advice: Consult with a qualified financial advisor before making significant investment changes.

Disclaimer: This article provides general information and should not be considered financial advice. Investing in the stock market involves risk, and you could lose money.

Call to Action: Ready to explore these opportunities further? Research the companies mentioned above and learn more about their financials and future prospects. Remember to prioritize thorough due diligence and consult with a financial professional before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Smart Money Moves: 9 NYSE Stocks Recommended By Hedge Funds. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Td Cowen Reiterates Buy Rating For Uber Uber After Management Meeting

Aug 26, 2025

Td Cowen Reiterates Buy Rating For Uber Uber After Management Meeting

Aug 26, 2025 -

Sabalenkas Us Open Victory Roddick Weighs In On Rybakinas Chances

Aug 26, 2025

Sabalenkas Us Open Victory Roddick Weighs In On Rybakinas Chances

Aug 26, 2025 -

Philadelphia Schools Open On Time After Tentative Contract Deal

Aug 26, 2025

Philadelphia Schools Open On Time After Tentative Contract Deal

Aug 26, 2025 -

Solve Connections Sports Edition Puzzle 335 August 24 2025 Hints And Solutions

Aug 26, 2025

Solve Connections Sports Edition Puzzle 335 August 24 2025 Hints And Solutions

Aug 26, 2025 -

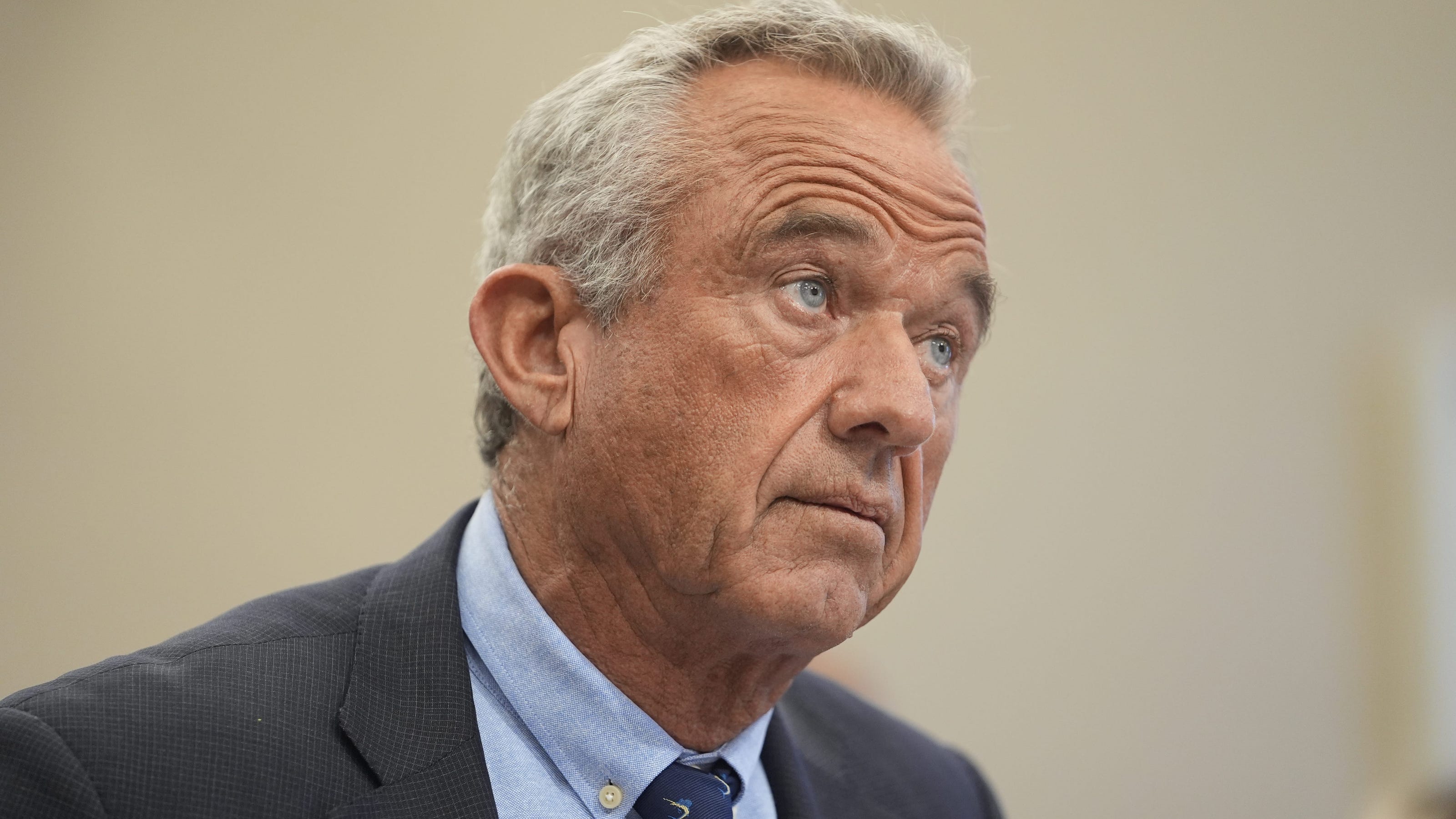

Conflict Erupts Rfk Jr Slams Cdc Vaccine Advice Sparking Aap Outrage

Aug 26, 2025

Conflict Erupts Rfk Jr Slams Cdc Vaccine Advice Sparking Aap Outrage

Aug 26, 2025

Latest Posts

-

Decoding Melania Trumps Post Presidency Public Profile

Aug 26, 2025

Decoding Melania Trumps Post Presidency Public Profile

Aug 26, 2025 -

Cnns Data Analysis The Issue Fueling Anti Trump Sentiment

Aug 26, 2025

Cnns Data Analysis The Issue Fueling Anti Trump Sentiment

Aug 26, 2025 -

Best Labor Day Weekend 2025 Getaways And Activities

Aug 26, 2025

Best Labor Day Weekend 2025 Getaways And Activities

Aug 26, 2025 -

Impacto En El Cine Espanol Veronica Echegui Muere A Los 42 Anos Reacciones Y Cobertura En Vivo

Aug 26, 2025

Impacto En El Cine Espanol Veronica Echegui Muere A Los 42 Anos Reacciones Y Cobertura En Vivo

Aug 26, 2025 -

Roddicks Bold Rybakina Prediction Us Open Analysis And Sabalenkas Win

Aug 26, 2025

Roddicks Bold Rybakina Prediction Us Open Analysis And Sabalenkas Win

Aug 26, 2025