Record High Gold Prices: A Safe Investment In Uncertain Times?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Record High Gold Prices: A Safe Investment in Uncertain Times?

Gold prices have soared to record highs, leaving many investors wondering: is now the time to buy? With global economic uncertainty and geopolitical tensions dominating headlines, the allure of gold as a safe haven asset is stronger than ever. But is this a fleeting surge, or a sign of a sustained upward trend? Let's delve into the factors driving these record prices and explore whether gold truly represents a wise investment strategy in today's volatile market.

The Drivers Behind Gold's Ascent:

Several key factors contribute to gold's current price surge:

-

Inflationary Pressures: Rampant inflation worldwide erodes the purchasing power of fiat currencies. Gold, historically viewed as a hedge against inflation, becomes increasingly attractive as a store of value. This is especially true when considering the impact of persistent high inflation rates on other asset classes. [Link to article about current inflation rates]

-

Geopolitical Instability: Ongoing conflicts and geopolitical tensions create uncertainty in global markets. Investors often flock to gold as a safe haven asset during times of political and economic turmoil, driving demand and consequently, prices. [Link to reputable news source covering current geopolitical events]

-

Weakening Dollar: The US dollar, the world's reserve currency, has experienced relative weakness recently. This makes gold, priced in dollars, more affordable for investors holding other currencies, boosting demand. [Link to a financial news website showing USD exchange rates]

-

Increased Investor Demand: As traditional investments like stocks and bonds experience volatility, investors are increasingly diversifying their portfolios by including gold. This increased demand further fuels the price increase.

Is Gold a Safe Investment? A Nuanced Perspective:

While gold often acts as a safe haven, it's crucial to remember that it's not a guaranteed investment. Its price can fluctuate significantly based on various factors beyond inflation and geopolitical events.

Pros of Investing in Gold:

- Inflation Hedge: Gold historically performs well during inflationary periods, preserving purchasing power.

- Diversification: Adding gold to a diversified portfolio can reduce overall risk.

- Tangible Asset: Unlike digital assets, gold is a physical asset you can possess.

- Safe Haven: It often appreciates in value during times of economic or political uncertainty.

Cons of Investing in Gold:

- Volatility: While a safe haven, gold prices still fluctuate, and significant losses are possible.

- No Yield: Unlike dividend-paying stocks or interest-bearing bonds, gold itself doesn't generate income.

- Storage Costs: Storing physical gold can incur expenses for security and insurance.

- Liquidity Concerns: While generally liquid, selling large quantities of gold might take time and require specialized services.

Investing in Gold: Strategies to Consider:

There are several ways to invest in gold, each with its own set of pros and cons:

- Physical Gold: Buying gold bars or coins offers tangible ownership but requires secure storage.

- Gold ETFs (Exchange-Traded Funds): These funds track the price of gold, offering easier trading than physical gold.

- Gold Mining Stocks: Investing in companies that mine gold can provide leveraged exposure but comes with higher risk.

Conclusion: A Cautious Approach is Key:

The record high gold prices are undeniably noteworthy. While gold's role as a safe haven asset in uncertain times is well-established, it's crucial to approach investment decisions cautiously. Consider your risk tolerance, overall investment strategy, and financial goals before investing in gold. Diversification is key, and professional financial advice is always recommended before making significant investment choices. Don't treat this as a get-rich-quick scheme; rather, view it as a potential element of a long-term, diversified portfolio strategy.

Call to Action: Do your research, consult a financial advisor, and make informed decisions based on your individual circumstances. Understanding the risks and rewards associated with gold is crucial before allocating capital to this asset class.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Record High Gold Prices: A Safe Investment In Uncertain Times?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

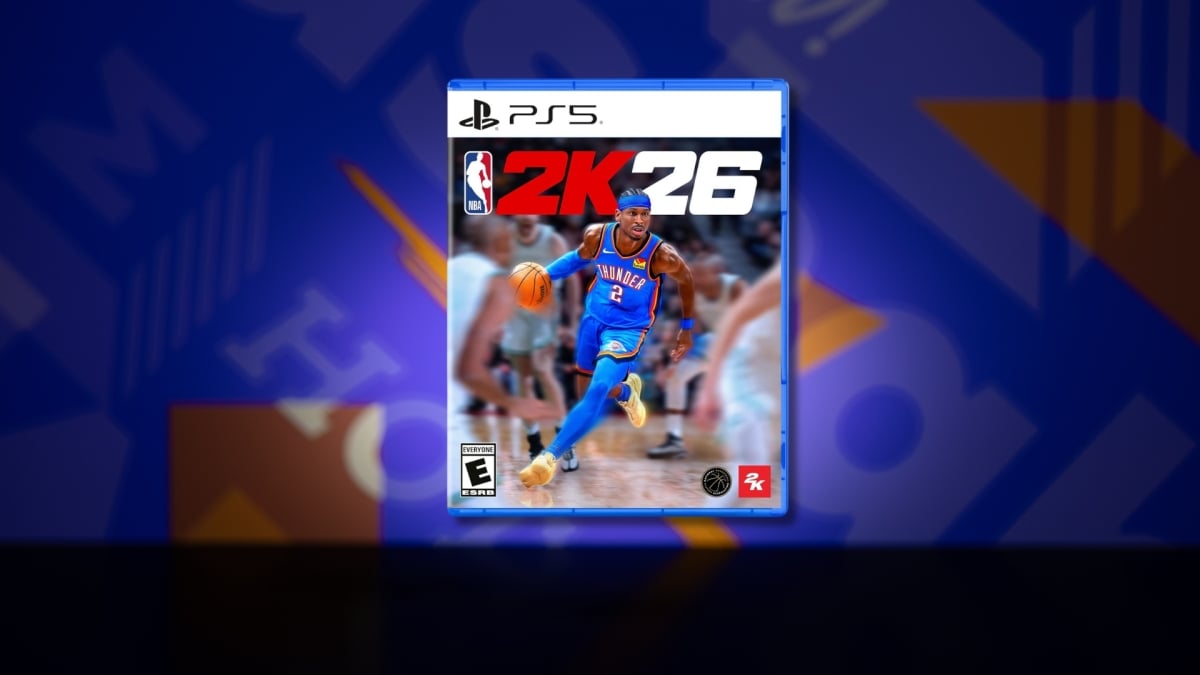

Get Ahead Nba 2 K26 Early Access Release Date Editions And Vc Breakdown

Sep 03, 2025

Get Ahead Nba 2 K26 Early Access Release Date Editions And Vc Breakdown

Sep 03, 2025 -

Asylum Reforms Changes To Family Reunion Policies Explained

Sep 03, 2025

Asylum Reforms Changes To Family Reunion Policies Explained

Sep 03, 2025 -

Karoline Leavitts My Own Two Eyes Account Scrutiny And Controversy

Sep 03, 2025

Karoline Leavitts My Own Two Eyes Account Scrutiny And Controversy

Sep 03, 2025 -

2025 Lg Evo C5 4 K Oled Tv Best Labor Day Deal On E Bay

Sep 03, 2025

2025 Lg Evo C5 4 K Oled Tv Best Labor Day Deal On E Bay

Sep 03, 2025 -

Judkins Suspension Ohio State Legend Faces Nflpa Action

Sep 03, 2025

Judkins Suspension Ohio State Legend Faces Nflpa Action

Sep 03, 2025

Latest Posts

-

Parking Fine Fraud Recognizing And Preventing Scams

Sep 05, 2025

Parking Fine Fraud Recognizing And Preventing Scams

Sep 05, 2025 -

Messi Se Despide El Ultimo Baile Ante Venezuela En Casa

Sep 05, 2025

Messi Se Despide El Ultimo Baile Ante Venezuela En Casa

Sep 05, 2025 -

Student Loan Debt The Warning Signs Of A Looming Bubble

Sep 05, 2025

Student Loan Debt The Warning Signs Of A Looming Bubble

Sep 05, 2025 -

Beijings Show Of Strength Analysis Of Chinas Military Parade From Bbc Correspondents

Sep 05, 2025

Beijings Show Of Strength Analysis Of Chinas Military Parade From Bbc Correspondents

Sep 05, 2025 -

Decoding Chinas Military Parade Assessing The Nations Growing Power

Sep 05, 2025

Decoding Chinas Military Parade Assessing The Nations Growing Power

Sep 05, 2025