Property Tax Reform: Understanding The Implications Of "Suited Not Booted"

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Property Tax Reform: Understanding the Implications of "Suited Not Booted"

Property taxes are a cornerstone of local government funding, but their fairness and impact are frequently debated. A recent shift in focus, often described as the "suited not booted" approach to property tax reform, is generating significant discussion. This article delves into the core principles of this reform movement and analyzes its potential implications for homeowners, businesses, and local government finances.

What Does "Suited Not Booted" Mean?

The phrase "suited not booted" is a catchy metaphor highlighting a key aspect of this property tax reform movement. It emphasizes a shift away from solely relying on property taxes levied on ordinary homeowners (the "booted") and towards a more equitable system that also targets commercial properties and higher-income earners (the "suited"). This reform aims to address the disproportionate burden placed on residential property owners in many jurisdictions. Traditional property tax systems often fall short in accurately reflecting the true market value of commercial properties, leading to under-assessment and a lower tax contribution from wealthier segments of the population.

Key Principles of "Suited Not Booted" Reform:

-

Commercial Property Revaluation: A central tenet is the comprehensive and accurate revaluation of commercial properties. This involves using sophisticated appraisal methods to ensure assessments reflect current market values, leading to a fairer distribution of the tax burden. Outdated assessment practices often undervalue commercial properties, creating an imbalance.

-

Increased Transparency: Greater transparency in the assessment process is crucial. This includes readily available data on property valuations, assessment methodologies, and appeals processes. Openness builds trust and allows taxpayers to scrutinize the fairness of their assessments.

-

Targeted Tax Incentives: Some proposals involve strategic tax incentives to encourage economic development while maintaining a balanced tax base. This might include tax breaks for specific industries or investments that benefit the community.

-

Addressing Tax Avoidance Strategies: The reform also aims to address sophisticated tax avoidance strategies employed by some commercial property owners. This includes closing loopholes and implementing stricter enforcement mechanisms.

Implications for Homeowners, Businesses, and Local Governments:

The implications of "suited not booted" reform are multifaceted:

-

Homeowners: Could potentially see a reduction in their property tax burden as the tax base broadens. However, this depends on the specific implementation of the reforms and the local tax structure.

-

Businesses: May experience an increase in property taxes if their properties are accurately revalued. This could lead to increased operating costs, but it also promotes a more equitable system.

-

Local Governments: The overall impact on local government revenue depends on the effectiveness of the reforms in broadening the tax base. While some revenue streams might shift, the goal is to maintain or even improve overall revenue while promoting fairness.

Challenges and Potential Obstacles:

Implementing "suited not booted" reform faces several challenges:

-

Political Resistance: Commercial property owners and developers may resist efforts to increase their tax contributions. Strong lobbying efforts could impede reform.

-

Assessment Complexity: Accurately assessing complex commercial properties requires specialized expertise and resources.

-

Legal Challenges: Property owners may challenge reassessments through legal appeals, potentially delaying implementation.

Conclusion:

The "suited not booted" approach to property tax reform represents a significant shift towards a more equitable system. While challenges exist, its potential benefits for homeowners and the overall fairness of the tax system are compelling. Further research and public debate are essential to ensure successful implementation and maximize its positive impacts. Staying informed about local initiatives and engaging in civic discourse is crucial for ensuring a tax system that serves the needs of all community members. For more information on property tax laws in your area, consult your local government website or seek advice from a qualified tax professional.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Property Tax Reform: Understanding The Implications Of "Suited Not Booted". We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Analysis Krugman Deconstructs The Moral And Economic Failures Of Trumps Immigration Stance

Aug 20, 2025

Analysis Krugman Deconstructs The Moral And Economic Failures Of Trumps Immigration Stance

Aug 20, 2025 -

Wilmington Nc Coastal Flood Advisory Cape Fear River Flooding Monday

Aug 20, 2025

Wilmington Nc Coastal Flood Advisory Cape Fear River Flooding Monday

Aug 20, 2025 -

Guardians Arizona Redevelopment News And Progress

Aug 20, 2025

Guardians Arizona Redevelopment News And Progress

Aug 20, 2025 -

Controversy Erupts Trump Retains Gold Fifa Trophy Leaving Winners With Replica

Aug 20, 2025

Controversy Erupts Trump Retains Gold Fifa Trophy Leaving Winners With Replica

Aug 20, 2025 -

Golden State Warriors Kuminga Impasse An Nba Insiders Proposed Resolution

Aug 20, 2025

Golden State Warriors Kuminga Impasse An Nba Insiders Proposed Resolution

Aug 20, 2025

Latest Posts

-

Kayfus And Rocchio Lead Guardians To Victory Over Diamondbacks

Aug 20, 2025

Kayfus And Rocchio Lead Guardians To Victory Over Diamondbacks

Aug 20, 2025 -

Results Day Stress Coping Mechanisms For Neurodivergent Individuals

Aug 20, 2025

Results Day Stress Coping Mechanisms For Neurodivergent Individuals

Aug 20, 2025 -

The Real Trump Jon Stewarts Wake Up Call For Maga Nation

Aug 20, 2025

The Real Trump Jon Stewarts Wake Up Call For Maga Nation

Aug 20, 2025 -

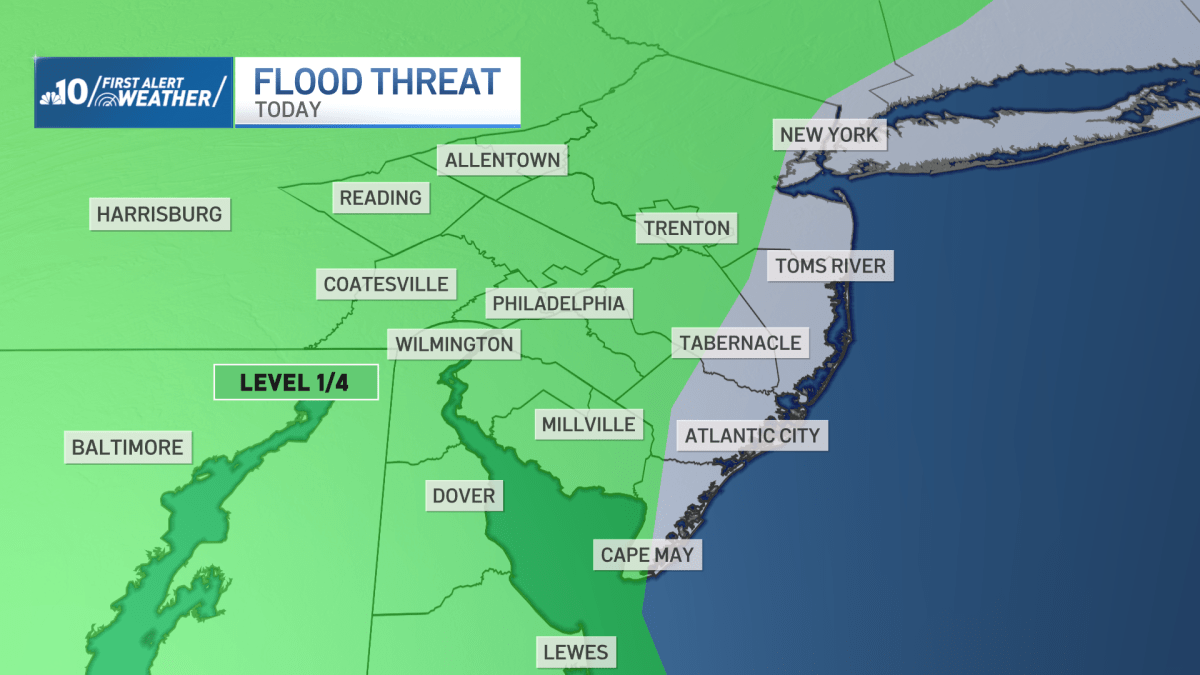

Philadelphia Suburbs Swamped By Flooding Following Torrential Rains

Aug 20, 2025

Philadelphia Suburbs Swamped By Flooding Following Torrential Rains

Aug 20, 2025 -

Norwegian Royal Family Scandal Son Of Crown Princess Indicted On Multiple Counts

Aug 20, 2025

Norwegian Royal Family Scandal Son Of Crown Princess Indicted On Multiple Counts

Aug 20, 2025