Positive Earnings Outlook Sends UnitedHealth (UNH) Stock Higher

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Positive Earnings Outlook Sends UnitedHealth (UNH) Stock Higher

UnitedHealth Group (UNH) stock surged on Wednesday following the release of a surprisingly upbeat second-quarter earnings report and an optimistic outlook for the remainder of the year. The healthcare giant exceeded analysts' expectations, boosting investor confidence and sending ripples through the broader healthcare sector. This positive performance underscores the company's resilience and strategic positioning within a dynamic healthcare landscape.

The market reacted enthusiastically to the news, with UNH shares experiencing a significant jump in trading volume. This surge reflects investor optimism about the company's future performance and its potential for continued growth. Let's delve deeper into the specifics of the report and what it means for investors.

Q2 Earnings Beat Expectations: A Closer Look

UnitedHealth reported adjusted earnings per share (EPS) of $6.15, significantly exceeding the consensus analyst estimate of $5.79. This positive surprise was driven by strong performance across its two major segments: UnitedHealthcare (the insurance arm) and Optum (the healthcare services arm).

-

UnitedHealthcare: Demonstrated robust membership growth and improved medical cost ratios, indicating efficient management of healthcare expenses. This segment continues to benefit from its broad network of providers and its focus on value-based care.

-

Optum: Showcased strong revenue growth fueled by increased demand for its healthcare services, including pharmacy care services, and health services. This highlights the increasing importance of integrated healthcare solutions and the success of Optum's diversification strategy.

A Bullish Outlook for the Remainder of 2024

The company's positive outlook for the full year is equally encouraging. UnitedHealth raised its full-year EPS guidance, further solidifying investor confidence. This upward revision demonstrates the company's continued strong financial performance and reflects its belief in its ability to navigate the challenges of the healthcare industry. This optimistic projection contributes significantly to the positive market sentiment surrounding UNH.

What This Means for Investors

The strong Q2 results and raised guidance paint a positive picture for UNH investors. The company's diversified business model, coupled with its strong financial performance, positions it well for future growth. However, it's important for investors to consider the broader macroeconomic environment and potential risks within the healthcare sector before making any investment decisions. Factors like regulatory changes and healthcare inflation should always be factored into a comprehensive investment strategy.

Analyzing the Long-Term Potential of UNH

UnitedHealth's consistent track record of strong earnings and innovative strategies make it an attractive investment for long-term investors. The company's commitment to technological advancements and its expansion into value-based care positions it for success in the evolving healthcare landscape. While short-term market fluctuations are inevitable, the long-term prospects for UNH remain positive for many analysts.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Always consult with a qualified financial advisor before making any investment decisions.

Related Articles:

- [Link to an article about healthcare sector trends]

- [Link to an article about value-based care]

- [Link to UnitedHealth's investor relations page]

Keywords: UnitedHealth, UNH, stock, earnings, healthcare, Q2 earnings, earnings report, investor, investment, healthcare sector, stock market, Optum, UnitedHealthcare, EPS, guidance, growth, value-based care, financial performance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Positive Earnings Outlook Sends UnitedHealth (UNH) Stock Higher. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Monday Strike Kaiser Permanente Nurses In Oakland And Roseville To Protest

Sep 10, 2025

Monday Strike Kaiser Permanente Nurses In Oakland And Roseville To Protest

Sep 10, 2025 -

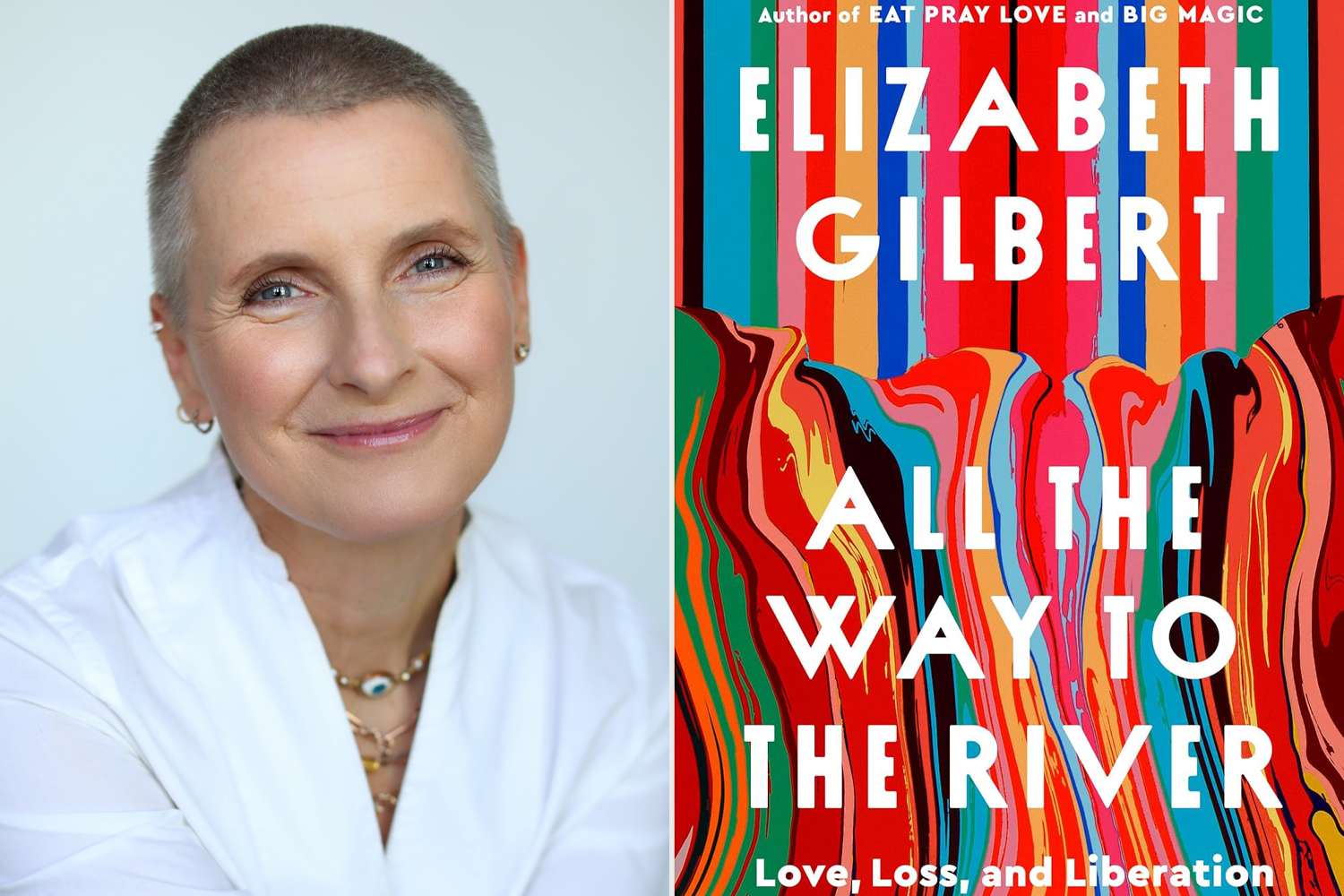

Author Elizabeth Gilbert Opens Up A Memoir Of Sex Drugs And A Murder Plot

Sep 10, 2025

Author Elizabeth Gilbert Opens Up A Memoir Of Sex Drugs And A Murder Plot

Sep 10, 2025 -

Harrys Uk Return A Touching Tribute To The Late Queen Alongside Prince William

Sep 10, 2025

Harrys Uk Return A Touching Tribute To The Late Queen Alongside Prince William

Sep 10, 2025 -

Record Cocaine Seizure A Blow To The Superhighway Drug Trade

Sep 10, 2025

Record Cocaine Seizure A Blow To The Superhighway Drug Trade

Sep 10, 2025 -

Hottest Looks The Most Talked About Styles At The Mtv Vmas 2025

Sep 10, 2025

Hottest Looks The Most Talked About Styles At The Mtv Vmas 2025

Sep 10, 2025

Latest Posts

-

Student Privacy And Ai Examining The Use Of Ai Support Services In High Schools

Sep 10, 2025

Student Privacy And Ai Examining The Use Of Ai Support Services In High Schools

Sep 10, 2025 -

Missing Student Jack O Sullivan Donor Offers 100 000 Reward

Sep 10, 2025

Missing Student Jack O Sullivan Donor Offers 100 000 Reward

Sep 10, 2025 -

Banksy Strikes Again Fresh Artwork Found At London High Court

Sep 10, 2025

Banksy Strikes Again Fresh Artwork Found At London High Court

Sep 10, 2025 -

England Flag On Westbury White Horse Damaged Full Report

Sep 10, 2025

England Flag On Westbury White Horse Damaged Full Report

Sep 10, 2025 -

Sabalenkas Us Open Reign Continues Highlights From The Anisimova Final

Sep 10, 2025

Sabalenkas Us Open Reign Continues Highlights From The Anisimova Final

Sep 10, 2025