New Property Tax Rules: How The Changes Affect Homeowners

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

New Property Tax Rules: How the Changes Affect Homeowners

Are you prepared for the latest changes to property tax laws? Recent updates to property tax regulations could significantly impact your finances. This article breaks down the key changes and explains how they affect homeowners across the nation. Understanding these new rules is crucial to protecting your investment and ensuring you're paying the correct amount.

The recent changes to property tax laws represent a significant shift in how property taxes are assessed and collected. While specific details vary by state and even local municipality, several common themes emerge. These changes are designed to address issues ranging from outdated assessment methods to fairer tax burdens, but the impact on individual homeowners can be complex.

H2: Key Changes in Property Tax Laws

Several key areas have seen significant revisions. These include:

-

Reassessment Frequency: Many jurisdictions are altering how often property values are reassessed. Some are increasing the frequency, leading to more frequent tax bill adjustments, while others are aiming for a more consistent schedule to provide better predictability. Understanding your local jurisdiction's reassessment schedule is crucial for budgeting purposes.

-

Assessment Methods: Outdated assessment methods are being replaced with more sophisticated techniques, often incorporating advanced data analytics and comparable property sales information. This shift aims for greater accuracy in property valuations, but it also means that your property tax bill could increase or decrease depending on the new assessment.

-

Exemptions and Credits: Changes are being made to existing exemptions and credits, impacting specific homeowner groups. For example, some states are expanding exemptions for seniors or veterans, while others are tightening eligibility criteria. It's important to research any changes to exemptions that might apply to your situation.

-

Appealing Your Assessment: The process for appealing a property tax assessment may have been simplified or complicated, depending on your location. Understanding the new appeal process is critical if you believe your property has been unfairly assessed. Many jurisdictions offer online resources to guide homeowners through the appeal process. [Link to a relevant state or national resource on property tax appeals].

H2: How the Changes Impact You

The impact of these new rules will vary significantly depending on your location, the value of your property, and your individual circumstances.

-

Increased Taxes: For some homeowners, the changes may lead to higher property taxes. This could be due to increased reassessment frequency, updated valuation methods reflecting rising property values, or changes to exemptions.

-

Decreased Taxes: Conversely, some homeowners might see a decrease in their property tax bills, particularly if their property value has remained relatively stagnant while surrounding property values have increased.

-

Greater Predictability: While some changes may lead to immediate adjustments, the goal in many cases is to provide greater predictability in property tax assessments over time. This can help homeowners better budget for their annual property tax payments.

H3: What You Should Do Now

To effectively navigate these changes, take these steps:

-

Review your property tax bill: Carefully examine your most recent property tax statement to understand the new assessment and any changes to your tax liability.

-

Research your local jurisdiction's rules: Familiarize yourself with the specific changes implemented in your area. Contact your local assessor's office for clarification if needed.

-

Consider appealing your assessment (if necessary): If you believe your property has been unfairly assessed, understand the new appeals process and take the necessary steps to contest the assessment.

-

Consult a tax professional: For complex situations or if you require personalized advice, consulting a qualified tax professional is recommended.

The new property tax rules present both challenges and opportunities for homeowners. By understanding the changes and taking proactive steps, you can better manage your property taxes and protect your financial interests. Staying informed is key to navigating this evolving landscape. Check back regularly for updates on property tax regulations in your area.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on New Property Tax Rules: How The Changes Affect Homeowners. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Krugmans Critique Dissecting The Inhumanity Of Trumps Immigration Stance

Aug 20, 2025

Krugmans Critique Dissecting The Inhumanity Of Trumps Immigration Stance

Aug 20, 2025 -

My Own Two Eyes Or Misinterpretation Evaluating Karoline Leavitts Trump Narrative

Aug 20, 2025

My Own Two Eyes Or Misinterpretation Evaluating Karoline Leavitts Trump Narrative

Aug 20, 2025 -

Bryan Kohbergers Creepy Demeanor University Accounts Before Idaho Student Slayings

Aug 20, 2025

Bryan Kohbergers Creepy Demeanor University Accounts Before Idaho Student Slayings

Aug 20, 2025 -

Us Russia Relations White House Talks Take Center Stage After Alaska Meeting

Aug 20, 2025

Us Russia Relations White House Talks Take Center Stage After Alaska Meeting

Aug 20, 2025 -

Morecambe Fc Names Ashvir Singh Johal Youngest Boss In Top Five English Tiers

Aug 20, 2025

Morecambe Fc Names Ashvir Singh Johal Youngest Boss In Top Five English Tiers

Aug 20, 2025

Latest Posts

-

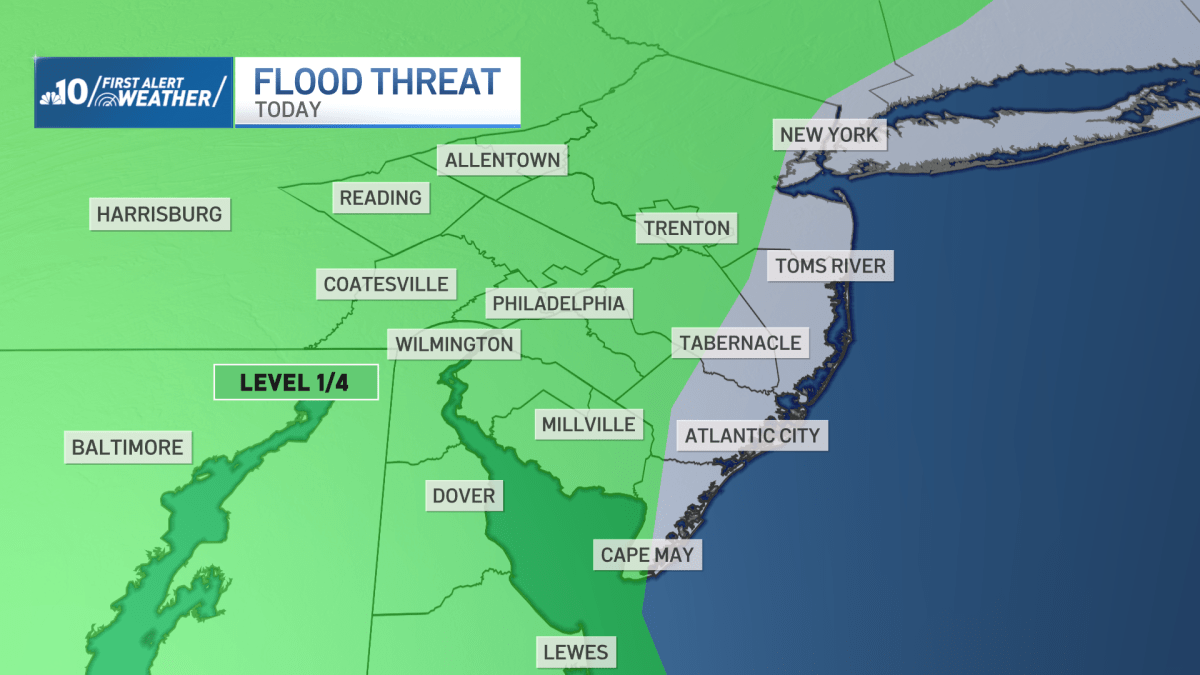

Powerful Storms Unleash Downpours And Widespread Flooding In Philadelphia

Aug 20, 2025

Powerful Storms Unleash Downpours And Widespread Flooding In Philadelphia

Aug 20, 2025 -

Rodons Stellar Outing Five Ks Power Yankees To 13th Win

Aug 20, 2025

Rodons Stellar Outing Five Ks Power Yankees To 13th Win

Aug 20, 2025 -

Resolution Reached Uk And Us Settle Apple Privacy Dispute

Aug 20, 2025

Resolution Reached Uk And Us Settle Apple Privacy Dispute

Aug 20, 2025 -

Cleveland Guardians Arizona Project Fallout

Aug 20, 2025

Cleveland Guardians Arizona Project Fallout

Aug 20, 2025 -

Cleveland Guardians Prospect Parker Messick Set For Big League Start

Aug 20, 2025

Cleveland Guardians Prospect Parker Messick Set For Big League Start

Aug 20, 2025