New Property Tax Laws: How To Protect Your Investment

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

New Property Tax Laws: How to Protect Your Investment

Are rising property taxes threatening your investment? New property tax laws are rolling out across the country, leaving many homeowners and investors scrambling to understand their implications and protect their assets. This comprehensive guide breaks down the key changes and provides actionable steps to safeguard your investment.

The landscape of property taxation is constantly evolving. Recent legislative changes, driven by factors ranging from budget shortfalls to reassessment methodologies, are significantly impacting property owners. Understanding these changes is crucial to avoid unexpected financial burdens and maintain the value of your property.

Understanding the New Laws: Key Changes & Their Impact

The specifics of new property tax laws vary by state and even by locality. However, some common trends include:

- Increased Assessments: Many areas are experiencing reassessments leading to higher property values and, consequently, higher tax bills. This can significantly impact your budget, especially if you're on a fixed income or relying on rental income.

- Changes in Exemptions: Some states are modifying or eliminating certain property tax exemptions, previously available to seniors, veterans, or disabled individuals. This can result in a substantial increase in taxes for those who previously benefited from these exemptions.

- New Taxing Authorities: In some regions, newly established taxing authorities or expanded powers of existing ones are leading to the introduction of new taxes or increases in existing ones. This can be particularly challenging for those unfamiliar with the intricacies of local governance.

- Shifting Tax Burdens: Some jurisdictions are shifting the tax burden from commercial properties to residential properties, leading to an increase in residential property taxes.

How these changes affect your investment depends heavily on your specific situation. Are you a homeowner, landlord, or real estate investor? Do you own multiple properties? Understanding your individual circumstances is the first step in protecting your investment.

Protecting Your Investment: Practical Steps You Can Take

Here are some actionable steps to mitigate the impact of new property tax laws:

- Appeal Your Assessment: If you believe your property's assessment is inaccurate, file an appeal with your local assessor's office. Thoroughly document your case with comparable property sales data and evidence of any property flaws. [Link to a resource on appealing property taxes].

- Explore Tax Exemptions: Research available property tax exemptions in your area. Eligibility criteria vary, so carefully review the requirements and ensure you meet them. [Link to a state-specific resource on property tax exemptions].

- Budget Strategically: Factor potential tax increases into your annual budget. This proactive approach will help you avoid financial surprises and manage your finances effectively.

- Consider Tax-Deferred Exchanges: For real estate investors, a 1031 exchange can defer capital gains taxes when selling and reinvesting in similar properties. Consult with a qualified tax professional to explore this option. [Link to information on 1031 exchanges].

- Stay Informed: Regularly check your local government's website and publications for updates on property tax laws and assessment notices.

The Bottom Line: Proactive Planning is Key

Navigating the complexities of new property tax laws requires proactive planning and a clear understanding of your rights and responsibilities. By staying informed, appealing unfair assessments, and exploring available exemptions, you can significantly protect your investment and avoid unexpected financial burdens. Don't wait until it's too late; take action today to safeguard your financial future.

Call to Action: Do you have any questions or concerns about the new property tax laws in your area? Share your experiences in the comments below!

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on New Property Tax Laws: How To Protect Your Investment. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Mass Tourisms Dark Side Why European Cities Are Pushing Back

Aug 21, 2025

Mass Tourisms Dark Side Why European Cities Are Pushing Back

Aug 21, 2025 -

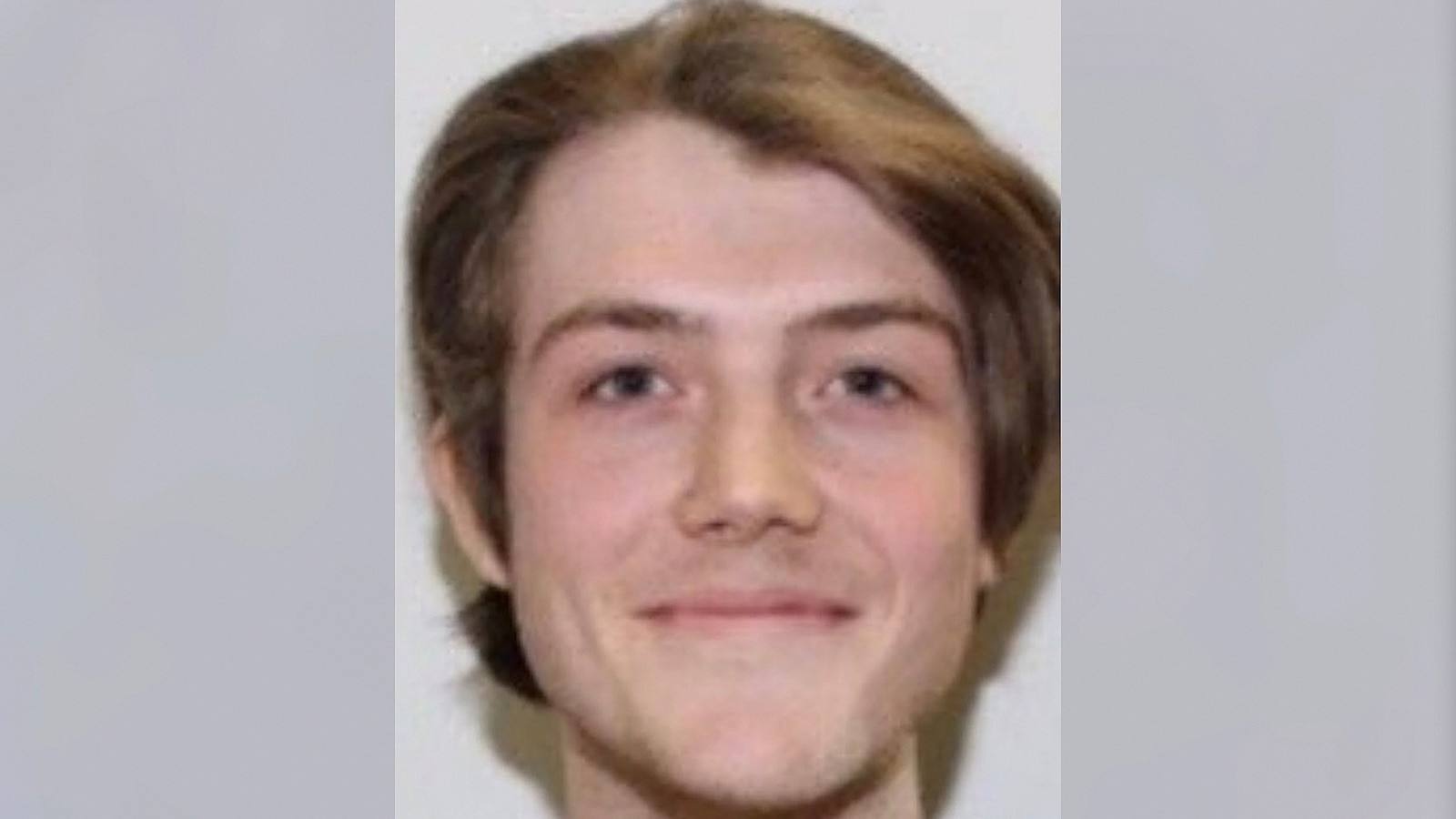

Bryan Kohbergers Domineering Personality Accounts From University Peers Before Idaho Crimes

Aug 21, 2025

Bryan Kohbergers Domineering Personality Accounts From University Peers Before Idaho Crimes

Aug 21, 2025 -

Rumors Debunked Stevie Wonder Speaks Out On His Sight

Aug 21, 2025

Rumors Debunked Stevie Wonder Speaks Out On His Sight

Aug 21, 2025 -

Trumps Mail In Voting Warnings Threat To Democracy Or Political Strategy

Aug 21, 2025

Trumps Mail In Voting Warnings Threat To Democracy Or Political Strategy

Aug 21, 2025 -

Solving The Housing Crisis Utilizing Vacant Properties

Aug 21, 2025

Solving The Housing Crisis Utilizing Vacant Properties

Aug 21, 2025

Latest Posts

-

Police Apprehend Man Accused Of Dragging Massachusetts State Trooper

Aug 21, 2025

Police Apprehend Man Accused Of Dragging Massachusetts State Trooper

Aug 21, 2025 -

Children Graduate In Gaza Amidst Grief For Deceased Parents

Aug 21, 2025

Children Graduate In Gaza Amidst Grief For Deceased Parents

Aug 21, 2025 -

More Than Just Pitches Alvarados Influence On The Philadelphia Phillies

Aug 21, 2025

More Than Just Pitches Alvarados Influence On The Philadelphia Phillies

Aug 21, 2025 -

Alvarados Return To Phillies Too Late For Postseason Run

Aug 21, 2025

Alvarados Return To Phillies Too Late For Postseason Run

Aug 21, 2025 -

Falling Chip Stocks Drag Down Palantir Impact Of Trump Era Policies

Aug 21, 2025

Falling Chip Stocks Drag Down Palantir Impact Of Trump Era Policies

Aug 21, 2025