New Property Tax Laws: How The Changes Will Affect You

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

New Property Tax Laws: How the Changes Will Affect You

Are you prepared for the impact of the recently enacted property tax laws? These significant changes could mean substantial alterations to your annual property tax bill, so understanding the details is crucial. This article breaks down the key changes and explains how they will affect homeowners and property owners across the nation.

The recently passed legislation introduces several key modifications to the existing property tax system. While specific details vary by state and even locality, several common themes emerge. Understanding these changes is crucial to protecting your financial interests.

Key Changes in the New Property Tax Laws:

-

Reassessment Procedures: Many jurisdictions are updating their property reassessment processes. This might mean more frequent reassessments, leading to potential increases or decreases in your assessed property value. Understanding your local jurisdiction's reassessment schedule is paramount. Check your local government website for specifics on assessment timelines and appeals processes.

-

Exemptions and Credits: Some of the new laws introduce or expand existing property tax exemptions and credits for specific groups, such as seniors, veterans, and individuals with disabilities. These exemptions can significantly reduce your tax burden. Research your eligibility for any applicable exemptions in your area – this could save you thousands of dollars annually.

-

Increased Homestead Exemptions: Several states have increased the homestead exemption, reducing the taxable value of your primary residence. This can result in lower property taxes, particularly beneficial for long-term homeowners.

-

Changes to Tax Rates: Tax rates themselves may be altered, either increasing or decreasing depending on local government budgets and priorities. It's vital to check your local tax assessor's office for updated rates and any accompanying explanations.

-

Impact on Property Values: The new laws might indirectly influence property values. Changes in tax rates or assessment procedures could affect market prices, depending on the overall economic climate. Staying informed about local real estate trends is crucial for understanding the potential long-term consequences.

How to Prepare for the Changes:

-

Review your property tax assessment: Carefully examine your current property tax assessment to understand your current tax liability. Compare this to the new rates and procedures announced in your area.

-

Check for available exemptions and credits: Research the new laws to determine if you qualify for any exemptions or credits that can lower your tax bill.

-

Understand the appeals process: Familiarize yourself with the appeals process in your jurisdiction. If you believe your property is overvalued, you might be able to appeal the assessment. Knowing the deadlines and procedures is crucial.

-

Consult a tax professional: For complex situations or if you require clarification on specific aspects of the new laws, consulting a qualified tax professional is recommended. They can provide personalized advice based on your unique circumstances.

-

Stay informed: Keep abreast of any further updates or clarifications regarding the new property tax laws. Local news sources and government websites are excellent resources for staying up-to-date.

The Bottom Line:

The new property tax laws represent significant changes that could impact your finances. By proactively understanding these changes and taking the necessary steps to prepare, you can minimize potential negative effects and even potentially reduce your property tax burden. Don't wait; start researching your local changes today.

Call to Action: Visit your local assessor's website to review your property's assessment and learn more about the updated property tax laws in your area. (Link to a generic example of a local assessor's website would go here, if available).

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on New Property Tax Laws: How The Changes Will Affect You. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Chelsea Clintons Photo A Calculated Response To Trumps Uninvited Presence

Aug 21, 2025

Chelsea Clintons Photo A Calculated Response To Trumps Uninvited Presence

Aug 21, 2025 -

Youngest Manager In Top Five Tiers Ashvir Singh Johals Rise To Success

Aug 21, 2025

Youngest Manager In Top Five Tiers Ashvir Singh Johals Rise To Success

Aug 21, 2025 -

Karoline Leavitt And Donald Trump Examining The My Own Two Eyes Controversy

Aug 21, 2025

Karoline Leavitt And Donald Trump Examining The My Own Two Eyes Controversy

Aug 21, 2025 -

Michigan Lottery Daily 3 And Daily 4 Results For August 17th 2025

Aug 21, 2025

Michigan Lottery Daily 3 And Daily 4 Results For August 17th 2025

Aug 21, 2025 -

Migrant Hotel Closures Spark Debate Amidst Liam Gallaghers Pride

Aug 21, 2025

Migrant Hotel Closures Spark Debate Amidst Liam Gallaghers Pride

Aug 21, 2025

Latest Posts

-

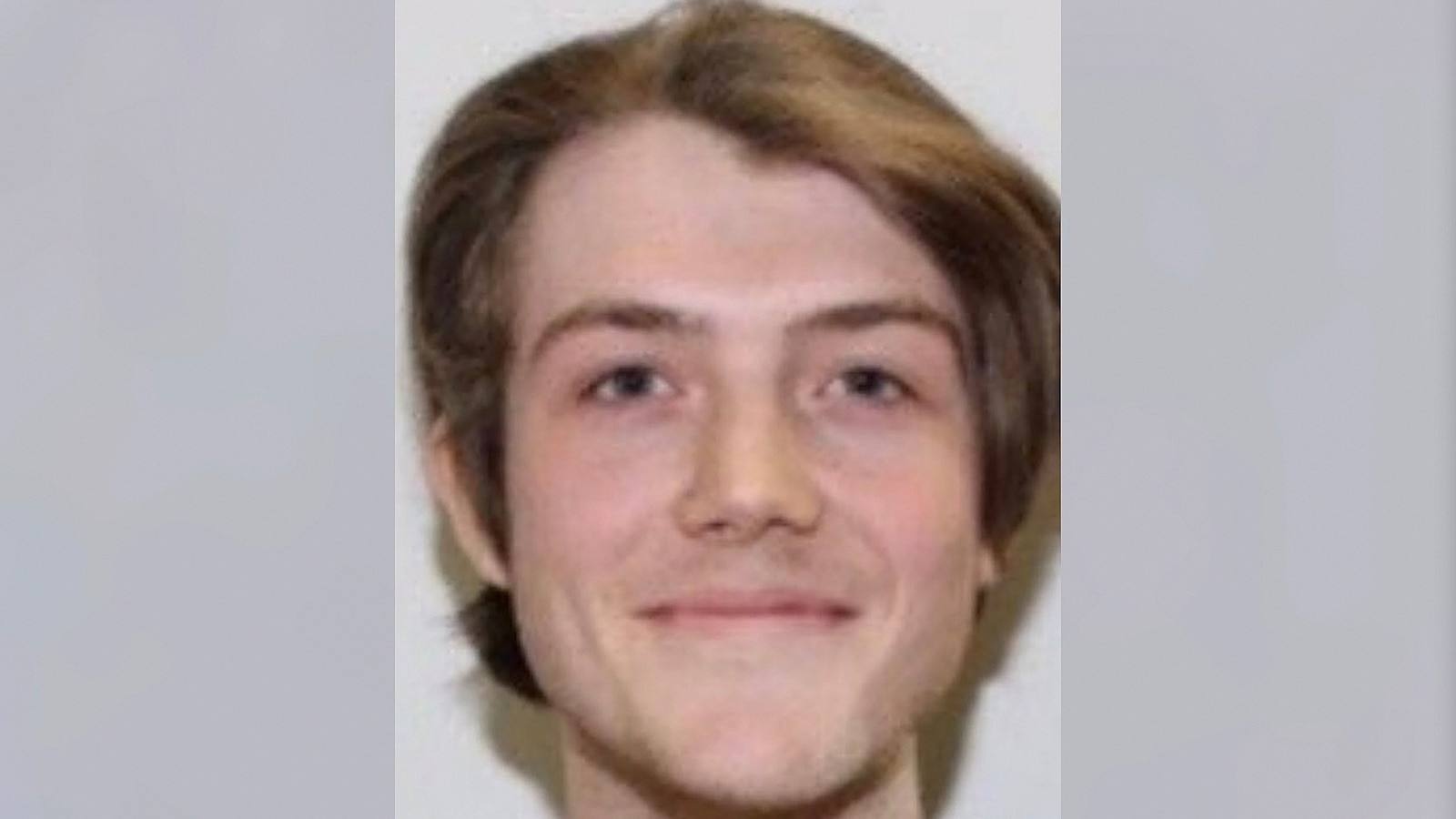

Police Apprehend Man Accused Of Dragging Massachusetts State Trooper

Aug 21, 2025

Police Apprehend Man Accused Of Dragging Massachusetts State Trooper

Aug 21, 2025 -

Children Graduate In Gaza Amidst Grief For Deceased Parents

Aug 21, 2025

Children Graduate In Gaza Amidst Grief For Deceased Parents

Aug 21, 2025 -

More Than Just Pitches Alvarados Influence On The Philadelphia Phillies

Aug 21, 2025

More Than Just Pitches Alvarados Influence On The Philadelphia Phillies

Aug 21, 2025 -

Alvarados Return To Phillies Too Late For Postseason Run

Aug 21, 2025

Alvarados Return To Phillies Too Late For Postseason Run

Aug 21, 2025 -

Falling Chip Stocks Drag Down Palantir Impact Of Trump Era Policies

Aug 21, 2025

Falling Chip Stocks Drag Down Palantir Impact Of Trump Era Policies

Aug 21, 2025