Mortgage Rates On Hold? Waiting For The Fed's Decision

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Mortgage Rates on Hold? Waiting on the Fed's Decision

Are you ready for a rollercoaster? The housing market is holding its breath, anxiously awaiting the Federal Reserve's next move. With inflation stubbornly persistent and the economy showing mixed signals, the question on everyone's mind is: will mortgage rates stay put, or are we in for another climb? This crucial decision will significantly impact potential homebuyers and existing homeowners alike.

The recent period of relative stability in mortgage rates has offered a brief respite for those hoping to enter or navigate the housing market. However, this calm before the storm might be short-lived. The Federal Open Market Committee (FOMC) meeting, scheduled for [Insert Date of Meeting], will be a pivotal moment, potentially setting the course for mortgage rates for the coming months.

Understanding the Connection: Fed Rates and Mortgage Rates

It's crucial to understand the intricate relationship between the Federal Reserve's actions and the rates you see on your mortgage application. When the Fed raises its benchmark interest rate (the federal funds rate), it typically leads to higher borrowing costs across the board, including mortgages. Conversely, a pause or reduction in the federal funds rate can signal a potential decrease in mortgage rates.

This isn't a direct correlation, however. Other economic factors, such as inflation, investor sentiment, and the overall performance of the bond market, also influence mortgage rates. While the Fed's decision carries significant weight, it's not the sole determinant.

What to Expect from the Upcoming FOMC Meeting?

Economists are divided on what the Fed will do. Some predict another interest rate hike to combat lingering inflation, while others believe the current rates are sufficient and a pause is warranted. The decision hinges on a complex assessment of various economic indicators, including:

- Inflation Data: The latest Consumer Price Index (CPI) and Producer Price Index (PPI) reports will be meticulously analyzed. A persistent upward trend might push the Fed towards a rate hike.

- Unemployment Figures: A strong labor market could embolden the Fed to continue its tightening policy, while rising unemployment might signal a need for caution.

- Economic Growth: Slowing economic growth might sway the Fed towards a more dovish approach, potentially leading to a pause or even rate cuts in the future.

The Impact on Homebuyers and Refinance Opportunities:

The Fed's decision will have far-reaching consequences for the housing market. For potential homebuyers, higher mortgage rates mean less purchasing power and potentially smaller homes within their budget. Conversely, a pause or decrease could reinvigorate the market, leading to increased competition.

Existing homeowners with adjustable-rate mortgages (ARMs) are particularly vulnerable to rate hikes. A rise in the federal funds rate could significantly increase their monthly payments. Those considering refinancing their mortgages should carefully weigh the risks and benefits based on the Fed's anticipated actions.

Looking Ahead: Navigating Uncertainty

The uncertainty surrounding the Fed's decision underscores the importance of careful planning and informed decision-making in the housing market. Consulting with a financial advisor and mortgage broker is crucial to navigate the complexities and make the best decisions for your individual financial situation. Stay informed about economic news and the Fed's announcements to better anticipate shifts in mortgage rates. The upcoming FOMC meeting is a watershed moment, and its impact will resonate throughout the housing market for months to come.

Call to Action: Stay tuned for updates following the FOMC meeting on [Insert Date of Meeting]! We'll provide expert analysis and insights into what the decision means for you. [Link to your website or relevant resource]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Mortgage Rates On Hold? Waiting For The Fed's Decision. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Teslas 1 Trillion Commitment To Elon Musk Risks And Rewards

Sep 09, 2025

Teslas 1 Trillion Commitment To Elon Musk Risks And Rewards

Sep 09, 2025 -

Balance Of Power Shift Burnham Addresses Rayners Departure From Cabinet

Sep 09, 2025

Balance Of Power Shift Burnham Addresses Rayners Departure From Cabinet

Sep 09, 2025 -

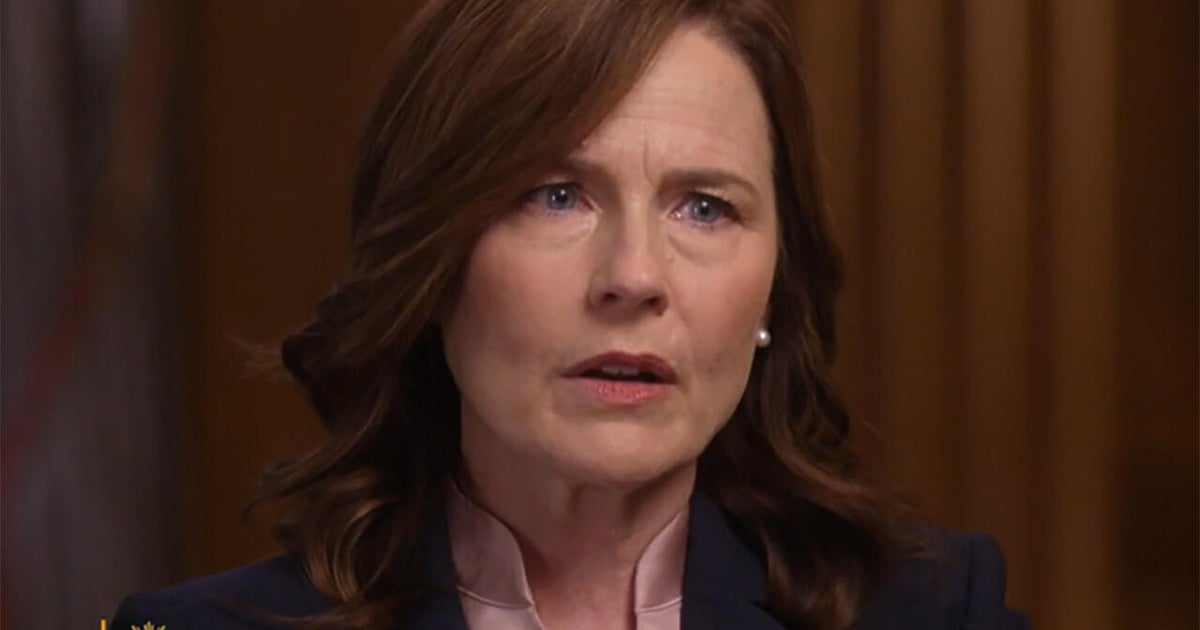

Justice Barrett Responds To Backlash Over Supreme Courts Role In Trumps Actions

Sep 09, 2025

Justice Barrett Responds To Backlash Over Supreme Courts Role In Trumps Actions

Sep 09, 2025 -

Former Top Doj Ethics Adviser Alleges Retaliation Names Pam Bondi

Sep 09, 2025

Former Top Doj Ethics Adviser Alleges Retaliation Names Pam Bondi

Sep 09, 2025 -

Pro Palestine Protest Arrests Surge To 890

Sep 09, 2025

Pro Palestine Protest Arrests Surge To 890

Sep 09, 2025

Latest Posts

-

Inflation Report U S Consumer Prices Rise In June Meeting Expectations

Sep 09, 2025

Inflation Report U S Consumer Prices Rise In June Meeting Expectations

Sep 09, 2025 -

Dwight Howard A First Ballot Hall Of Fame Case

Sep 09, 2025

Dwight Howard A First Ballot Hall Of Fame Case

Sep 09, 2025 -

One Day Strike Planned By Kaiser Permanente Nurses In Oakland And Roseville

Sep 09, 2025

One Day Strike Planned By Kaiser Permanente Nurses In Oakland And Roseville

Sep 09, 2025 -

Ariana Grande 2026 Concert Tickets Expected Costs And Where To Buy

Sep 09, 2025

Ariana Grande 2026 Concert Tickets Expected Costs And Where To Buy

Sep 09, 2025 -

St Elmos Fire 4 K Remaster Sony Confirms October Release

Sep 09, 2025

St Elmos Fire 4 K Remaster Sony Confirms October Release

Sep 09, 2025