Mortgage Rates Hit 11-Month Low: High 5% Range Now Possible

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Mortgage Rates Hit 11-Month Low: High 5% Range Now Possible

Record-low mortgage rates are fueling a renewed interest in homeownership. For months, prospective homebuyers have faced a challenging market characterized by high interest rates. But a surprising shift is underway, with mortgage rates plummeting to an 11-month low, potentially opening the door for more affordable home financing. This development could significantly impact the housing market, boosting buyer confidence and increasing activity.

The Current Landscape: A Welcome Change for Buyers

The average rate for a 30-year fixed-rate mortgage has fallen below 6%, hitting levels not seen since last year. This significant drop offers a breath of fresh air for those seeking to enter the housing market or refinance existing loans. Many lenders are now offering rates in the high 5% range, a considerable improvement from the peak rates exceeding 7% seen earlier this year. This decline is primarily attributed to easing inflation concerns and a more cautious approach by the Federal Reserve regarding future interest rate hikes.

What's Driving the Decrease? Understanding the Market Forces

Several factors contribute to this recent decline in mortgage rates:

- Easing Inflation: Recent economic data suggests inflation is cooling, leading to expectations that the Federal Reserve may slow or pause its interest rate increases. This decreased pressure on interest rates benefits borrowers.

- Federal Reserve Policy: While the Fed remains committed to combating inflation, its more measured approach to rate hikes has calmed market anxieties, contributing to lower mortgage rates.

- Increased Competition Among Lenders: Increased competition in the mortgage lending market can drive down rates as lenders strive to attract borrowers.

Is Now the Time to Buy or Refinance? A Deeper Dive

The lower mortgage rates present a compelling opportunity for both prospective homebuyers and those considering refinancing. For buyers, lower rates translate to lower monthly payments and increased affordability. For homeowners with existing mortgages, refinancing could significantly reduce their monthly expenses. However, it's crucial to carefully weigh the pros and cons and consult with a financial advisor before making any major decisions.

Factors to Consider:

- Your Personal Financial Situation: Assess your credit score, debt-to-income ratio, and overall financial health before applying for a mortgage or refinancing. A strong financial profile can help you secure the best rates.

- Long-Term Costs: Remember that even with lower rates, the total cost of a mortgage over 30 years is significant. Carefully evaluate your budget and long-term financial commitments.

- Market Conditions: While mortgage rates have decreased, housing prices in many areas remain elevated. Consider the overall market conditions in your area before making a purchase decision.

Looking Ahead: Potential Implications for the Housing Market

This drop in mortgage rates could revitalize the housing market, stimulating demand and potentially increasing home sales. However, it’s important to monitor economic indicators and the Federal Reserve's future actions to gauge the long-term outlook. The current situation is positive for potential buyers and those looking to refinance, but continued volatility is a possibility.

Call to Action:

Are you ready to explore your mortgage options? Connect with a trusted mortgage lender today to discuss your individual needs and explore the possibilities available with these improved rates. [Link to a reputable mortgage comparison website (example: NerdWallet, Bankrate)]. Remember to shop around and compare rates from multiple lenders to secure the best deal. Don't miss this opportunity to capitalize on the current market conditions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Mortgage Rates Hit 11-Month Low: High 5% Range Now Possible. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

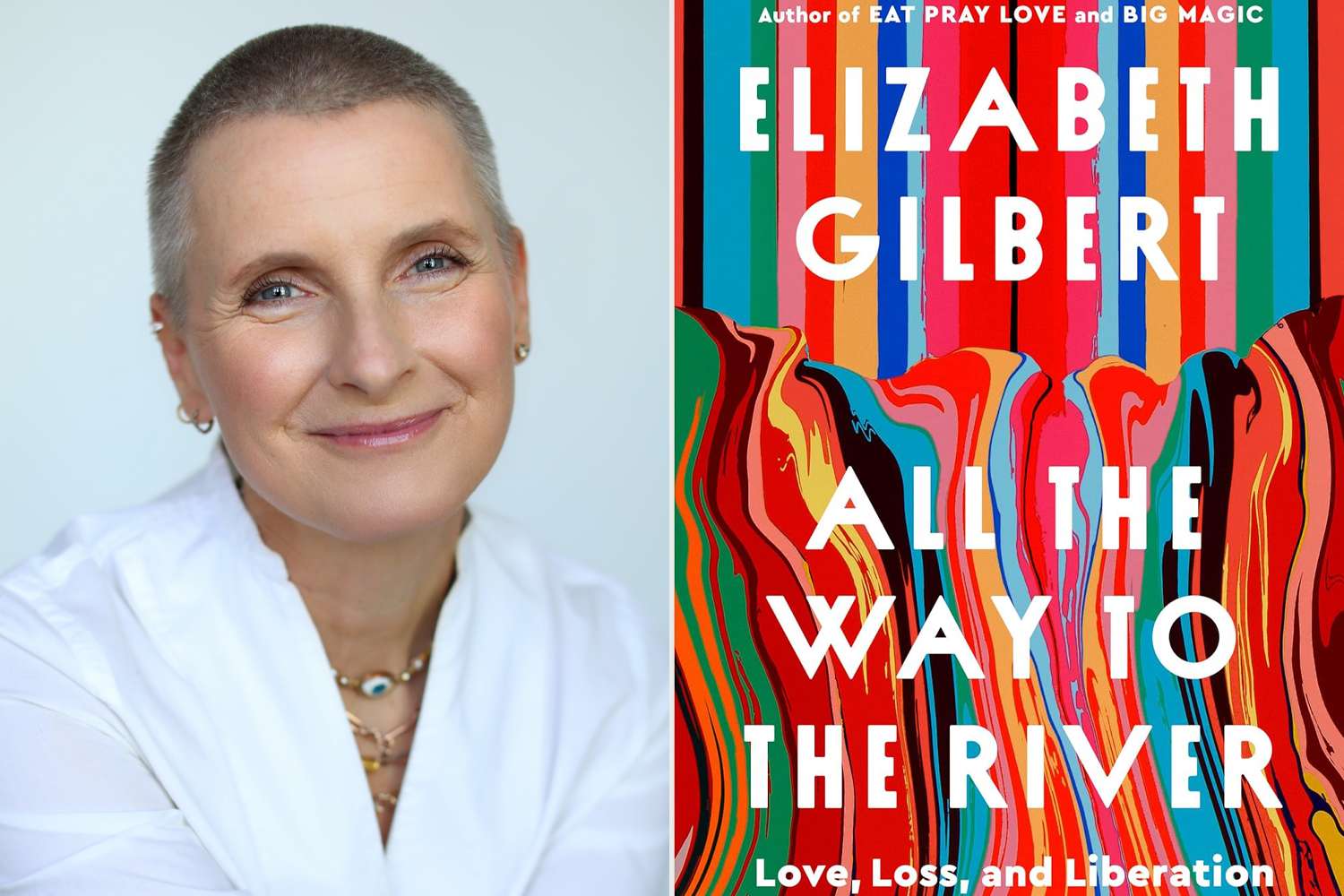

Elizabeth Gilberts Raw And Honest Memoir Details Sex Drugs And A Murder Plot

Sep 10, 2025

Elizabeth Gilberts Raw And Honest Memoir Details Sex Drugs And A Murder Plot

Sep 10, 2025 -

Italy Mourns The Passing Of Fashion Icon Giorgio Armani

Sep 10, 2025

Italy Mourns The Passing Of Fashion Icon Giorgio Armani

Sep 10, 2025 -

Remembering Giorgio Armani A Tribute To The Italian Maestro

Sep 10, 2025

Remembering Giorgio Armani A Tribute To The Italian Maestro

Sep 10, 2025 -

This Tuesday Groundbreaking Marks Start Of Sasds 2025 Project

Sep 10, 2025

This Tuesday Groundbreaking Marks Start Of Sasds 2025 Project

Sep 10, 2025 -

Long Distance Marriage Maintaining A Happy Relationship Across Borders

Sep 10, 2025

Long Distance Marriage Maintaining A Happy Relationship Across Borders

Sep 10, 2025

Latest Posts

-

Hidden Children Violent End The Story Of A Fugitive Father

Sep 10, 2025

Hidden Children Violent End The Story Of A Fugitive Father

Sep 10, 2025 -

Student Privacy And Ai Examining The Use Of Ai Support Services In High Schools

Sep 10, 2025

Student Privacy And Ai Examining The Use Of Ai Support Services In High Schools

Sep 10, 2025 -

Missing Student Jack O Sullivan Donor Offers 100 000 Reward

Sep 10, 2025

Missing Student Jack O Sullivan Donor Offers 100 000 Reward

Sep 10, 2025 -

Banksy Strikes Again Fresh Artwork Found At London High Court

Sep 10, 2025

Banksy Strikes Again Fresh Artwork Found At London High Court

Sep 10, 2025 -

England Flag On Westbury White Horse Damaged Full Report

Sep 10, 2025

England Flag On Westbury White Horse Damaged Full Report

Sep 10, 2025