Mortgage Rates Hit 11-Month Low: Are High 5% Rates The New Normal?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Mortgage Rates Hit 11-Month Low: Are High 5% Rates the New Normal?

The housing market is buzzing with news that could significantly impact potential homebuyers: mortgage rates have plummeted to an 11-month low. This unexpected dip offers a glimmer of hope for those priced out of the market by consistently high rates, but the question remains: is this a temporary reprieve, or are we settling into a new era of 5%+ interest rates?

The recent decline, according to Freddie Mac's Primary Mortgage Market Survey, sees the average rate for a 30-year fixed-rate mortgage hovering around 5.3%, a significant drop from the peaks witnessed earlier this year. This marks the lowest point since last year’s rate surge. For context, rates briefly touched 7% in late 2022, making homeownership a daunting prospect for many. This shift is largely attributed to easing inflation concerns and a more cautious approach by the Federal Reserve regarding future interest rate hikes.

What Does This Mean for Homebuyers?

This decrease in mortgage rates offers a much-needed boost to potential homebuyers. The lower rates translate to lower monthly payments, making homeownership more attainable for a broader range of individuals. Those who have been waiting on the sidelines, hoping for a more favorable market, might now find the opportunity to enter the market.

However, it's crucial to temper expectations. While 5.3% is lower than recent highs, it still represents a significant jump from the historically low rates seen in the pre-pandemic era. This means that monthly mortgage payments remain considerably higher than they were just a few years ago.

The Persistence of High Rates: A New Reality?

Experts remain divided on whether we've seen the bottom of the rate cycle. Several factors contribute to this uncertainty:

- Inflation: While inflation has cooled somewhat, it remains above the Federal Reserve's target. Any resurgence in inflation could prompt further interest rate increases, pushing mortgage rates back up.

- Economic Uncertainty: Global economic instability and potential recessionary pressures could influence the Federal Reserve's monetary policy decisions, impacting mortgage rates.

- Housing Inventory: The ongoing shortage of housing inventory continues to put upward pressure on home prices, partially offsetting the benefits of lower mortgage rates.

Navigating the Market: Tips for Homebuyers

Despite the uncertainty, the current market presents both challenges and opportunities. Here are some key considerations for prospective homebuyers:

- Get pre-approved: A pre-approval letter demonstrates your financial readiness and strengthens your position in a competitive market.

- Shop around for mortgages: Comparing rates and fees from multiple lenders is crucial to securing the best possible deal.

- Consider your long-term financial picture: Homeownership is a significant financial commitment. Carefully assess your budget and affordability before making an offer.

- Stay informed: Keep abreast of market trends and economic news to make informed decisions. Resources like [link to reputable financial news website] can provide valuable insights.

Conclusion:

While the recent drop in mortgage rates offers a positive development for the housing market, it's crucial to approach the situation with a balanced perspective. While the 11-month low provides a more favorable environment for homebuyers, the possibility of higher rates remains a factor to consider. Careful planning, informed decision-making, and staying updated on market trends are essential for navigating this dynamic market. Remember to consult with a qualified financial advisor to determine the best course of action based on your individual circumstances.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Mortgage Rates Hit 11-Month Low: Are High 5% Rates The New Normal?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Uk May Halt Visas Countries Without Repatriation Agreements Face Action

Sep 10, 2025

Uk May Halt Visas Countries Without Repatriation Agreements Face Action

Sep 10, 2025 -

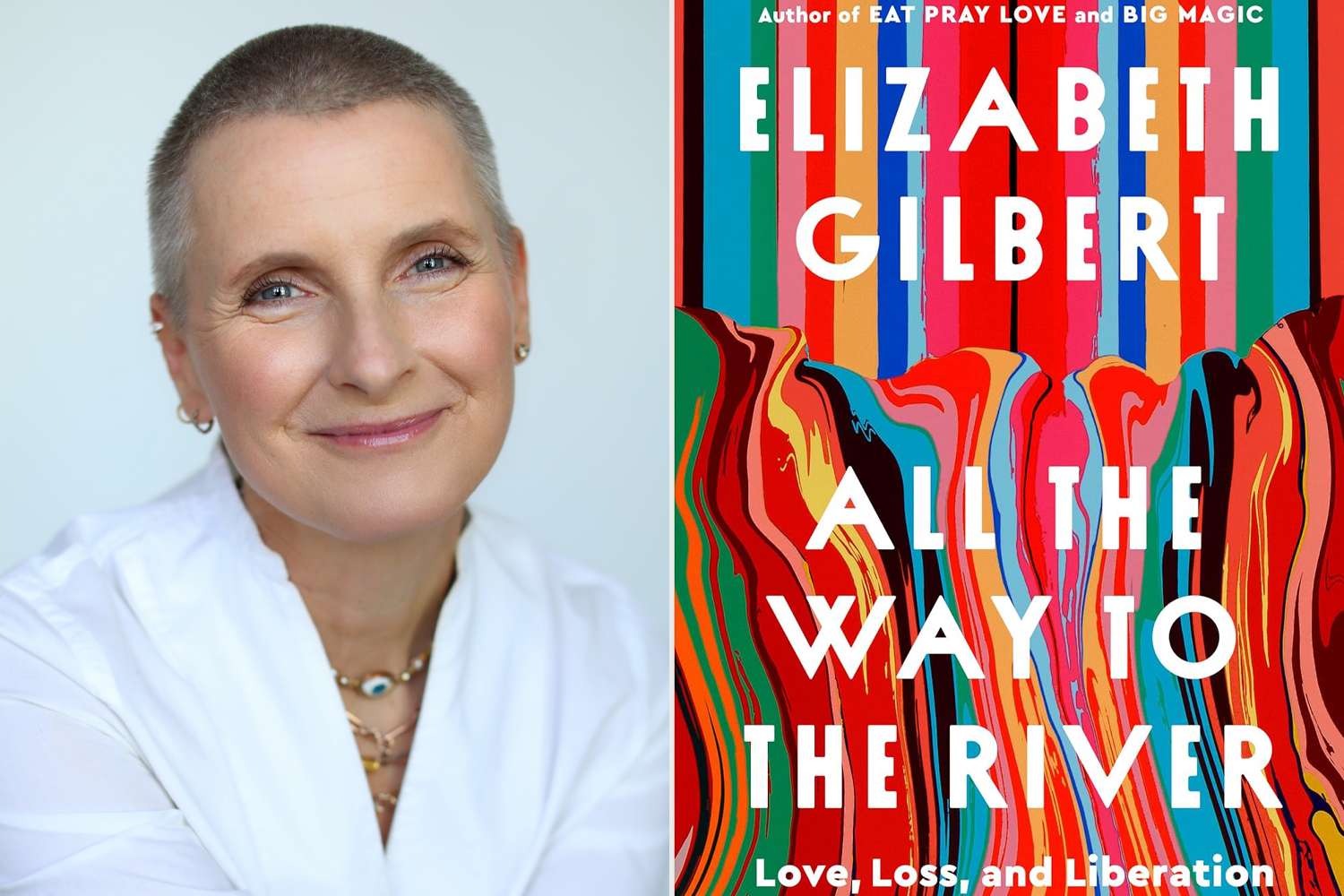

From Eat Pray Love To Murder Plot Elizabeth Gilberts Raw And Honest Memoir

Sep 10, 2025

From Eat Pray Love To Murder Plot Elizabeth Gilberts Raw And Honest Memoir

Sep 10, 2025 -

United Health Medicare Advantage Plans Membership On Track

Sep 10, 2025

United Health Medicare Advantage Plans Membership On Track

Sep 10, 2025 -

11 Month Low Mortgage Rates Are High 5 Rates The New Normal

Sep 10, 2025

11 Month Low Mortgage Rates Are High 5 Rates The New Normal

Sep 10, 2025 -

Unveiling Diplomatic Journeys An Examination Of World Leaders Overseas Travel

Sep 10, 2025

Unveiling Diplomatic Journeys An Examination Of World Leaders Overseas Travel

Sep 10, 2025

Latest Posts

-

Pam Bondi Faces Backlash After Firing Of Top Doj Ethics Adviser

Sep 10, 2025

Pam Bondi Faces Backlash After Firing Of Top Doj Ethics Adviser

Sep 10, 2025 -

New Report Names Englands Best And Worst Performing Nhs Trusts

Sep 10, 2025

New Report Names Englands Best And Worst Performing Nhs Trusts

Sep 10, 2025 -

Survey Finds Damage To Westbury White Horses England Flag

Sep 10, 2025

Survey Finds Damage To Westbury White Horses England Flag

Sep 10, 2025 -

Ethical Concerns Raised After Pam Bondi Fires Top Doj Ethics Advisor

Sep 10, 2025

Ethical Concerns Raised After Pam Bondi Fires Top Doj Ethics Advisor

Sep 10, 2025 -

New Banksy Artwork Discovered London High Court Grafitti

Sep 10, 2025

New Banksy Artwork Discovered London High Court Grafitti

Sep 10, 2025