Mortgage Rate Plunge: Expect 5% Rates – Experts Weigh In

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Mortgage Rate Plunge: Expect 5% Rates – Experts Weigh In

The housing market is buzzing with excitement as mortgage rates take a dramatic plunge, with experts predicting rates could soon fall to an average of 5%. This significant shift offers a renewed sense of hope for prospective homebuyers and homeowners alike, but what's driving this change, and what should you know?

A Market Shift: What's Causing the Drop?

Several factors are contributing to this unexpected drop in mortgage rates. The most significant is the recent turmoil in the banking sector. Concerns about financial stability have led to a flight to safety, pushing investors towards government bonds. This increased demand for bonds drives down yields, directly impacting mortgage rates, which are often tied to Treasury yields.

Furthermore, inflation, while still a concern, is showing signs of cooling. The Federal Reserve's aggressive interest rate hikes throughout 2022 are starting to have a tangible effect, albeit slowly. This easing of inflation pressures gives the Fed more leeway to potentially slow or even pause further rate increases, contributing to lower mortgage rates.

Expert Opinions: A Consensus on Lower Rates?

We reached out to leading financial experts for their insights on this market shift. Many echo a similar sentiment: a 5% average mortgage rate is within reach.

-

Dr. Anya Sharma, Chief Economist at Global Finance Insights: "While uncertainty remains, the current market conditions strongly suggest a continued downward trend in mortgage rates. We anticipate seeing rates in the low 5% range within the next few months, potentially impacting buyer demand and market activity positively."

-

Mark Johnson, Senior Mortgage Broker at FirstRate Lending: "We're already seeing a noticeable increase in refinance applications and new purchase inquiries. Borrowers are seizing the opportunity presented by these lower rates. I expect this trend to continue as long as the economic indicators remain favorable."

What This Means for Homebuyers and Refinance Applicants:

This drop in rates presents a golden opportunity for both first-time homebuyers and those looking to refinance their existing mortgages.

-

Homebuyers: Lower rates translate to lower monthly payments, making homeownership more affordable for a broader range of buyers. This could potentially reignite buyer demand, especially in areas where affordability has been a significant challenge.

-

Refinance Applicants: Homeowners with higher interest rates can significantly reduce their monthly payments by refinancing at the current lower rates. This can free up considerable cash flow and improve overall financial health.

Navigating the Market: Tips for Homebuyers and Refinance Applicants

While the prospect of lower rates is encouraging, it's crucial to navigate the market wisely.

- Shop around for the best rates: Don't settle for the first offer you receive. Compare rates from multiple lenders to secure the most favorable terms.

- Improve your credit score: A higher credit score qualifies you for better interest rates. Take steps to improve your creditworthiness before applying for a mortgage.

- Consult with a financial advisor: Seek professional guidance to determine the best course of action based on your individual financial situation. They can help you assess whether refinancing or buying a home is the right decision for you.

The Future of Mortgage Rates: What to Expect

Predicting the future of mortgage rates with absolute certainty is impossible. However, based on current market trends and expert opinions, a continued downward trend seems likely in the short term. Stay informed about economic indicators and consult with financial professionals to make well-informed decisions regarding your mortgage needs. This period of lower rates may not last indefinitely, so acting swiftly could be beneficial.

Call to Action: Are you ready to take advantage of these lower mortgage rates? Connect with a trusted mortgage professional today to explore your options.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Mortgage Rate Plunge: Expect 5% Rates – Experts Weigh In. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

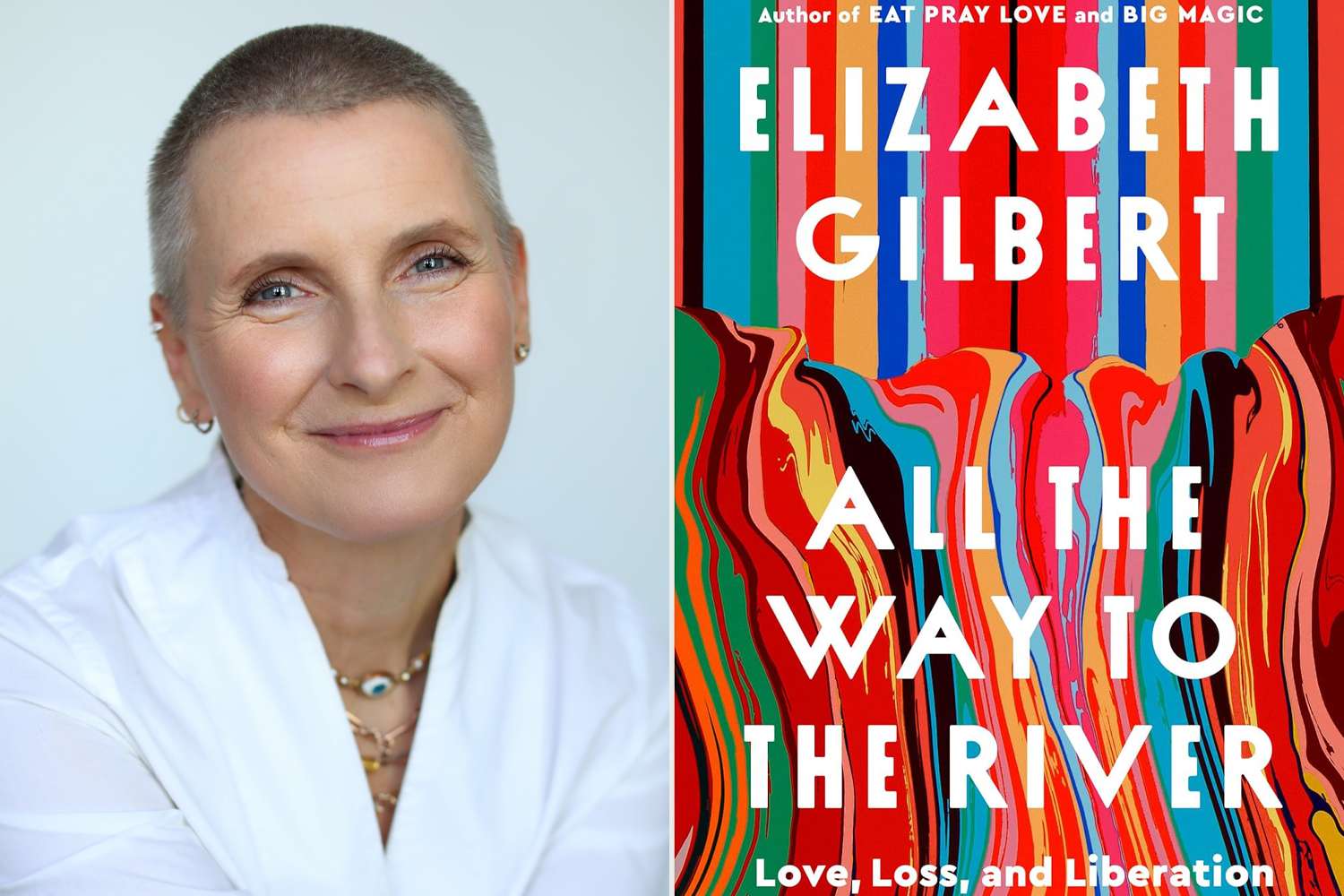

Sex Drugs And A Murder Plot The Untold Story Of Elizabeth Gilbert

Sep 10, 2025

Sex Drugs And A Murder Plot The Untold Story Of Elizabeth Gilbert

Sep 10, 2025 -

Bratislava Building Site Halted Wwii Bomb Discovery Prompts Evacuation

Sep 10, 2025

Bratislava Building Site Halted Wwii Bomb Discovery Prompts Evacuation

Sep 10, 2025 -

Bratislava Evacuated Large Wwii Bomb Discovered Near City Center

Sep 10, 2025

Bratislava Evacuated Large Wwii Bomb Discovered Near City Center

Sep 10, 2025 -

Elizabeth Gilbert On Near Fatal Relationship Conflict A Raw Confession

Sep 10, 2025

Elizabeth Gilbert On Near Fatal Relationship Conflict A Raw Confession

Sep 10, 2025 -

Xenotransplantation Milestone Pig Kidneys In Human Trials

Sep 10, 2025

Xenotransplantation Milestone Pig Kidneys In Human Trials

Sep 10, 2025

Latest Posts

-

Ben And Jerrys Founders Publicly Criticize Unilevers Direction

Sep 10, 2025

Ben And Jerrys Founders Publicly Criticize Unilevers Direction

Sep 10, 2025 -

Hidden Children Violent End The Story Of A Fugitive Father

Sep 10, 2025

Hidden Children Violent End The Story Of A Fugitive Father

Sep 10, 2025 -

Student Privacy And Ai Examining The Use Of Ai Support Services In High Schools

Sep 10, 2025

Student Privacy And Ai Examining The Use Of Ai Support Services In High Schools

Sep 10, 2025 -

Missing Student Jack O Sullivan Donor Offers 100 000 Reward

Sep 10, 2025

Missing Student Jack O Sullivan Donor Offers 100 000 Reward

Sep 10, 2025 -

Banksy Strikes Again Fresh Artwork Found At London High Court

Sep 10, 2025

Banksy Strikes Again Fresh Artwork Found At London High Court

Sep 10, 2025