Microsoft (MSFT): Is This A Once-in-a-Generation Investment Opportunity?

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Microsoft (MSFT): Is This a Once-in-a-Generation Investment Opportunity?

Is Microsoft poised for explosive growth, presenting a generational investment opportunity? Or are current valuations too high, signaling a potential slowdown? Let's delve into the data and explore the compelling arguments on both sides.

The tech giant Microsoft (MSFT) has been a staple in many investment portfolios for decades. Its consistent performance and steady dividend payouts have made it a reliable, if sometimes unspectacular, investment. However, recent developments in artificial intelligence (AI), cloud computing, and the burgeoning metaverse are fueling a debate: is MSFT currently a once-in-a-generation investment opportunity?

The Bull Case for Microsoft: A Multi-Pronged Growth Strategy

Several factors point to a bright future for Microsoft, justifying its elevated valuation in the eyes of many investors:

-

Dominance in Cloud Computing: Azure, Microsoft's cloud computing platform, is a major competitor to Amazon Web Services (AWS) and Google Cloud. Its growth trajectory is impressive, consistently exceeding expectations and contributing significantly to Microsoft's overall revenue. This positions MSFT as a key beneficiary of the ongoing shift to cloud-based services.

-

The AI Revolution: Microsoft's significant investment in OpenAI, the creator of ChatGPT, has positioned it at the forefront of the AI revolution. The integration of AI capabilities across its product suite – from Office 365 to its cloud services – is expected to drive substantial future growth and create entirely new revenue streams. This isn't just incremental improvement; it's a fundamental shift in how we interact with technology.

-

Gaming and the Metaverse: Xbox remains a strong player in the gaming market, while Microsoft's investments in metaverse technologies suggest a long-term strategy to capitalize on this emerging digital frontier. While the metaverse's potential is still largely unrealized, Microsoft's early positioning could give it a significant advantage.

-

Strong Brand Recognition and Ecosystem: Microsoft boasts unparalleled brand recognition and a vast, loyal customer base. This inherent strength allows it to easily introduce new products and services, leveraging its existing ecosystem to accelerate adoption.

-

Consistent Profitability and Dividend Payouts: Microsoft has a history of strong profitability and consistent dividend payouts, providing investors with both capital appreciation potential and income generation.

The Bear Case: Valuation Concerns and Potential Headwinds

Despite the compelling arguments for growth, some investors remain cautious:

-

High Valuation: Microsoft's current stock price reflects considerable optimism about its future prospects. Some analysts argue that the stock is overvalued, leaving little room for error and potentially making it vulnerable to market corrections.

-

Competition in the Cloud: While Azure is growing rapidly, competition from AWS and Google Cloud remains fierce. Maintaining its market share will require continued innovation and significant investment.

-

Regulatory Scrutiny: Like many large tech companies, Microsoft faces increasing regulatory scrutiny concerning antitrust concerns and data privacy. Negative regulatory outcomes could impact its future growth trajectory.

-

Economic Slowdown: A broader economic slowdown could negatively impact business spending on cloud services and software, potentially impacting Microsoft's revenue.

Conclusion: A Calculated Risk with Significant Potential

Whether Microsoft represents a once-in-a-generation investment opportunity is ultimately a matter of individual risk tolerance and investment horizon. The company's strong fundamentals, strategic positioning in key growth areas, and history of innovation suggest significant long-term potential. However, the high valuation and potential headwinds warrant careful consideration. Thorough due diligence, including analyzing financial statements and considering broader market conditions, is crucial before making any investment decisions. Consult with a financial advisor to determine if MSFT aligns with your personal investment strategy.

Disclaimer: This article provides general information and should not be considered financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Microsoft (MSFT): Is This A Once-in-a-Generation Investment Opportunity?. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Can Nc State Exact Revenge Against Wake Forest A Preview Of The Rivalry

Sep 12, 2025

Can Nc State Exact Revenge Against Wake Forest A Preview Of The Rivalry

Sep 12, 2025 -

Israel Shows Bbc Evacuation Sites Gaza Residents Respond With Defiance

Sep 12, 2025

Israel Shows Bbc Evacuation Sites Gaza Residents Respond With Defiance

Sep 12, 2025 -

New Nasa Discovery Significant Biosignatures Found In Martian Rock

Sep 12, 2025

New Nasa Discovery Significant Biosignatures Found In Martian Rock

Sep 12, 2025 -

U S Naval Academy On Lockdown Officials Confirm Security Threat

Sep 12, 2025

U S Naval Academy On Lockdown Officials Confirm Security Threat

Sep 12, 2025 -

The Truth About Trump Jon Stewarts No Holds Barred Attack On Maga World

Sep 12, 2025

The Truth About Trump Jon Stewarts No Holds Barred Attack On Maga World

Sep 12, 2025

Latest Posts

-

Analyzing Week 2 Rookies Bill Croskey Merritts Fantasy Football Impact

Sep 12, 2025

Analyzing Week 2 Rookies Bill Croskey Merritts Fantasy Football Impact

Sep 12, 2025 -

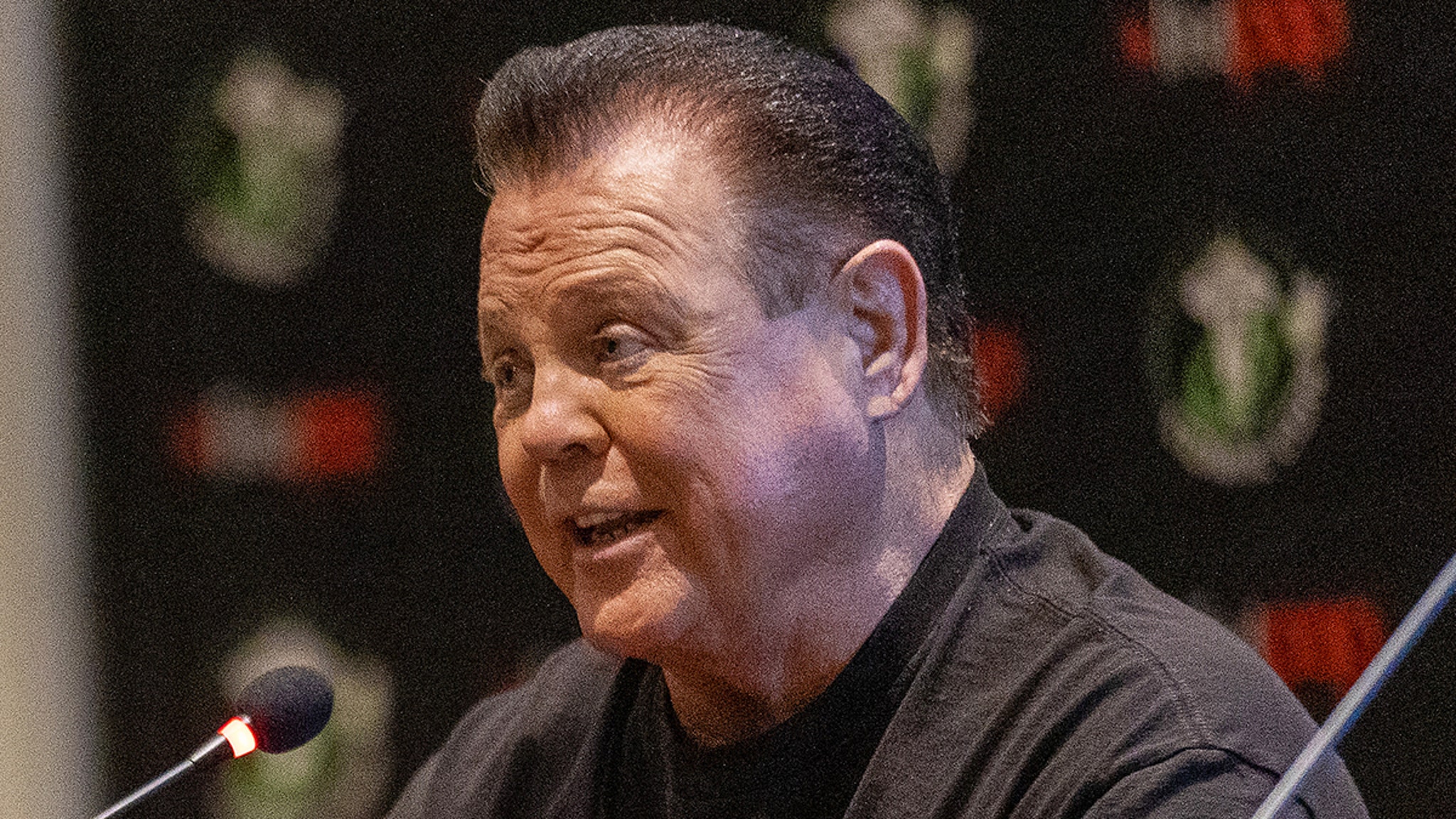

Update On Jerry Lawlers Condition Following Recent Stroke

Sep 12, 2025

Update On Jerry Lawlers Condition Following Recent Stroke

Sep 12, 2025 -

Astros Al West Lead Slips To Half Game After Blue Jays Shutout

Sep 12, 2025

Astros Al West Lead Slips To Half Game After Blue Jays Shutout

Sep 12, 2025 -

New Epstein Letter Purported Trump Signature Sparks Gop Response

Sep 12, 2025

New Epstein Letter Purported Trump Signature Sparks Gop Response

Sep 12, 2025 -

Wrestling Legend Jerry Lawler Pulls Out Of Scheduled Events Due To Health

Sep 12, 2025

Wrestling Legend Jerry Lawler Pulls Out Of Scheduled Events Due To Health

Sep 12, 2025