Microsoft (MSFT): Evaluating The Limited Window Of Opportunity For Investors.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Microsoft (MSFT): A Limited Window of Opportunity? Evaluating the Tech Giant's Future

Microsoft (MSFT) has long been a staple of any diversified investment portfolio, a seemingly unshakeable giant in the tech world. But with recent market fluctuations and the ever-evolving landscape of the tech industry, investors are asking: is now the time to buy, sell, or hold MSFT stock? This article delves into the current state of Microsoft, examining the potential opportunities and risks for investors in what some analysts are calling a limited window of opportunity.

The Current Landscape: A Mixed Bag for MSFT

Microsoft's recent performance has been a mixed bag. While the company continues to dominate in cloud computing with its Azure platform, competing fiercely with Amazon Web Services (AWS) and Google Cloud, challenges remain. The slowing global economy is impacting enterprise spending, a key driver of Azure's growth. Furthermore, the ongoing debate surrounding AI regulation could potentially impact the development and adoption of Microsoft's AI-powered products, including Bing Chat and GitHub Copilot.

Strengths: A Foundation Built on Innovation and Market Dominance

Despite these challenges, Microsoft possesses significant strengths that continue to attract investors:

- Dominant Cloud Presence: Azure's growth, though slowing, remains impressive, solidifying Microsoft's position as a major player in the cloud computing market. This provides a strong foundation for future revenue streams.

- Diversified Revenue Streams: Microsoft's revenue isn't solely reliant on Azure. Its diverse portfolio, encompassing Windows, Office 365, Xbox, and LinkedIn, provides resilience against market fluctuations affecting any single sector.

- Strong Brand Recognition and Loyalty: Microsoft enjoys unparalleled brand recognition and loyalty, giving it a significant advantage in attracting both consumers and businesses.

- Strategic Investments in AI: Microsoft's aggressive investment in artificial intelligence positions it well for future growth in this rapidly expanding market. Its partnership with OpenAI is a prime example of this forward-thinking strategy.

Weaknesses: Navigating Economic Headwinds and Competitive Pressures

However, certain weaknesses could limit Microsoft's growth potential in the near term:

- Economic Uncertainty: The global economic slowdown is impacting enterprise spending, directly impacting the growth of cloud services like Azure.

- Intense Competition: The tech industry is fiercely competitive. Microsoft faces strong competition from Amazon, Google, and other tech giants in various sectors.

- Regulatory Scrutiny: Increasing regulatory scrutiny of the tech industry, particularly concerning antitrust and data privacy, poses a significant risk to Microsoft's future operations.

Is This a Limited Window of Opportunity?

The question of whether this is a limited window of opportunity for MSFT investors hinges on several factors: your risk tolerance, investment horizon, and your assessment of the company's ability to navigate the challenges outlined above.

For long-term investors with a high risk tolerance, the current dip might represent a buying opportunity. Microsoft's strong fundamentals and strategic investments in AI suggest a robust future. However, short-term investors might want to proceed with caution, considering the potential for further market volatility.

What to Do Next:

Before making any investment decisions, it is crucial to conduct thorough research and consult with a financial advisor. Consider diversifying your portfolio to mitigate risk and carefully analyze your own risk tolerance before investing in any individual stock, including MSFT. Stay updated on the latest news and financial reports regarding Microsoft to make informed decisions. You can find valuable resources on sites such as [link to reputable financial news source].

Disclaimer: This article provides general information and should not be considered as financial advice. Investing in the stock market involves risk, and you could lose money.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Microsoft (MSFT): Evaluating The Limited Window Of Opportunity For Investors.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Maga Lawmakers Plan Sparks Debate A Charlie Kirk Capitol Statue

Sep 12, 2025

Maga Lawmakers Plan Sparks Debate A Charlie Kirk Capitol Statue

Sep 12, 2025 -

Potential Evidence Of Ancient Life Found In Martian Rocks By Nasa Rover

Sep 12, 2025

Potential Evidence Of Ancient Life Found In Martian Rocks By Nasa Rover

Sep 12, 2025 -

House Republicans Push For Charlie Kirk Capitol Statue

Sep 12, 2025

House Republicans Push For Charlie Kirk Capitol Statue

Sep 12, 2025 -

Urgent Response Naval Academy On Lockdown Following Threat

Sep 12, 2025

Urgent Response Naval Academy On Lockdown Following Threat

Sep 12, 2025 -

Should You Start Or Sit Romeo Doubs Matthew Golden And Tucker Kraft This Week

Sep 12, 2025

Should You Start Or Sit Romeo Doubs Matthew Golden And Tucker Kraft This Week

Sep 12, 2025

Latest Posts

-

9 11 Identification New Developments In Unidentified Remains Case

Sep 12, 2025

9 11 Identification New Developments In Unidentified Remains Case

Sep 12, 2025 -

Southport Murder Investigation Hiding In The Toilet To Escape

Sep 12, 2025

Southport Murder Investigation Hiding In The Toilet To Escape

Sep 12, 2025 -

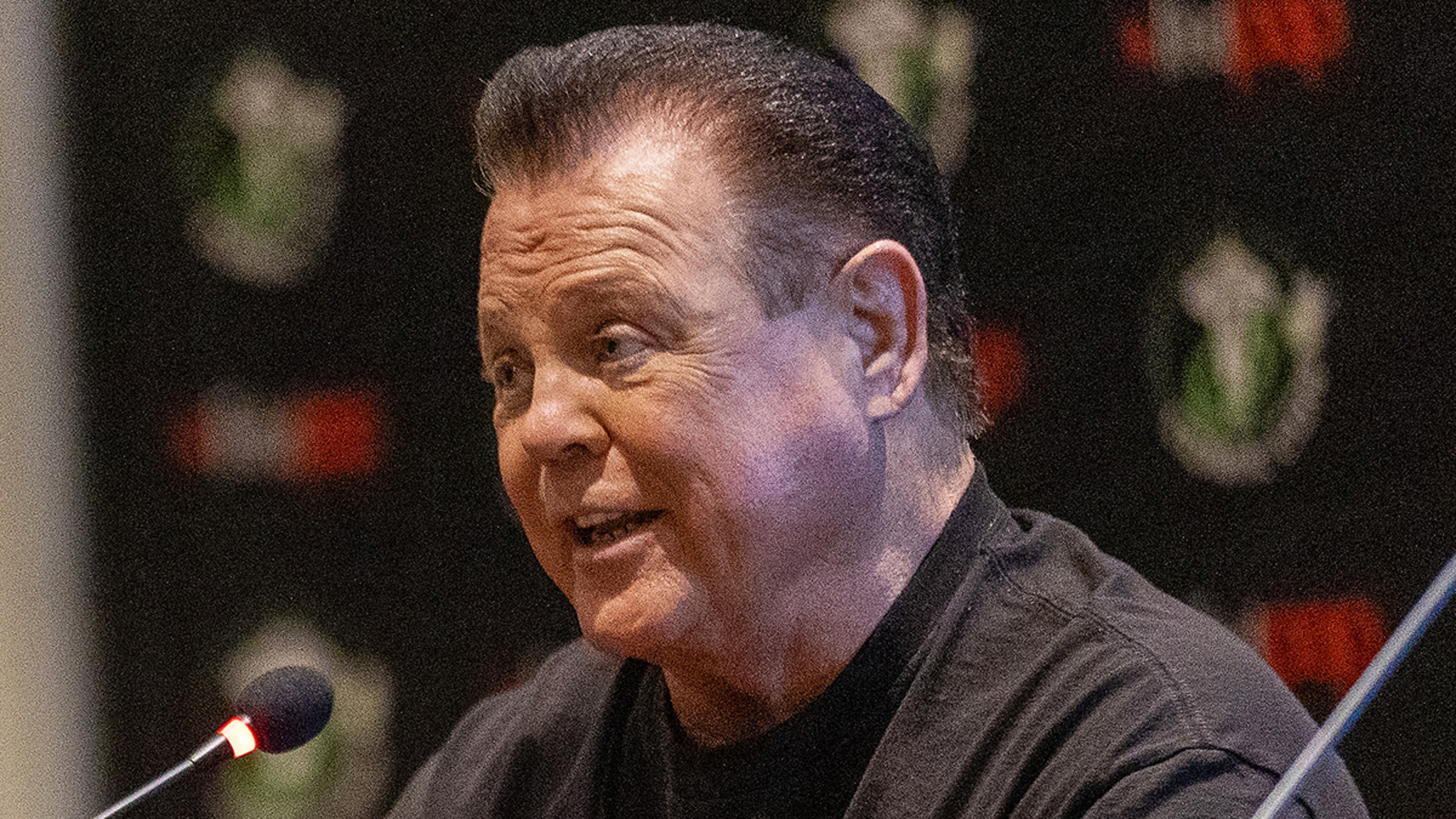

Hall Of Famer Jerry Lawlers Health Battle A Stroke And The Fight Back

Sep 12, 2025

Hall Of Famer Jerry Lawlers Health Battle A Stroke And The Fight Back

Sep 12, 2025 -

College Football Week 3 Nc State Vs Wake Forest Preview Betting Lines And Prediction

Sep 12, 2025

College Football Week 3 Nc State Vs Wake Forest Preview Betting Lines And Prediction

Sep 12, 2025 -

Betting On Thursdays Acc Clash Nc State Vs Wake Forest Odds Prediction And Best Bet

Sep 12, 2025

Betting On Thursdays Acc Clash Nc State Vs Wake Forest Odds Prediction And Best Bet

Sep 12, 2025