Mega-Merger: Keurig Dr Pepper's $18 Billion+ Acquisition And Corporate Restructuring

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Mega-Merger: Keurig Dr Pepper's $18 Billion+ Acquisition Spree and Corporate Restructuring Shakes Up the Beverage Industry

The beverage industry is buzzing after Keurig Dr Pepper (KDP) announced a massive acquisition spree, exceeding $18 billion, triggering a wave of corporate restructuring and raising significant questions about the future of the market. This mega-merger isn't just about adding brands to the portfolio; it signifies a strategic shift in KDP's approach to market dominance and presents both opportunities and challenges.

A Multi-Billion Dollar Bet on Growth:

KDP's aggressive acquisition strategy isn't new, but the scale of these recent deals marks a significant escalation. The company has been strategically acquiring brands to bolster its market share and diversify its product offerings. This latest wave of acquisitions targets key segments within the beverage industry, aiming to solidify its position against major competitors like Coca-Cola and PepsiCo. While the exact details of each acquisition vary, the overall goal is clear: expansion and increased market penetration. Analysts predict this will lead to significant growth in both revenue and market capitalization for KDP in the coming years.

The Restructuring Ripple Effect:

Such a significant increase in size and scope necessitates a comprehensive corporate restructuring. This involves streamlining operations, integrating newly acquired brands, and potentially consolidating certain aspects of the business. This process is expected to lead to some job displacement in overlapping roles, prompting concerns from employee advocacy groups. However, KDP has emphasized its commitment to a smooth transition and minimizing job losses wherever possible. The restructuring also includes refining supply chains, optimizing distribution networks, and potentially rebranding some products for a more unified and cohesive market presence.

Key Areas of Focus in the Restructuring:

- Supply Chain Optimization: Integrating diverse supply chains from newly acquired brands is a major undertaking. KDP will likely focus on efficiency improvements and cost reductions to maximize profitability.

- Marketing and Branding: Successfully integrating a multitude of brands requires a cohesive marketing strategy. Expect to see a renewed emphasis on brand synergy and potentially some rebranding efforts to streamline the KDP portfolio.

- Innovation and Product Development: The merger will facilitate greater investment in research and development, leading to more innovative beverage options to cater to evolving consumer preferences.

Challenges and Opportunities:

While the acquisitions present significant opportunities for growth, KDP faces considerable challenges. Successful integration of multiple brands, managing a larger and more complex organization, and navigating potential regulatory hurdles are key concerns. Competition remains fierce, and KDP will need to execute its strategy flawlessly to maintain its competitive edge. Furthermore, successfully adapting to changing consumer preferences, including the growing demand for healthier and more sustainable beverage choices, will be critical for long-term success.

Looking Ahead:

The impact of KDP’s $18 billion+ acquisition spree and the subsequent corporate restructuring is likely to be felt throughout the beverage industry for years to come. This bold move underscores the company's ambition to become a dominant force, but its success hinges on effective execution of its integration and restructuring plans. Only time will tell whether this gamble pays off, but one thing is certain: the beverage landscape has been irrevocably altered. This situation will undoubtedly be closely monitored by industry analysts and investors alike. Stay tuned for further updates as this story unfolds.

Keywords: Keurig Dr Pepper, KDP, Acquisition, Merger, Corporate Restructuring, Beverage Industry, Coca-Cola, PepsiCo, Market Share, Supply Chain, Branding, Innovation, Growth, Market Capitalization.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Mega-Merger: Keurig Dr Pepper's $18 Billion+ Acquisition And Corporate Restructuring. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Doubt Cast On Karoline Leavitts My Own Two Eyes Trump Narrative

Aug 27, 2025

Doubt Cast On Karoline Leavitts My Own Two Eyes Trump Narrative

Aug 27, 2025 -

Love Thy Nader Platforms And Availability For Brooks Naders Reality Show

Aug 27, 2025

Love Thy Nader Platforms And Availability For Brooks Naders Reality Show

Aug 27, 2025 -

Beverage Industry Reshaped Keurig Dr Peppers 18 Billion Dutch Coffee Purchase And Dual Company Strategy

Aug 27, 2025

Beverage Industry Reshaped Keurig Dr Peppers 18 Billion Dutch Coffee Purchase And Dual Company Strategy

Aug 27, 2025 -

Denver And Colorado Brace For Severe Storms Flash Flood Warning Issued

Aug 27, 2025

Denver And Colorado Brace For Severe Storms Flash Flood Warning Issued

Aug 27, 2025 -

Protecting Voting Rights The Save Acts Role On Womens Equality Day 2025

Aug 27, 2025

Protecting Voting Rights The Save Acts Role On Womens Equality Day 2025

Aug 27, 2025

Latest Posts

-

Tennis Star Carlos Alcaraz Laughs Off Us Open Haircut Disaster

Aug 27, 2025

Tennis Star Carlos Alcaraz Laughs Off Us Open Haircut Disaster

Aug 27, 2025 -

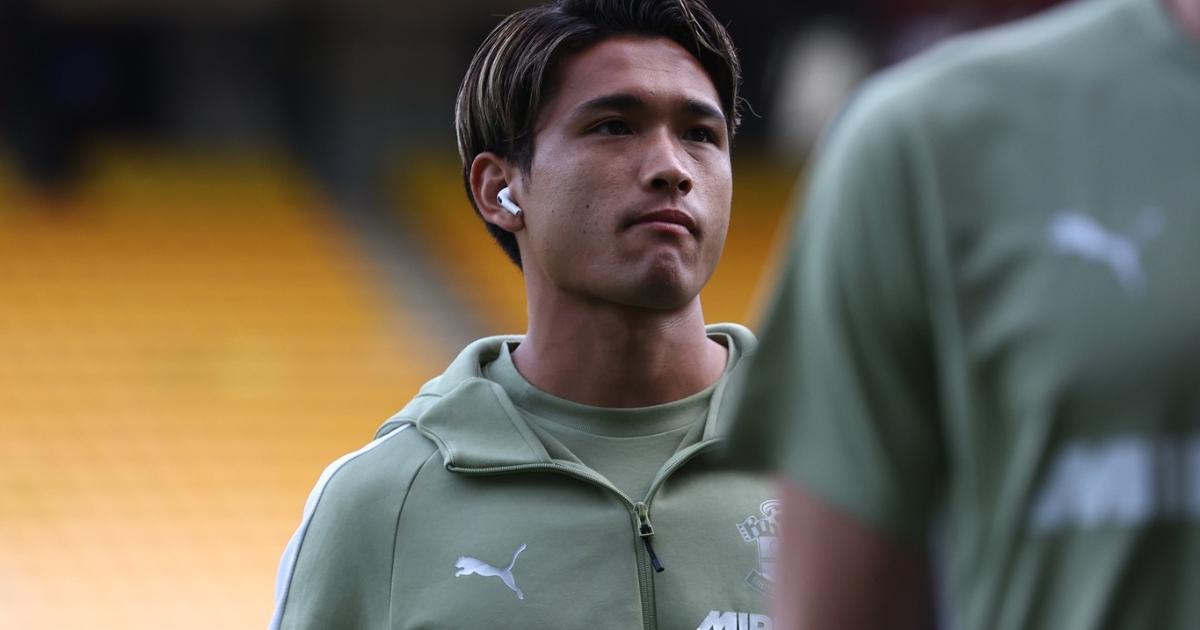

Southamptons Matsuki Is He Developing Into A Top Player

Aug 27, 2025

Southamptons Matsuki Is He Developing Into A Top Player

Aug 27, 2025 -

Emma Heming Willis On Bruce Willis Condition His Brain Is Failing

Aug 27, 2025

Emma Heming Willis On Bruce Willis Condition His Brain Is Failing

Aug 27, 2025 -

Sources Claim Taylor Swift And Travis Kelce Are Engaged

Aug 27, 2025

Sources Claim Taylor Swift And Travis Kelce Are Engaged

Aug 27, 2025 -

After Two Seasons Giants Cut Ties With Quarterback Tommy De Vito

Aug 27, 2025

After Two Seasons Giants Cut Ties With Quarterback Tommy De Vito

Aug 27, 2025