Market Volatility Sends Gold Prices To Record High

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Volatility Sends Gold Prices to Record High: Safe Haven Demand Drives Surge

Record-breaking gold prices are making headlines as investors seek refuge from turbulent markets. Global uncertainty, fueled by [mention specific recent geopolitical event or economic indicator, e.g., rising interest rates and banking sector concerns], has driven a massive surge in demand for gold, pushing prices to unprecedented levels. This safe-haven asset is proving its worth once again, offering investors a much-needed buffer against market volatility.

Why are gold prices soaring?

The current surge in gold prices isn't a standalone event; it's a direct response to a complex interplay of factors impacting the global economy.

-

Inflationary Pressures: Persistent inflation continues to erode the purchasing power of fiat currencies, making gold, a historically stable store of value, an attractive alternative. As central banks continue to grapple with inflation control, investors are increasingly hedging their bets with gold.

-

Geopolitical Instability: [Mention specific geopolitical events impacting the market, e.g., the ongoing conflict in Ukraine] creates a climate of uncertainty, prompting investors to seek the security of tangible assets like gold. The perceived risk associated with geopolitical events is a significant driver of gold's price appreciation.

-

Recession Fears: Concerns about a potential global recession are also contributing to the gold rush. During economic downturns, investors often turn to gold as a safe haven, expecting its value to hold up better than other assets. This "flight to safety" is a well-documented phenomenon in financial markets. Read more about [link to a relevant article about recessionary fears].

-

Weakening Dollar: A weaker US dollar typically boosts gold prices, as it makes gold cheaper for investors holding other currencies. The current weakening of the dollar against major currencies is further fueling the gold price rally. Learn more about the factors affecting the US dollar's value [link to a relevant article about the US dollar].

Gold as a Safe Haven Asset:

Gold's role as a safe haven asset is well-established. Historically, during times of economic uncertainty or geopolitical turmoil, investors flock to gold as a hedge against risk. Its inherent value and limited supply make it a desirable asset in turbulent markets. This inherent stability is a key reason why gold is often included in diversified investment portfolios.

What does this mean for investors?

The record-high gold prices present both opportunities and challenges for investors. While the current surge offers potential gains, it's crucial to remember that gold prices can be volatile. Investors should carefully consider their risk tolerance and investment strategy before making any decisions. It's always advisable to consult with a qualified financial advisor before making significant investment changes.

Looking Ahead:

Predicting future gold prices is inherently challenging, but analysts are closely monitoring the evolving geopolitical landscape and economic indicators. Factors like inflation rates, interest rate policies, and geopolitical developments will continue to significantly impact gold's price trajectory. Stay tuned for further updates as the market continues to evolve.

Call to Action: Stay informed about market trends by subscribing to our newsletter [link to newsletter signup] for regular updates on gold prices and other important financial news.

Keywords: Gold prices, gold price surge, market volatility, safe haven asset, inflation, geopolitical instability, recession fears, weakening dollar, investment, precious metals, financial news, economic outlook.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Volatility Sends Gold Prices To Record High. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Cnn Anchor Delivers Reality Check On Gops Epstein Narrative

Sep 04, 2025

Cnn Anchor Delivers Reality Check On Gops Epstein Narrative

Sep 04, 2025 -

The Unseen Message Interpreting Chelsea Clintons Post Trump Photo

Sep 04, 2025

The Unseen Message Interpreting Chelsea Clintons Post Trump Photo

Sep 04, 2025 -

Explore Liverpool Why You Shouldnt Miss The British Science Festival

Sep 04, 2025

Explore Liverpool Why You Shouldnt Miss The British Science Festival

Sep 04, 2025 -

Final I Os 17 Beta Strong Indication Of The Upcoming I Phone 17 Release

Sep 04, 2025

Final I Os 17 Beta Strong Indication Of The Upcoming I Phone 17 Release

Sep 04, 2025 -

Throwback Thursday Taco Bells Y2 K Menu Returns

Sep 04, 2025

Throwback Thursday Taco Bells Y2 K Menu Returns

Sep 04, 2025

Latest Posts

-

Online Outpouring After Beloved Brother Wease Announces Exit

Sep 06, 2025

Online Outpouring After Beloved Brother Wease Announces Exit

Sep 06, 2025 -

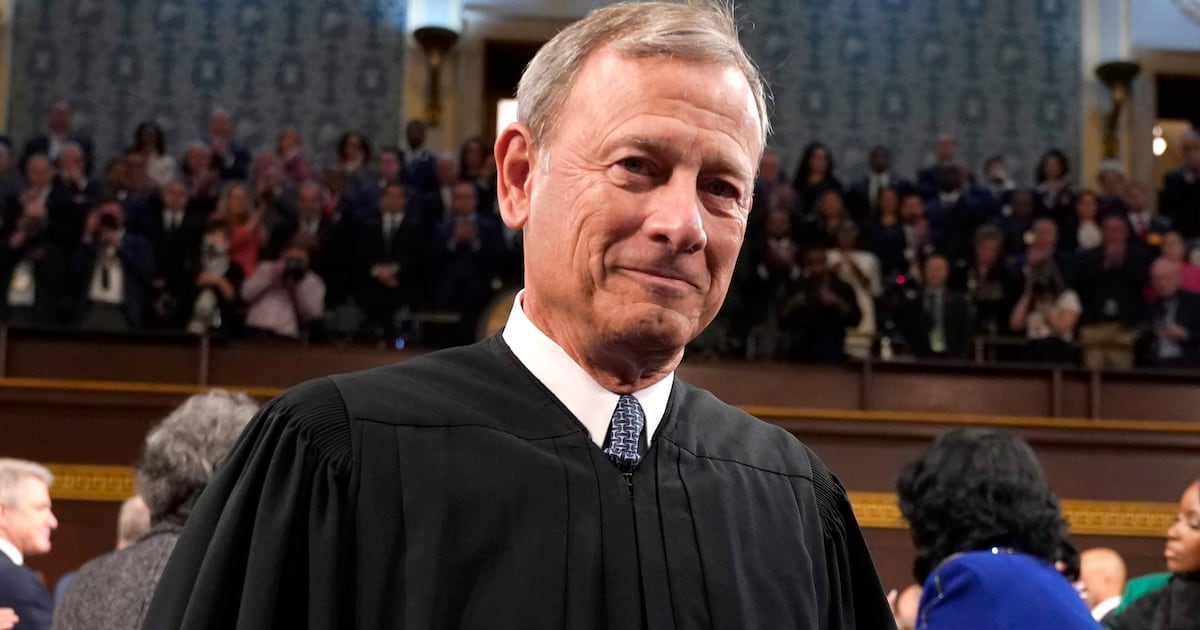

Leaked Documents Detail Chief Justice Roberts Supreme Court Agenda

Sep 06, 2025

Leaked Documents Detail Chief Justice Roberts Supreme Court Agenda

Sep 06, 2025 -

The End Of An Era Brother Weases Farewell To Rochester Radio

Sep 06, 2025

The End Of An Era Brother Weases Farewell To Rochester Radio

Sep 06, 2025 -

Illegal Sports Streaming Giant Streameast Shut Down In Major Crackdown

Sep 06, 2025

Illegal Sports Streaming Giant Streameast Shut Down In Major Crackdown

Sep 06, 2025 -

Riba Stirling Prize Nomination The Restoration Of Big Bens Elizabeth Tower

Sep 06, 2025

Riba Stirling Prize Nomination The Restoration Of Big Bens Elizabeth Tower

Sep 06, 2025