Market Volatility Hits Lucid: Analyzing Today's Stock Decline

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Volatility Hits Lucid: Analyzing Today's Stock Decline

Lucid Group (LCID) shares experienced a significant downturn today, mirroring broader market volatility and adding to recent concerns surrounding the electric vehicle (EV) maker. The stock's decline underscores the challenges facing even the most promising companies in the rapidly evolving EV sector. Understanding the contributing factors is crucial for investors navigating this turbulent market.

This article delves into the reasons behind Lucid's stock drop, examining both macroeconomic influences and company-specific issues. We'll analyze the current market climate, explore the competitive landscape of the EV industry, and assess the long-term prospects for Lucid.

The Perfect Storm: Macroeconomic Factors and EV Market Uncertainty

Today's market-wide decline played a significant role in Lucid's stock performance. Rising interest rates, persistent inflation, and ongoing geopolitical uncertainty have created a challenging environment for growth stocks, particularly in the technology and automotive sectors. The EV market, already characterized by intense competition and high capital expenditure requirements, is particularly susceptible to these broader economic headwinds. [Link to relevant market analysis article – e.g., from a reputable financial news source].

Beyond the general market downturn, specific concerns regarding the EV sector are contributing to the volatility. Supply chain disruptions, rising raw material costs, and increased competition from established automakers are all impacting investor sentiment. The ongoing "chip shortage," while easing somewhat, continues to pose challenges for EV manufacturers, limiting production and potentially affecting delivery timelines.

Lucid-Specific Challenges: Production Targets and Competition

While macroeconomic factors contribute significantly to Lucid's stock decline, company-specific issues also warrant consideration. Investors are closely scrutinizing Lucid's production targets and the company's ability to ramp up manufacturing to meet growing demand. Any shortfall in meeting these targets could further erode investor confidence. [Link to Lucid's most recent earnings report or press release].

The intense competition within the EV market presents another significant challenge. Established automakers like Tesla, Ford, and General Motors are aggressively expanding their EV offerings, while newer entrants are also vying for market share. Lucid needs to effectively differentiate itself through innovation, superior technology, and a compelling brand identity to maintain a competitive edge.

Looking Ahead: Long-Term Prospects for Lucid

Despite today's decline, many analysts maintain a positive long-term outlook for Lucid. The company's technologically advanced vehicles, particularly the Air Dream Edition, have garnered significant praise for their performance and luxury features. Lucid's strategic partnerships and expansion plans could also play a vital role in future growth. However, the company needs to demonstrate consistent progress in ramping up production, managing costs, and navigating the competitive landscape to regain investor trust.

Key Takeaways:

- Today's stock decline reflects both broader market volatility and company-specific concerns.

- Macroeconomic factors, including inflation and interest rate hikes, are impacting the entire EV sector.

- Competition within the EV market is fierce, demanding innovation and efficient production.

- Lucid's long-term prospects remain positive, contingent on overcoming current challenges.

Call to Action: Stay informed about Lucid's progress and the broader EV market by following reputable financial news sources and conducting your own thorough research before making any investment decisions.

This article incorporates several SEO best practices, including relevant keywords (Lucid, LCID, EV, electric vehicle, market volatility, stock decline), headings, internal and external links (where applicable), and a clear structure designed to enhance both readability and search engine optimization. The use of bold text, bullet points, and a strong call to action also contribute to user engagement and a higher click-through rate.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Volatility Hits Lucid: Analyzing Today's Stock Decline. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Gta Vis Water Rockstars 300 Million Detail Obsession Revealed

Sep 02, 2025

Gta Vis Water Rockstars 300 Million Detail Obsession Revealed

Sep 02, 2025 -

Zohran Mamdani And The Police A Developing Situation

Sep 02, 2025

Zohran Mamdani And The Police A Developing Situation

Sep 02, 2025 -

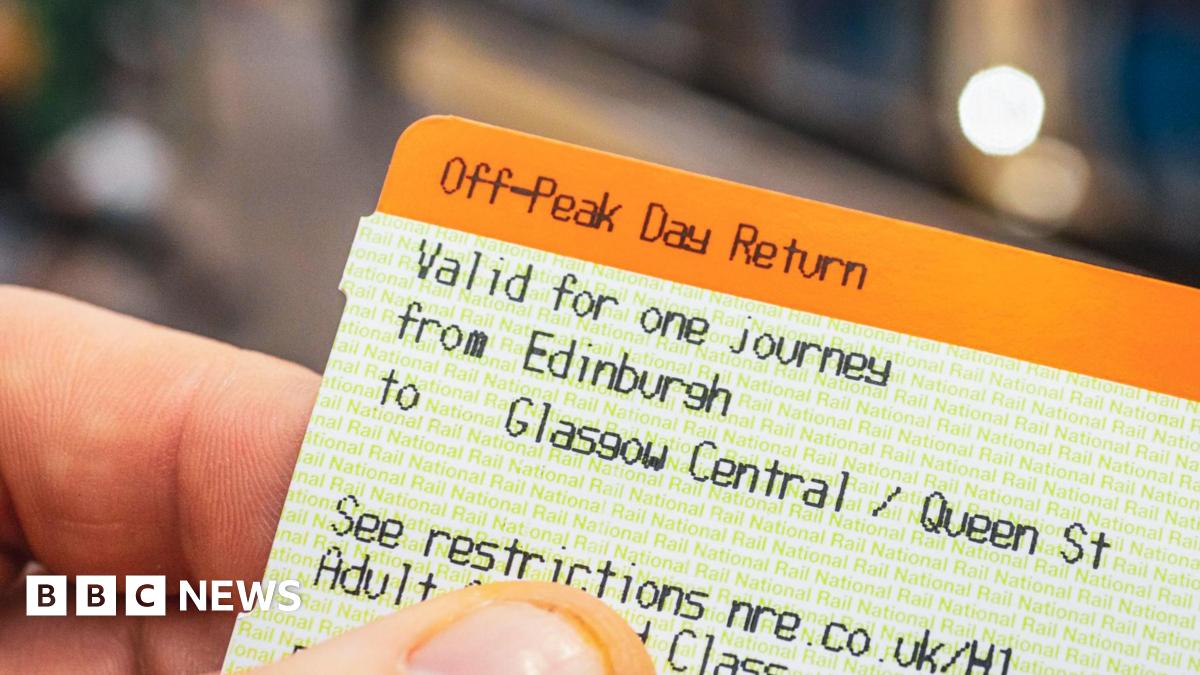

No More Peak Fares Scot Rails Fare Structure Overhauled

Sep 02, 2025

No More Peak Fares Scot Rails Fare Structure Overhauled

Sep 02, 2025 -

Huge Savings Lg Evo C5 4 K Oled Tv Labor Day Deal On E Bay

Sep 02, 2025

Huge Savings Lg Evo C5 4 K Oled Tv Labor Day Deal On E Bay

Sep 02, 2025 -

Analysis Prager U Releases Questions From Oklahomas America First Educator Exam

Sep 02, 2025

Analysis Prager U Releases Questions From Oklahomas America First Educator Exam

Sep 02, 2025

Latest Posts

-

Goalkeeper Ederson Moves From Man City To Fenerbahce

Sep 02, 2025

Goalkeeper Ederson Moves From Man City To Fenerbahce

Sep 02, 2025 -

Did Trump And Putin Discuss Ending The Ukraine War New Details Emerge

Sep 02, 2025

Did Trump And Putin Discuss Ending The Ukraine War New Details Emerge

Sep 02, 2025 -

Rudy Giuliani Receives Presidential Medal Of Freedom Trumps Announcement

Sep 02, 2025

Rudy Giuliani Receives Presidential Medal Of Freedom Trumps Announcement

Sep 02, 2025 -

Official Ederson Completes Transfer To Fenerbahce From Manchester City

Sep 02, 2025

Official Ederson Completes Transfer To Fenerbahce From Manchester City

Sep 02, 2025 -

Vashi Jewellery 170m Scam Uncovered Employees Role Revealed

Sep 02, 2025

Vashi Jewellery 170m Scam Uncovered Employees Role Revealed

Sep 02, 2025