Market Volatility: Analyzing CoreWeave's Stock Drop (NASDAQ:CRWV)

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Volatility: Analyzing CoreWeave's Stock Drop (NASDAQ:CRWV)

The tech sector has seen its share of turbulence lately, and CoreWeave (NASDAQ:CRWV), a prominent player in the cloud computing space specializing in high-performance computing (HPC) and artificial intelligence (AI) workloads, is experiencing a significant downturn. This article delves into the reasons behind CoreWeave's recent stock drop, examining market conditions, company performance, and future outlook. Understanding these factors is crucial for investors navigating the complexities of the current market volatility.

CoreWeave's Recent Performance: A Deep Dive

CoreWeave's initial public offering (IPO) generated considerable buzz, fueled by the explosive growth of the AI sector and the company's strong position within it. However, the stock price has experienced a notable decline since its peak, prompting concerns among investors. Several factors contribute to this volatility:

1. Broader Market Downturn: The overall tech sector has faced headwinds recently, with rising interest rates and economic uncertainty impacting investor sentiment. This broader market downturn has disproportionately affected growth stocks like CoreWeave, which are often valued based on future potential rather than current profitability. This is a crucial context for understanding CoreWeave's performance, as it’s not solely an issue of company-specific challenges.

2. Competition in the HPC and AI Market: The high-performance computing and AI cloud market is intensely competitive, with established giants like Amazon Web Services (AWS), Microsoft Azure, and Google Cloud Platform (GCP) vying for market share. CoreWeave faces the challenge of differentiating itself and securing a significant portion of this rapidly expanding but fiercely contested market. The competitive landscape is a key factor influencing investor confidence.

3. Profitability Concerns: While CoreWeave boasts impressive technological capabilities and a growing customer base, questions remain about its path to profitability. Investors are scrutinizing the company's financial performance, looking for indicators of sustainable growth and a clear strategy for achieving profitability in the long term. This is a common concern for many tech startups focused on rapid expansion.

4. General Investor Sentiment: Beyond concrete financial data, investor sentiment plays a significant role in stock price fluctuations. Negative news cycles, analyst downgrades, or even general market pessimism can trigger sell-offs, regardless of the underlying fundamentals of the company. Understanding investor psychology is critical in analyzing CoreWeave's recent performance.

Analyzing the Future: What's Next for CoreWeave?

Despite the recent setbacks, CoreWeave possesses several strengths: its innovative technology, strategic partnerships, and growing customer base in the rapidly expanding AI sector. The company's long-term prospects depend on its ability to:

- Successfully navigate the competitive landscape: CoreWeave needs to solidify its competitive advantage by focusing on niche markets and delivering exceptional service.

- Achieve profitability: A clear roadmap to profitability is crucial for regaining investor confidence and driving long-term sustainable growth.

- Effectively communicate its value proposition: Clear and consistent communication with investors is essential for managing expectations and maintaining trust.

Conclusion: Navigating the Volatility

CoreWeave's stock drop highlights the inherent volatility of the tech market, especially for companies operating in rapidly evolving sectors like AI and HPC. While the recent downturn presents challenges, the company's underlying technology and market positioning remain promising. Investors should carefully weigh the risks and opportunities before making any investment decisions, keeping a close eye on the company's financial performance and strategic initiatives. Further research and monitoring of market trends are crucial for making informed decisions in this dynamic environment. Remember to consult with a financial advisor before making any investment choices.

Keywords: CoreWeave, NASDAQ:CRWV, stock drop, market volatility, high-performance computing, HPC, artificial intelligence, AI, cloud computing, tech sector, investor sentiment, profitability, competition, IPO, growth stocks, financial performance.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Volatility: Analyzing CoreWeave's Stock Drop (NASDAQ:CRWV). We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ai Powered Education A High School Pilot Program Raises Concerns

Sep 11, 2025

Ai Powered Education A High School Pilot Program Raises Concerns

Sep 11, 2025 -

Girl Scouts Cookie Lineup Expands Meet The Newest Treat

Sep 11, 2025

Girl Scouts Cookie Lineup Expands Meet The Newest Treat

Sep 11, 2025 -

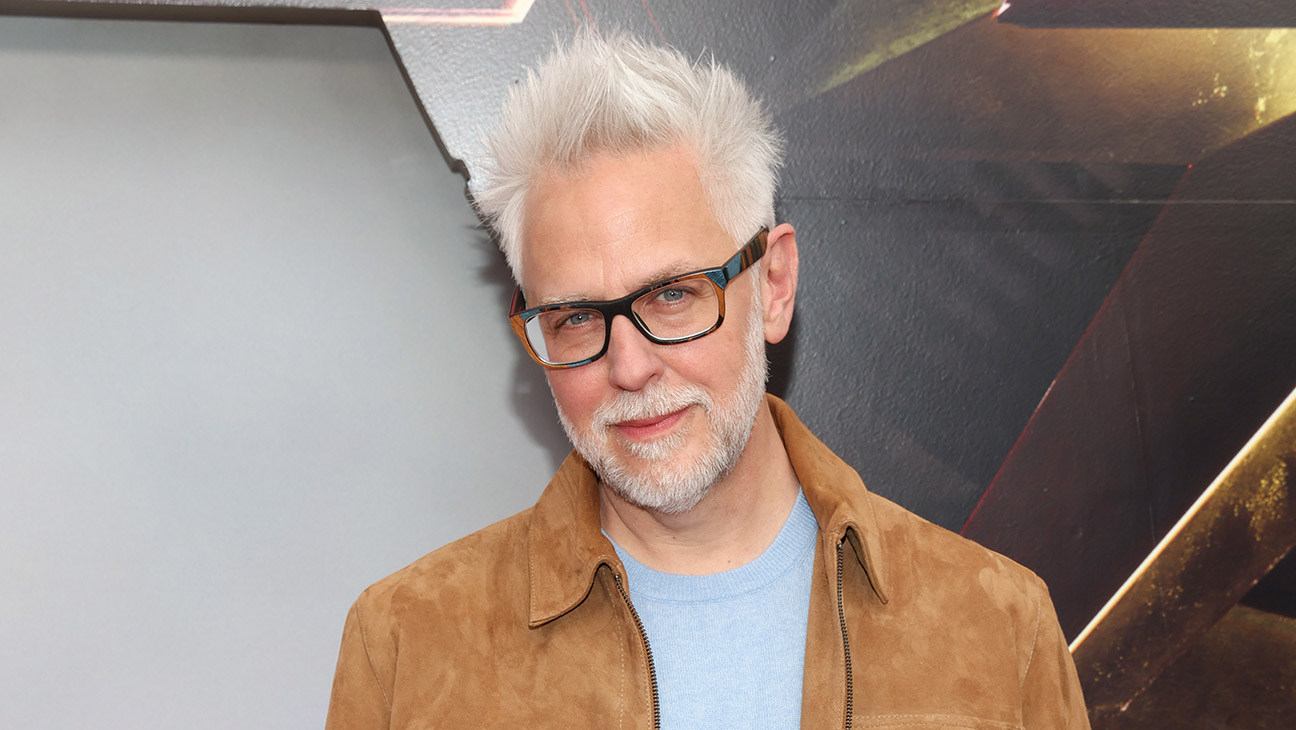

James Gunn Unveils Man Of Tomorrow As Superman Follow Up Film

Sep 11, 2025

James Gunn Unveils Man Of Tomorrow As Superman Follow Up Film

Sep 11, 2025 -

Alex Winter Navigating Adulthoods Challenges

Sep 11, 2025

Alex Winter Navigating Adulthoods Challenges

Sep 11, 2025 -

Shana Festes Heartland A Mystery Thriller Starring Jessica Chastain

Sep 11, 2025

Shana Festes Heartland A Mystery Thriller Starring Jessica Chastain

Sep 11, 2025

Latest Posts

-

Quarterly Revenue Miss Sends Synopsys Stock Lower

Sep 11, 2025

Quarterly Revenue Miss Sends Synopsys Stock Lower

Sep 11, 2025 -

The Ben And Jerrys Legacy Founders Speak Out Against Unilever

Sep 11, 2025

The Ben And Jerrys Legacy Founders Speak Out Against Unilever

Sep 11, 2025 -

Rare Opportunity Core Weaves Crwv Stock Market Decline

Sep 11, 2025

Rare Opportunity Core Weaves Crwv Stock Market Decline

Sep 11, 2025 -

Coupe De Cheveux Marion Cotillard Inspiration Et Conseils Pour Reproduire Son Style

Sep 11, 2025

Coupe De Cheveux Marion Cotillard Inspiration Et Conseils Pour Reproduire Son Style

Sep 11, 2025 -

Ben And Jerrys Founders Distance Themselves From Unilever

Sep 11, 2025

Ben And Jerrys Founders Distance Themselves From Unilever

Sep 11, 2025