Market Update: Lucid Stock Suffers 4%+ Drop – What Investors Need To Know

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Market Update: Lucid Stock Suffers 4%+ Drop – What Investors Need to Know

Lucid Group (LCID) stock experienced a significant downturn today, plunging over 4% in a market already grappling with uncertainty. This sharp decline leaves investors questioning the future trajectory of the electric vehicle (EV) maker and prompting a closer look at the underlying factors contributing to this slump. Understanding these factors is crucial for navigating the volatile EV market and making informed investment decisions.

What Triggered the Lucid Stock Drop?

While no single event directly caused today's dramatic fall, several contributing factors likely played a role:

-

Broader Market Weakness: The overall market sentiment is currently bearish, with concerns about inflation, interest rates, and a potential recession impacting various sectors, including the already volatile EV market. This general negativity has undoubtedly spilled over into Lucid's stock price.

-

Production Challenges and Delivery Delays: Lucid, like many other EV startups, has faced challenges ramping up production to meet demand. While the company has shown progress, any perceived shortfall in meeting production targets or experiencing delivery delays can negatively impact investor confidence. News regarding potential production bottlenecks or supply chain disruptions could further exacerbate this.

-

Increased Competition: The EV market is becoming increasingly crowded, with established automakers and new entrants vying for market share. Intense competition puts pressure on pricing and profitability, impacting investor perception of Lucid's long-term viability. The aggressive pricing strategies employed by competitors are a significant factor in the current market dynamics.

-

Investor Sentiment and Speculation: Lucid's stock price has been highly volatile since its initial public offering (IPO), driven in part by investor sentiment and speculation. Negative news cycles, even if relatively minor, can amplify sell-offs in a market already characterized by uncertainty. Analyzing recent news coverage and social media sentiment reveals a significant shift towards bearish predictions for LCID's short-term future.

What Should Investors Do?

The 4%+ drop in Lucid stock presents a challenging situation for investors. There is no one-size-fits-all answer, and decisions should be based on individual risk tolerance and investment strategies.

-

Long-Term Perspective: For long-term investors with a bullish outlook on the future of electric vehicles, this dip could represent a buying opportunity. However, it's essential to carefully analyze the company's fundamentals and future prospects before making any investment decisions.

-

Diversification: Diversifying your investment portfolio across various sectors and asset classes can mitigate the risk associated with individual stock volatility. This strategy is especially crucial in a volatile market like the current one.

-

Due Diligence: Before reacting to short-term market fluctuations, conduct thorough research on Lucid's financial performance, production targets, and competitive landscape. Understanding the company's strategic plans and future growth potential is vital for informed decision-making.

Looking Ahead:

The future of Lucid and its stock price remains uncertain. The company’s success hinges on its ability to overcome production challenges, navigate intense competition, and deliver on its promises to investors. Closely monitoring news and financial reports, alongside an understanding of the broader market conditions, will be essential for navigating this volatile environment. Staying informed is key to making well-informed investment decisions regarding LCID. Remember to consult with a qualified financial advisor before making any major investment choices.

Keywords: Lucid Stock, LCID, Electric Vehicle, EV Market, Stock Market, Investment, Market Volatility, Stock Drop, EV Startup, Production Challenges, Competition, Investor Sentiment, Financial News, Market Update.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Market Update: Lucid Stock Suffers 4%+ Drop – What Investors Need To Know. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Transfer News Donnarumma Moves To Man City Replacing Ederson

Sep 03, 2025

Transfer News Donnarumma Moves To Man City Replacing Ederson

Sep 03, 2025 -

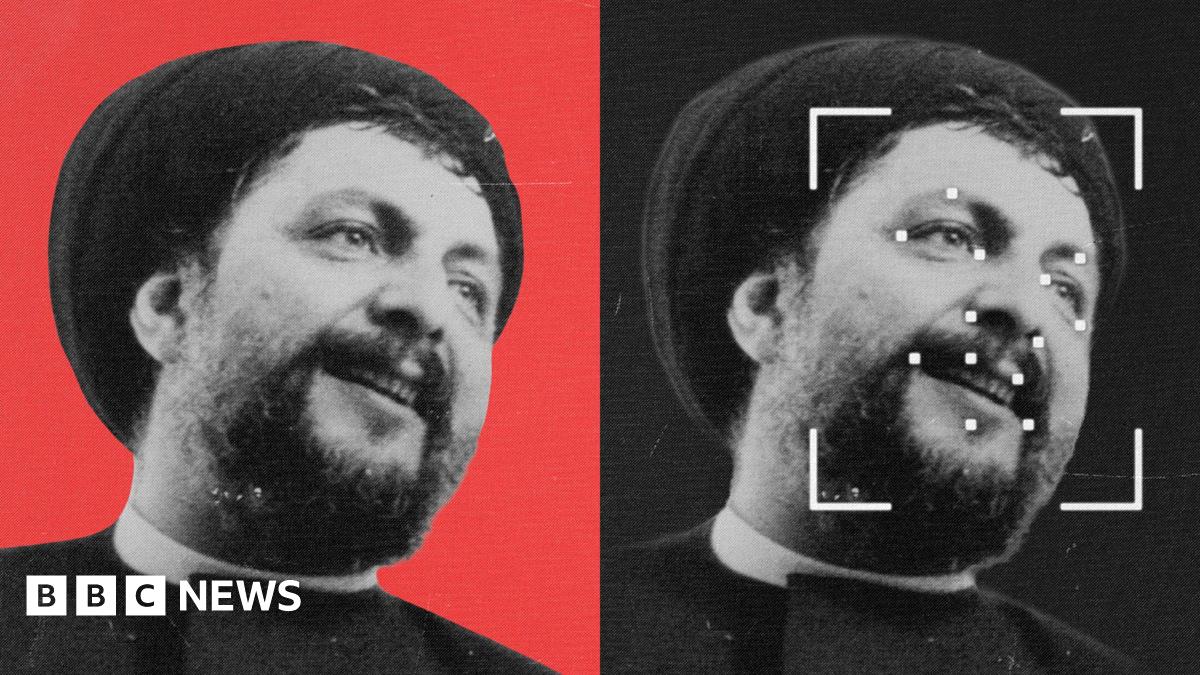

Libya Mortuary Holds Potential Clue In Musa Al Sadr Disappearance Case

Sep 03, 2025

Libya Mortuary Holds Potential Clue In Musa Al Sadr Disappearance Case

Sep 03, 2025 -

Nba 2 K26 Review In Progress What We Know So Far

Sep 03, 2025

Nba 2 K26 Review In Progress What We Know So Far

Sep 03, 2025 -

China Positions Itself As Global Leader Xi And Putins Alliance

Sep 03, 2025

China Positions Itself As Global Leader Xi And Putins Alliance

Sep 03, 2025 -

1 3 Billion Powerball Jackpot The Winning Numbers And Whats Next

Sep 03, 2025

1 3 Billion Powerball Jackpot The Winning Numbers And Whats Next

Sep 03, 2025

Latest Posts

-

Us Filmmaker Faces Legal Fight Over Downton Shabby Film

Sep 05, 2025

Us Filmmaker Faces Legal Fight Over Downton Shabby Film

Sep 05, 2025 -

Mason Gelder Funeral Home Announces Passing Of William Bill S Foriska Jeannette Pa

Sep 05, 2025

Mason Gelder Funeral Home Announces Passing Of William Bill S Foriska Jeannette Pa

Sep 05, 2025 -

American Dream Deferred The High Cost Of Student Loans

Sep 05, 2025

American Dream Deferred The High Cost Of Student Loans

Sep 05, 2025 -

Sept 2 2025 West Virginia Lottery Mega Millions And Daily 3 Results

Sep 05, 2025

Sept 2 2025 West Virginia Lottery Mega Millions And Daily 3 Results

Sep 05, 2025 -

How To Spot And Avoid Parking Fine Scams

Sep 05, 2025

How To Spot And Avoid Parking Fine Scams

Sep 05, 2025