Lucid Stock Slump: A 4%+ Loss And What It Means For Investors

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lucid Stock Slump: A 4%+ Loss and What It Means for Investors

Lucid Group (LCID) stock took a significant hit on [Date of Stock Drop], plunging over 4% and leaving investors wondering what's next for the electric vehicle (EV) maker. This dramatic drop follows a period of fluctuating performance, raising concerns about the company's long-term prospects and the broader EV market. Understanding the reasons behind this slump is crucial for current and prospective investors.

What Triggered the Lucid Stock Decline?

While pinpointing a single cause for the 4%+ loss is difficult, several factors likely contributed to the sell-off. These include:

-

Increased Competition: The EV market is becoming increasingly crowded, with established automakers like Ford and GM, alongside Tesla and other startups, vying for market share. Lucid faces intense pressure to compete on price, innovation, and production scale. This competitive landscape is impacting investor confidence.

-

Production Challenges: Lucid has faced production hurdles in the past, impacting its ability to meet its ambitious delivery targets. Any news or speculation about further production delays can significantly impact investor sentiment, as seen in this recent stock decline. Analysts are closely watching Lucid's ability to ramp up production efficiently.

-

Macroeconomic Factors: The broader economic climate is another significant factor. Rising interest rates, inflation, and concerns about a potential recession are impacting investor risk appetite across various sectors, including the EV market. Investors are becoming more selective, favoring companies with strong fundamentals and proven profitability.

-

Lack of Profitability: Lucid, like many other EV companies, is currently not profitable. This is a key concern for many investors, who are looking for companies that can demonstrate a clear path to profitability in the near future. Continued losses can lead to decreased investor confidence.

What Does This Mean for Investors?

The recent Lucid stock slump presents a complex situation for investors. While the 4%+ drop is concerning, it's crucial to avoid knee-jerk reactions. Here are some key considerations:

-

Long-Term Vision: Investing in Lucid, or any EV company, requires a long-term perspective. The EV market is still relatively young and experiencing rapid growth, but it's also volatile. Investors should carefully assess their risk tolerance before investing in such companies.

-

Fundamental Analysis: Before making any investment decisions, conduct thorough fundamental analysis of Lucid's financial performance, production capacity, and competitive landscape. Consider factors like its technology, brand recognition, and long-term growth potential.

-

Diversification: Diversification is crucial in any investment portfolio. Don't put all your eggs in one basket. Spread your investments across different asset classes to mitigate risk.

-

Market Sentiment: Pay close attention to market sentiment and news surrounding Lucid and the broader EV industry. Staying informed is key to making well-informed investment decisions.

Looking Ahead: Is This a Buying Opportunity?

Whether the recent drop presents a buying opportunity depends entirely on individual investor risk tolerance and long-term outlook. Some investors might see this as a chance to acquire shares at a discounted price, believing in Lucid's long-term potential. However, others may choose to wait for more positive signs before investing.

Conclusion:

The 4%+ loss in Lucid stock serves as a reminder of the inherent risks associated with investing in the volatile EV sector. While Lucid possesses promising technology and a strong brand, investors need to carefully weigh the risks and rewards before making any investment decisions. Thorough research and a long-term perspective are critical for navigating the complexities of this dynamic market. Remember to consult with a financial advisor before making any investment decisions.

Keywords: Lucid Stock, LCID, Electric Vehicle, EV, Stock Market, Investment, Stock Decline, EV Market, Competition, Production Challenges, Macroeconomic Factors, Profitability, Investor Sentiment, Buying Opportunity, Stock Analysis.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lucid Stock Slump: A 4%+ Loss And What It Means For Investors. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

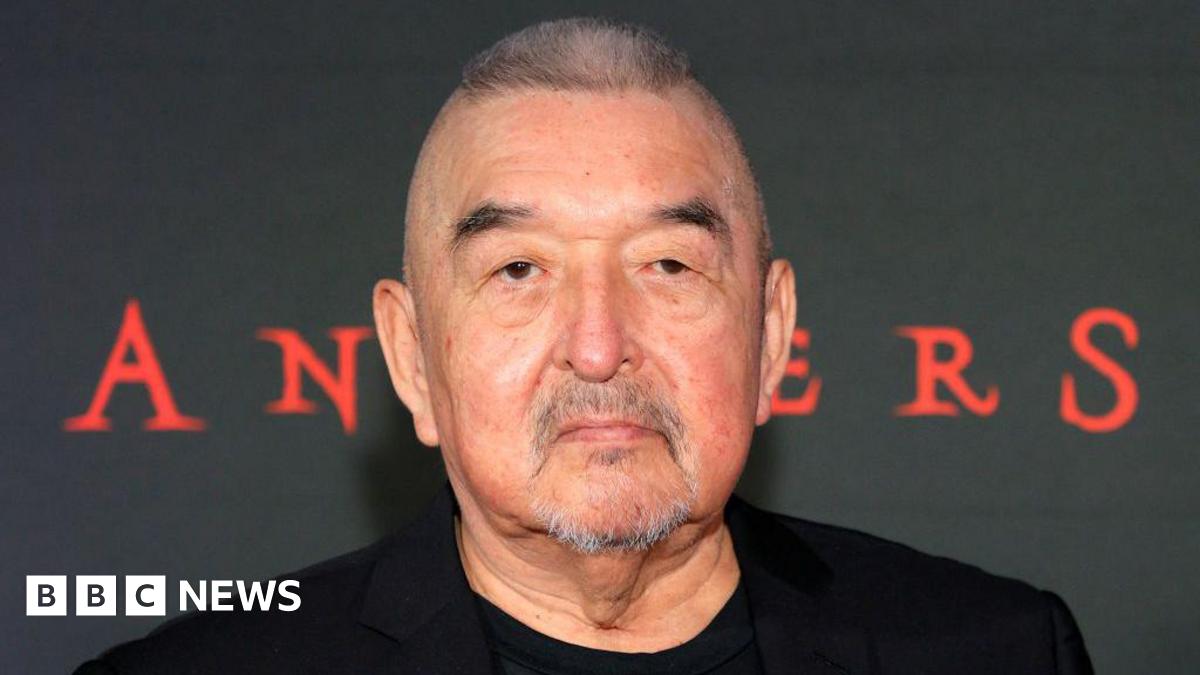

Tributes Pour In Following Death Of Graham Greene Dances With Wolves Actor At 73

Sep 03, 2025

Tributes Pour In Following Death Of Graham Greene Dances With Wolves Actor At 73

Sep 03, 2025 -

The Ultimate Song Of The Summer Debate Cnn Asks New Yorkers For Their Picks

Sep 03, 2025

The Ultimate Song Of The Summer Debate Cnn Asks New Yorkers For Their Picks

Sep 03, 2025 -

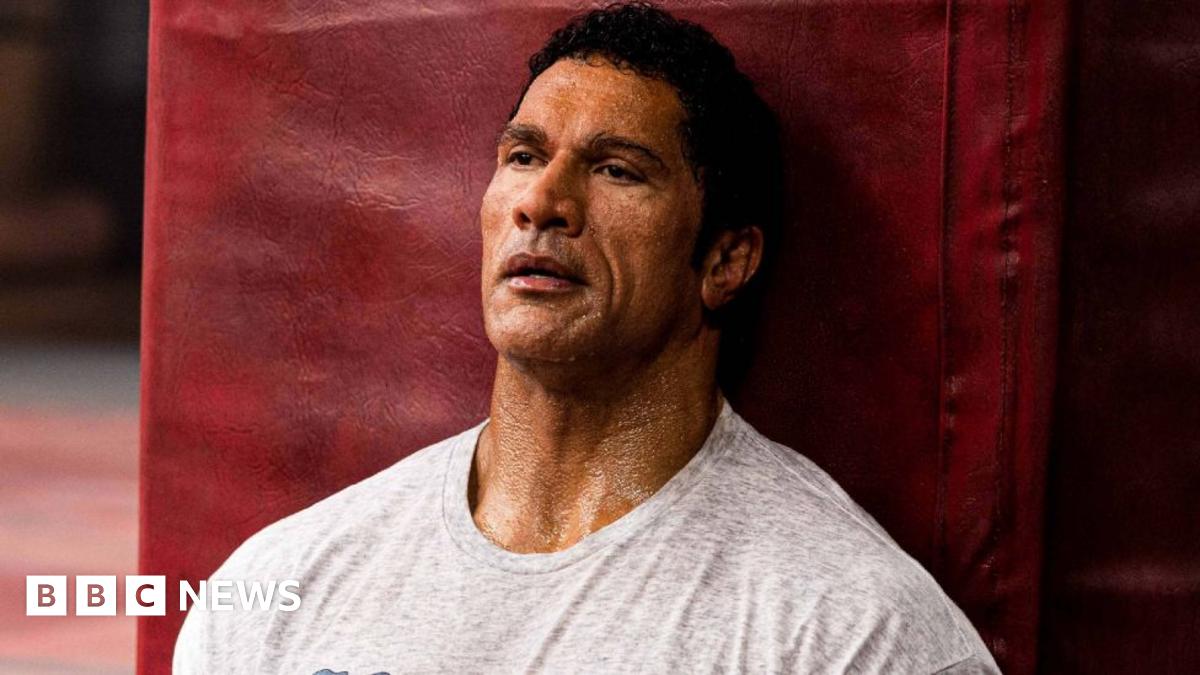

Oscar Contender Dwayne Johnsons Transformation For The Smashing Machine Role

Sep 03, 2025

Oscar Contender Dwayne Johnsons Transformation For The Smashing Machine Role

Sep 03, 2025 -

China Prepares For Spectacle Beijings Upcoming Military Parade

Sep 03, 2025

China Prepares For Spectacle Beijings Upcoming Military Parade

Sep 03, 2025 -

Western New York Claims Another Powerball Victory

Sep 03, 2025

Western New York Claims Another Powerball Victory

Sep 03, 2025

Latest Posts

-

Underrated Fantasy Gem Turns 30 A Must Watch For Every Fan

Sep 04, 2025

Underrated Fantasy Gem Turns 30 A Must Watch For Every Fan

Sep 04, 2025 -

West Virginia Cash Pop Winning Numbers Tuesdays Draw Results

Sep 04, 2025

West Virginia Cash Pop Winning Numbers Tuesdays Draw Results

Sep 04, 2025 -

Venezuela Claims Drug Smuggling Video Is Ai Generated

Sep 04, 2025

Venezuela Claims Drug Smuggling Video Is Ai Generated

Sep 04, 2025 -

86 On Rotten Tomatoes This 6 Season Fantasy Epic Turns 30

Sep 04, 2025

86 On Rotten Tomatoes This 6 Season Fantasy Epic Turns 30

Sep 04, 2025 -

30 Years Of Xena Warrior Princess Legacy And Impact

Sep 04, 2025

30 Years Of Xena Warrior Princess Legacy And Impact

Sep 04, 2025