Lucid Stock (LCID) Under Pressure: Stifel's Negative Outlook And Lowered Price Target

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lucid Stock (LCID) Under Pressure: Stifel's Negative Outlook and Lowered Price Target

Lucid Group (LCID) stock took a significant hit recently after Stifel Nicolaus, a prominent investment bank, downgraded its rating and slashed its price target for the electric vehicle (EV) maker. This move sent ripples through the already volatile EV sector, prompting investors to reassess their positions in Lucid and sparking concerns about the company's future prospects. The news highlights the ongoing challenges faced by many EV startups as they navigate a fiercely competitive market and strive for profitability.

Stifel's Rationale: Production Shortfalls and Mounting Concerns

Stifel's decision to downgrade Lucid wasn't arbitrary. Analysts cited several key factors contributing to their pessimistic outlook. The most significant concern revolves around Lucid's production targets. The company has consistently faced challenges in meeting its ambitious production goals, leading to concerns about its ability to scale its operations efficiently and compete effectively with established EV giants like Tesla and newer entrants.

The lowered price target, a substantial reduction from the previous forecast, reflects this diminished confidence. Stifel's analysts believe Lucid's current valuation doesn't accurately reflect the company's near-term challenges and potential for slower-than-expected growth. This highlights the inherent risks associated with investing in early-stage EV companies, where execution and market acceptance are crucial for success.

Impact on Lucid Stock and Investor Sentiment

The news from Stifel immediately impacted Lucid's stock price, causing a sharp decline. This underscores the sensitivity of EV stocks to analyst ratings and the overall market sentiment surrounding the sector. Investor confidence in Lucid, already fragile due to previous production setbacks, took a further blow.

The situation emphasizes the importance of staying informed about analyst ratings and company performance when investing in the volatile EV market. Investors should conduct thorough due diligence and consider diversifying their portfolios to mitigate risk.

The Broader EV Landscape and Future Outlook for Lucid

Lucid's struggles aren't unique within the EV industry. Many startups are facing similar challenges, including supply chain disruptions, rising production costs, and intense competition. The path to profitability for these companies is proving to be longer and more arduous than initially anticipated.

However, it's important to note that Lucid possesses some key strengths. Their Air luxury sedan has garnered positive reviews, and the company boasts innovative technology and a strong brand image. Whether Lucid can leverage these strengths to overcome its current challenges and achieve sustainable growth remains to be seen.

What's Next for Lucid?

The coming months will be crucial for Lucid. The company needs to demonstrate progress in meeting its production targets, improving its operational efficiency, and managing its financial resources effectively. Successful execution on these fronts will be key to restoring investor confidence and potentially reversing the current downward trend in its stock price. Investors will be closely watching Lucid's upcoming financial reports and production updates for any signs of improvement.

Investing in the EV Sector: A Word of Caution

The EV sector remains dynamic and highly volatile. Investing in EV stocks, especially those of newer companies, involves significant risk. Thorough research and a diversified investment strategy are crucial for mitigating potential losses. Consider consulting with a qualified financial advisor before making any investment decisions.

Keywords: Lucid Stock, LCID, Stifel Nicolaus, Electric Vehicle, EV, EV Stock, Stock Market, Investment, Analyst Rating, Price Target, Production, Growth, Tesla, Market Volatility, Investor Sentiment, Financial News, Stock News

(Note: This article provides information for educational purposes only and is not financial advice. Always conduct thorough research and consult a financial professional before making investment decisions.)

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lucid Stock (LCID) Under Pressure: Stifel's Negative Outlook And Lowered Price Target. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Ohio States Quinshon Judkins Nflpa Suspension Confirmed By Espn Cleveland

Sep 03, 2025

Ohio States Quinshon Judkins Nflpa Suspension Confirmed By Espn Cleveland

Sep 03, 2025 -

Gaza City Attacks Intensify Thousands Of Families And Children Displaced

Sep 03, 2025

Gaza City Attacks Intensify Thousands Of Families And Children Displaced

Sep 03, 2025 -

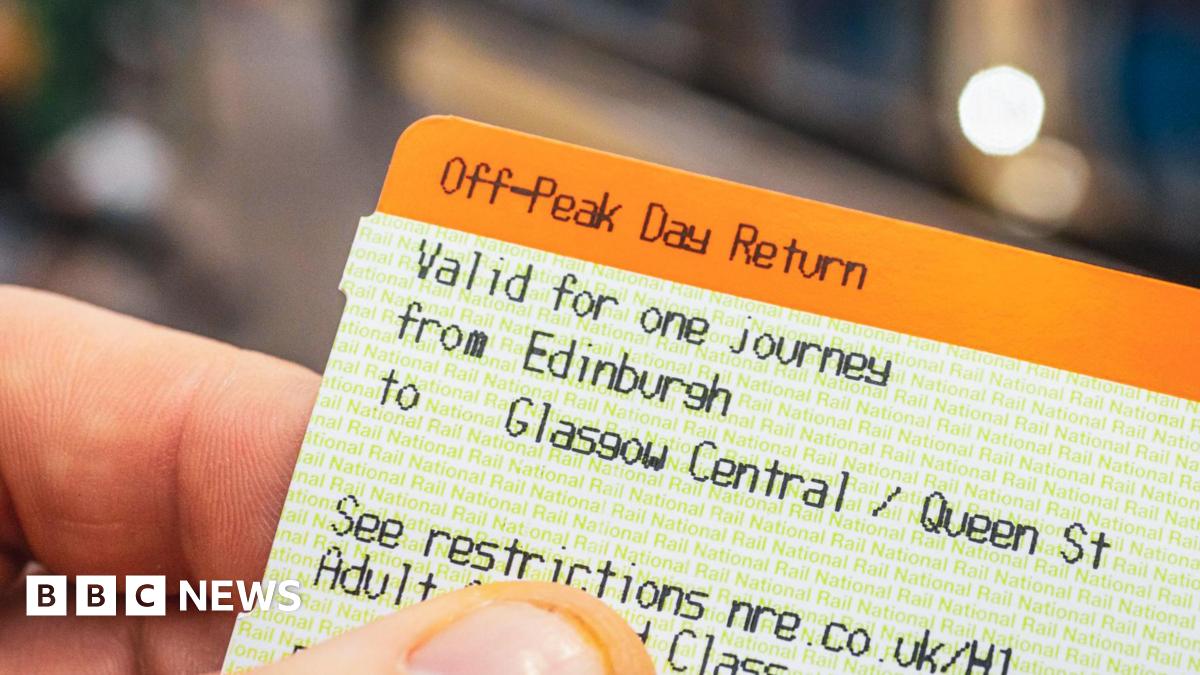

Scot Rails Peak Time Fare Removal Impact And Implications For Passengers

Sep 03, 2025

Scot Rails Peak Time Fare Removal Impact And Implications For Passengers

Sep 03, 2025 -

Did You Win Hoosier Lotto Cash 5 Results For August 30 2025

Sep 03, 2025

Did You Win Hoosier Lotto Cash 5 Results For August 30 2025

Sep 03, 2025 -

No More Peak Fares On Scot Rail Analyzing The Permanent Fare Shift

Sep 03, 2025

No More Peak Fares On Scot Rail Analyzing The Permanent Fare Shift

Sep 03, 2025

Latest Posts

-

Metal Eden Cgi Trailer A First Look At Gameplay

Sep 03, 2025

Metal Eden Cgi Trailer A First Look At Gameplay

Sep 03, 2025 -

Labours Asylum Plan And The Latest Developments At Number 10

Sep 03, 2025

Labours Asylum Plan And The Latest Developments At Number 10

Sep 03, 2025 -

Is Metal Eden Worth Playing A Critical Fps Review

Sep 03, 2025

Is Metal Eden Worth Playing A Critical Fps Review

Sep 03, 2025 -

Humanitarian Crisis Deepens Families And Children Flee Gaza Citys Growing Conflict

Sep 03, 2025

Humanitarian Crisis Deepens Families And Children Flee Gaza Citys Growing Conflict

Sep 03, 2025 -

Playing The 1 3 Billion Powerball In Sc Debit Card Purchases And Lottery Rules

Sep 03, 2025

Playing The 1 3 Billion Powerball In Sc Debit Card Purchases And Lottery Rules

Sep 03, 2025