Lucid Stock (LCID) Price Target Cut: Stifel Remains Bearish

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lucid Stock (LCID) Price Target Cut: Stifel Remains Bearish on EV Maker

Lucid Group (LCID) investors received unwelcome news this week as Stifel Nicolaus, a prominent investment bank, slashed its price target for the electric vehicle (EV) maker. This move underscores a growing concern among some analysts about Lucid's ability to meet ambitious production targets and navigate the increasingly competitive EV market. The cut reflects a more bearish outlook on the company's short-term prospects, sending ripples through the already volatile LCID stock.

Stifel's Downgrade and the Rationale Behind It

Stifel analyst John Murphy lowered the price target for Lucid stock from $10 to a mere $7, representing a significant drop. This adjustment follows a period of disappointing production figures and increased concerns about the company's financial health. Murphy cited several factors contributing to his pessimistic outlook, including:

-

Production Challenges: Lucid has consistently struggled to meet its ambitious production goals. While the company has shown progress, the pace of production remains a key concern for investors and analysts alike. This slow ramp-up significantly impacts the company's ability to generate revenue and achieve profitability.

-

Intense Competition: The EV market is becoming increasingly crowded, with established players like Tesla and a wave of new entrants vying for market share. Lucid faces intense competition, forcing it to aggressively compete on price and features. This pressure could squeeze profit margins and hinder its growth trajectory.

-

Supply Chain Issues: Like many companies in the automotive industry, Lucid has been grappling with supply chain disruptions. These disruptions can lead to production delays, increased costs, and ultimately impact the company's bottom line. The ongoing global supply chain volatility adds further uncertainty to Lucid's future performance.

Impact on Lucid Stock (LCID)

The Stifel price target cut sent LCID stock tumbling, highlighting the market's sensitivity to negative analyst sentiment. Investors are closely monitoring Lucid's progress and the company's ability to address the challenges it faces. The stock's performance will likely remain volatile in the near term, dependent on future production updates, financial results, and overall market conditions.

What's Next for Lucid?

Lucid needs to demonstrate a clear path to profitability and sustainable growth to regain investor confidence. This will likely involve:

-

Increased Production Efficiency: Improving production efficiency and meeting its production targets are crucial for Lucid's future success. This requires streamlining its manufacturing processes and addressing any supply chain bottlenecks.

-

Strategic Partnerships: Forming strategic partnerships could help Lucid expand its reach, access new technologies, and improve its supply chain resilience.

-

Focus on Innovation: Continued innovation in battery technology, autonomous driving features, and other key areas will be vital in differentiating Lucid's vehicles in the increasingly competitive EV market.

Investing in Lucid Stock: A High-Risk, High-Reward Proposition?

Investing in Lucid stock remains a high-risk, high-reward proposition. While the company possesses innovative technology and a potentially strong brand, the significant challenges it faces warrant a cautious approach. Potential investors should carefully consider their risk tolerance and thoroughly research the company's financial performance and future prospects before making any investment decisions. Always consult with a financial advisor before making any investment decisions.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves inherent risks, and past performance is not indicative of future results.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lucid Stock (LCID) Price Target Cut: Stifel Remains Bearish. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Metal Eden Cgi Trailer A First Look At The Gameplay

Sep 03, 2025

Metal Eden Cgi Trailer A First Look At The Gameplay

Sep 03, 2025 -

Your Guide To Dancing With The Stars Season 34

Sep 03, 2025

Your Guide To Dancing With The Stars Season 34

Sep 03, 2025 -

Afghanistan Earthquake Disaster Assessing The Damage And Casualties

Sep 03, 2025

Afghanistan Earthquake Disaster Assessing The Damage And Casualties

Sep 03, 2025 -

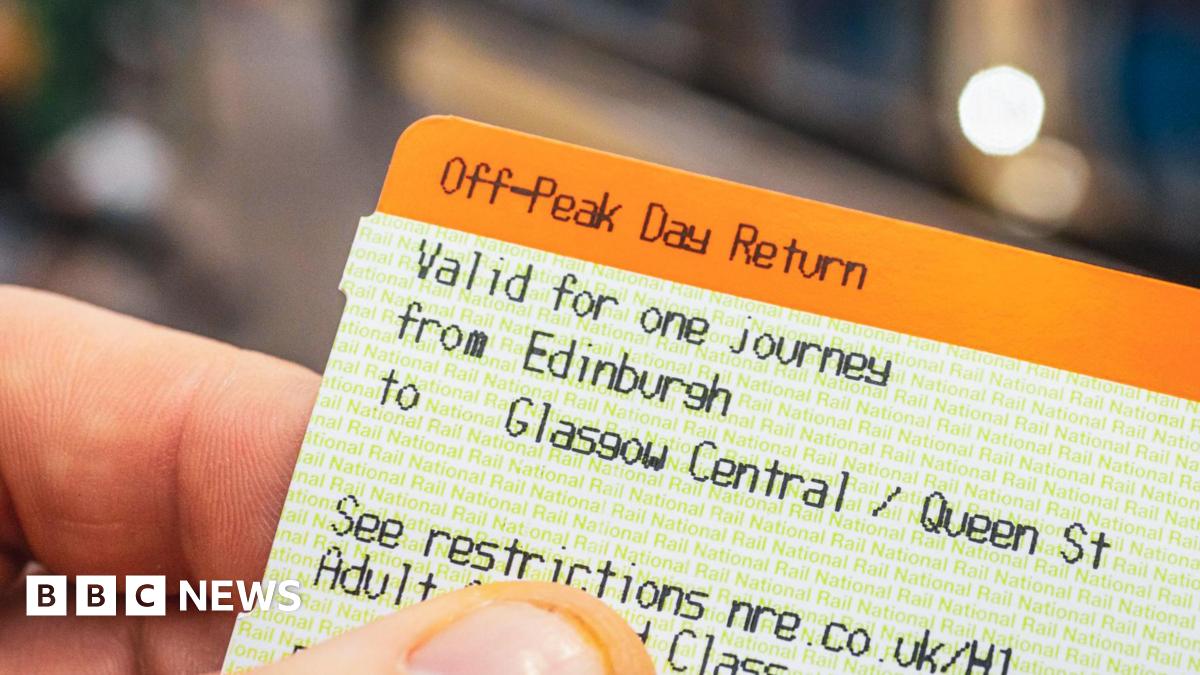

Scot Rails Peak Time Surcharges Officially Abolished

Sep 03, 2025

Scot Rails Peak Time Surcharges Officially Abolished

Sep 03, 2025 -

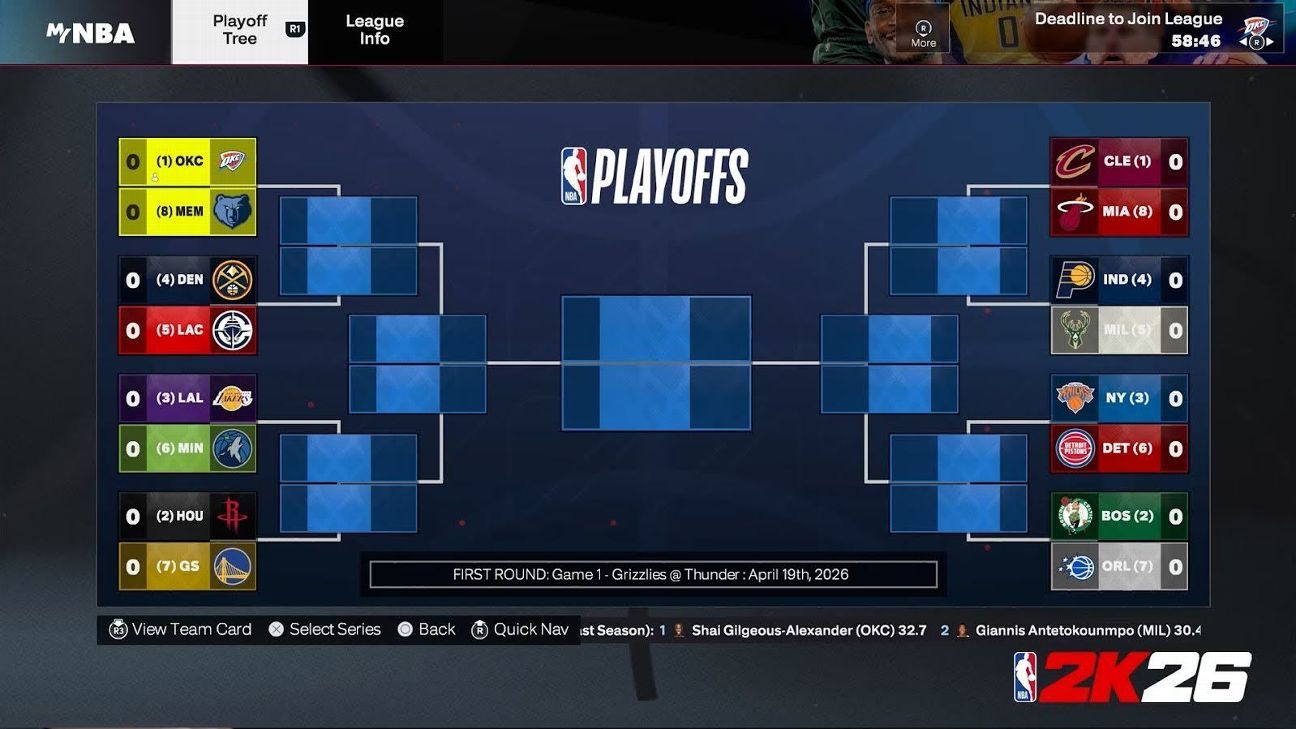

2 K Games Unveils New Features For My Nba And My Gm In Nba 2 K26

Sep 03, 2025

2 K Games Unveils New Features For My Nba And My Gm In Nba 2 K26

Sep 03, 2025

Latest Posts

-

College Footballs Loss Judkins Committed To Nfl Draft Process

Sep 03, 2025

College Footballs Loss Judkins Committed To Nfl Draft Process

Sep 03, 2025 -

Labours Asylum Crackdown And The Implications For No 10

Sep 03, 2025

Labours Asylum Crackdown And The Implications For No 10

Sep 03, 2025 -

Nyt Spelling Bee September 3 Hints And Answers For 549

Sep 03, 2025

Nyt Spelling Bee September 3 Hints And Answers For 549

Sep 03, 2025 -

See The Northern Lights In The Uk Heres What You Need To Know

Sep 03, 2025

See The Northern Lights In The Uk Heres What You Need To Know

Sep 03, 2025 -

Sutter Health Employees Social Media Post Sparks Investigation

Sep 03, 2025

Sutter Health Employees Social Media Post Sparks Investigation

Sep 03, 2025