Lucid Motors Stock Plunges: Understanding Today's 4%+ Drop

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lucid Motors Stock Plunges: Understanding Today's 4%+ Drop

Lucid Group (LCID) stock experienced a significant downturn today, plummeting over 4% in a single trading session. This sharp decline has sent ripples through the electric vehicle (EV) market and left investors wondering about the underlying causes. While pinpointing a single reason is difficult, several factors likely contributed to this substantial drop. Let's delve into the potential reasons behind Lucid's stock plunge and what it might mean for the future.

H2: Production Challenges and Delivery Shortfalls:

One of the most significant factors impacting Lucid's stock price is the company's ongoing struggle to meet its ambitious production targets. While Lucid has showcased impressive technology and a sleek design with its Air luxury sedan, translating that into mass production has proven challenging. Reports of production bottlenecks and slower-than-expected delivery numbers have consistently weighed on investor sentiment. Analysts point to supply chain disruptions and manufacturing complexities as major contributing factors. This ongoing struggle to scale production efficiently directly impacts the company's revenue projections and overall market confidence.

H2: Broader Market Volatility and EV Sector Concerns:

The recent downturn in Lucid's stock price cannot be viewed in isolation. The broader market has experienced volatility recently, with the tech sector, which includes many EV companies, taking a significant hit. Investor concerns about rising interest rates, inflation, and a potential economic slowdown have led to a general sell-off in growth stocks, including those in the EV space. This macroeconomic environment has negatively impacted sentiment across the entire EV sector, creating a headwind for Lucid and its competitors alike.

H3: Competition Heats Up in the Luxury EV Market:

Lucid faces increasingly fierce competition from established automakers like Tesla, as well as other emerging EV players. The luxury EV segment is becoming increasingly crowded, with competitors offering comparable technology and features at potentially more competitive price points. This intensifying competition puts pressure on Lucid to maintain its market share and justify its premium pricing strategy. The fight for market dominance in this rapidly evolving landscape is a key factor influencing investor perception.

H2: Analyzing the Future of Lucid Motors:

Despite today's significant drop, it's crucial to avoid knee-jerk reactions. Lucid's long-term prospects remain dependent on several key factors, including successfully addressing its production challenges, navigating the competitive landscape, and securing further funding to support its growth initiatives. The company's technological advancements and the growing demand for luxury EVs provide a foundation for future success. However, execution will be key to regaining investor confidence.

H2: What Investors Should Do:

Investors should carefully consider their risk tolerance and investment horizon before making any decisions regarding Lucid stock. Conducting thorough due diligence, staying informed about the company's progress, and understanding the broader market conditions are crucial steps in navigating the volatility of the EV market. Consulting with a financial advisor is always recommended before making any significant investment changes.

H3: Keywords to Watch:

- Lucid Motors Stock

- LCID Stock

- Electric Vehicle (EV) Stock

- EV Market

- Lucid Production

- Luxury EV

- Tesla

- Stock Market Volatility

This significant drop in Lucid Motors stock serves as a reminder of the inherent risks associated with investing in growth stocks, especially within a volatile market environment. While the future remains uncertain, understanding the contributing factors behind this downturn allows investors to make more informed decisions moving forward. Remember to always conduct thorough research before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lucid Motors Stock Plunges: Understanding Today's 4%+ Drop. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Complete Results Wwe Clash In Paris Rollins Maintains Reign

Sep 02, 2025

Complete Results Wwe Clash In Paris Rollins Maintains Reign

Sep 02, 2025 -

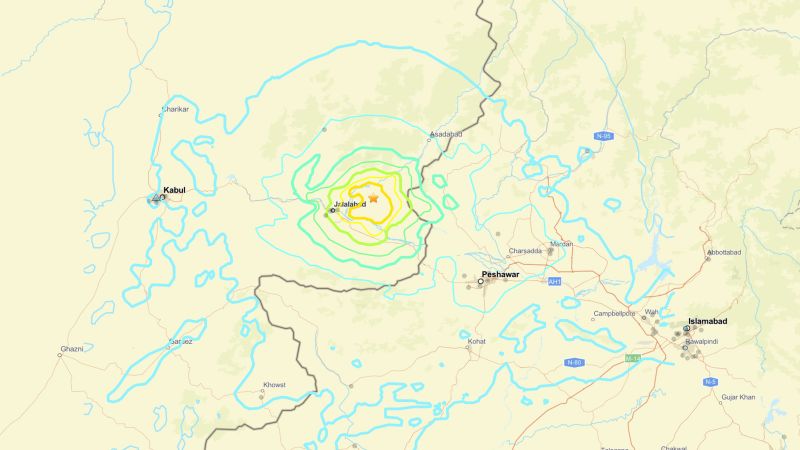

Urgent 6 0 Magnitude Earthquake Rocks Eastern Afghanistan Widespread Casualties Anticipated

Sep 02, 2025

Urgent 6 0 Magnitude Earthquake Rocks Eastern Afghanistan Widespread Casualties Anticipated

Sep 02, 2025 -

Cenas Sweet Victory Kiss Celebrating With Shay After Defeating Logan Paul

Sep 02, 2025

Cenas Sweet Victory Kiss Celebrating With Shay After Defeating Logan Paul

Sep 02, 2025 -

Learner Driver Abuse One Instructors Terrifying Experience

Sep 02, 2025

Learner Driver Abuse One Instructors Terrifying Experience

Sep 02, 2025 -

Lucid Stock Lcid Under Pressure Stifels Negative Outlook And Lower Price Target

Sep 02, 2025

Lucid Stock Lcid Under Pressure Stifels Negative Outlook And Lower Price Target

Sep 02, 2025

Latest Posts

-

Could It Be A La Nina Winter Regional Weather Predictions

Sep 03, 2025

Could It Be A La Nina Winter Regional Weather Predictions

Sep 03, 2025 -

Trump And Putins Secret Talks New Insights Into The Ukraine Conflict

Sep 03, 2025

Trump And Putins Secret Talks New Insights Into The Ukraine Conflict

Sep 03, 2025 -

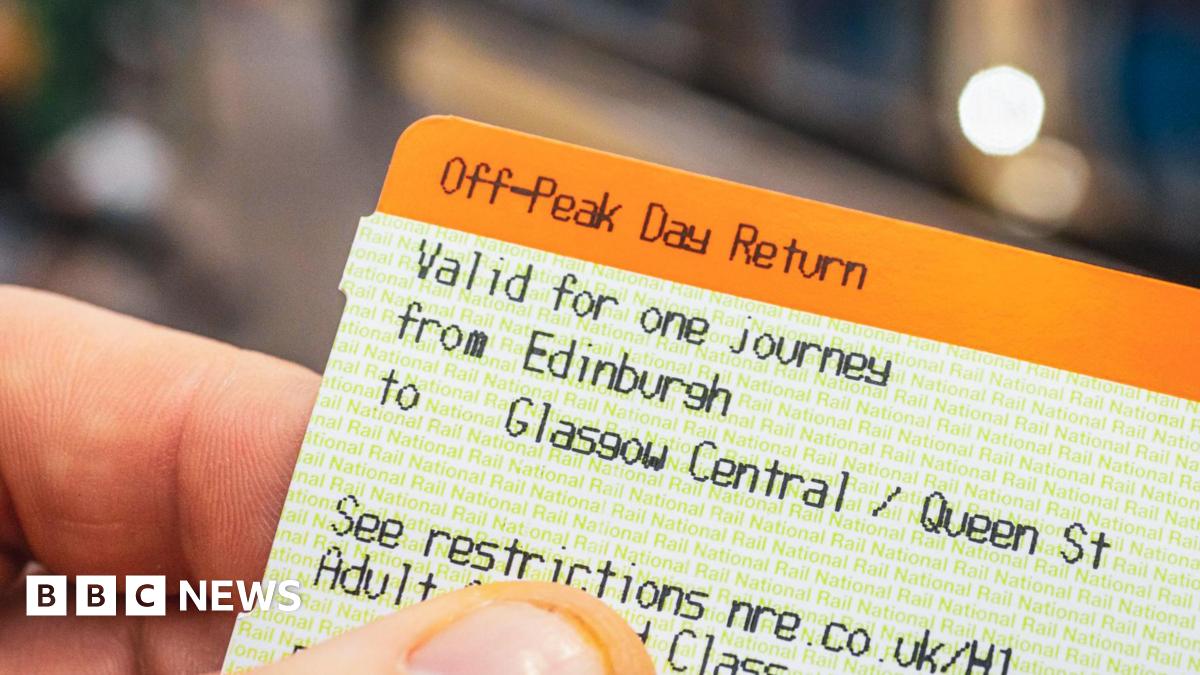

Permanent Fare Reduction Scot Rail Eliminates Peak Pricing

Sep 03, 2025

Permanent Fare Reduction Scot Rail Eliminates Peak Pricing

Sep 03, 2025 -

Vashi Jewellery 170 Million Fraud Unveiled Employees Used As Decoy Customers

Sep 03, 2025

Vashi Jewellery 170 Million Fraud Unveiled Employees Used As Decoy Customers

Sep 03, 2025 -

Sergio Gor From Trumps Inner Circle To Indias Diplomatic Mission

Sep 03, 2025

Sergio Gor From Trumps Inner Circle To Indias Diplomatic Mission

Sep 03, 2025