Lucid Group (LCID) Stock: Brokerage Target Price Consensus At $25.94

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lucid Group (LCID) Stock: Brokerage Target Price Consensus at $25.94 – Is This Electric Vehicle Maker Ready to Surge?

Lucid Group (LCID), the luxury electric vehicle (EV) manufacturer, is buzzing with activity as brokerage firms issue increasingly optimistic price targets. The current consensus among analysts points to a potential upside, with the average target price sitting at $25.94. But is this prediction realistic, and should investors be jumping on the Lucid bandwagon? Let's delve into the details and explore the factors driving this bullish sentiment.

The Bull Case for Lucid:

Several factors contribute to the positive outlook on LCID stock. Firstly, Lucid's Air Dream Edition has garnered significant praise for its impressive range and luxurious features, establishing the brand as a serious competitor in the high-end EV market. This strong initial product launch has cemented Lucid's position as a technology leader in the EV space.

Secondly, the company's ambitious expansion plans are attracting investor attention. Lucid is aggressively pursuing growth both domestically and internationally, aiming to significantly increase production capacity in the coming years. This aggressive expansion strategy suggests a strong belief in the company's future market share.

- Technological Innovation: Lucid's advanced battery technology and efficient powertrain are key differentiators, promising superior range and performance compared to many competitors. This technological edge is crucial in a rapidly evolving EV landscape.

- Luxury Market Focus: Targeting the luxury segment allows Lucid to command higher profit margins, a critical factor for long-term sustainability in a competitive market. This strategic focus minimizes reliance on high-volume sales to achieve profitability.

- Government Incentives: Government incentives and subsidies for EV adoption in various regions are providing a significant tailwind for Lucid's growth and profitability.

Challenges Facing Lucid:

Despite the positive outlook, Lucid faces considerable challenges. The EV market is highly competitive, with established players like Tesla and newer entrants constantly innovating and vying for market share. Maintaining its technological edge and securing a sizeable market share will be crucial for Lucid's success.

- Production Ramp-Up: Successfully scaling up production to meet growing demand is a major hurdle. Any production bottlenecks could negatively impact revenue and investor confidence.

- Supply Chain Issues: The global supply chain remains volatile, and securing critical components like batteries could prove challenging, potentially hindering production targets.

- Competition: The intense competition in the EV market necessitates continuous innovation and aggressive marketing to maintain a competitive edge.

Analyst Predictions and the $25.94 Target Price:

The $25.94 average target price represents a significant upside from the current share price, reflecting analysts' belief in Lucid's long-term potential. However, it's crucial to remember that these are just predictions, and the actual stock price can fluctuate significantly based on various factors, including market sentiment, economic conditions, and company performance.

Is it a Buy?

Whether or not to invest in LCID stock is a highly individual decision. Potential investors should conduct thorough due diligence, considering both the potential upside and the inherent risks. Analyzing the company's financial statements, understanding its competitive landscape, and considering your own risk tolerance are crucial steps before making any investment decisions. Consulting with a qualified financial advisor is always recommended.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and you could lose money. Always conduct your own research before making any investment decisions. Consider consulting with a financial advisor before making any investment decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lucid Group (LCID) Stock: Brokerage Target Price Consensus At $25.94. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

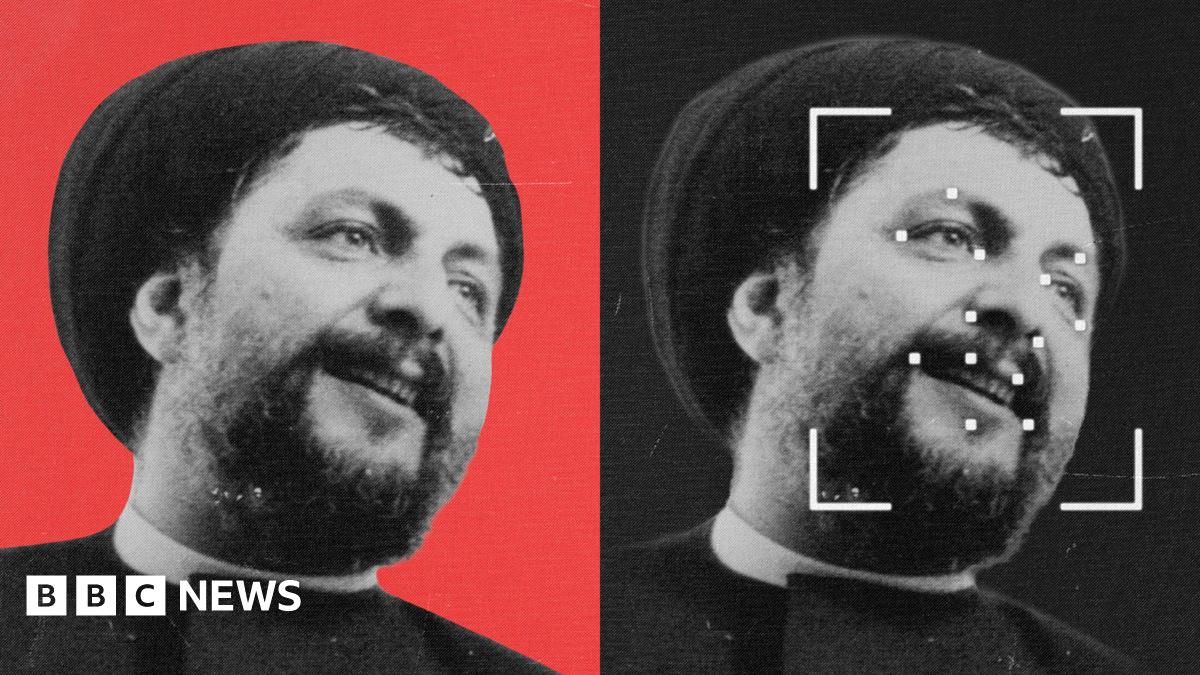

Musa Al Sadr Could Libyan Mortuary Body Finally Solve The 50 Year Old Mystery

Sep 03, 2025

Musa Al Sadr Could Libyan Mortuary Body Finally Solve The 50 Year Old Mystery

Sep 03, 2025 -

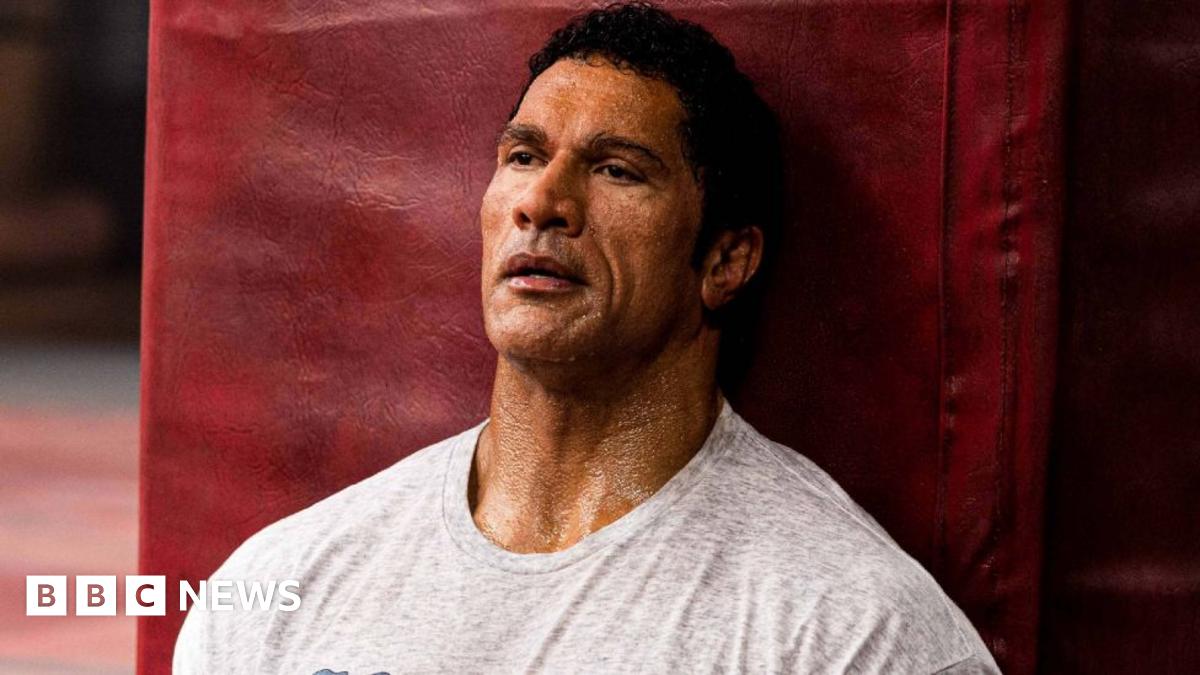

Oscar Contender Dwayne Johnsons Transformation For The Smashing Machine Role

Sep 03, 2025

Oscar Contender Dwayne Johnsons Transformation For The Smashing Machine Role

Sep 03, 2025 -

The Xi Putin Partnership Reshaping The Global Order

Sep 03, 2025

The Xi Putin Partnership Reshaping The Global Order

Sep 03, 2025 -

Official Manchester City Secure Donnarumma Signing Ederson Departs

Sep 03, 2025

Official Manchester City Secure Donnarumma Signing Ederson Departs

Sep 03, 2025 -

How To Watch The Dancing With The Stars Season 34 Cast Announcement Live And Free

Sep 03, 2025

How To Watch The Dancing With The Stars Season 34 Cast Announcement Live And Free

Sep 03, 2025

Latest Posts

-

Parking Fine Fraud Recognizing And Preventing Scams

Sep 05, 2025

Parking Fine Fraud Recognizing And Preventing Scams

Sep 05, 2025 -

Messi Se Despide El Ultimo Baile Ante Venezuela En Casa

Sep 05, 2025

Messi Se Despide El Ultimo Baile Ante Venezuela En Casa

Sep 05, 2025 -

Student Loan Debt The Warning Signs Of A Looming Bubble

Sep 05, 2025

Student Loan Debt The Warning Signs Of A Looming Bubble

Sep 05, 2025 -

Beijings Show Of Strength Analysis Of Chinas Military Parade From Bbc Correspondents

Sep 05, 2025

Beijings Show Of Strength Analysis Of Chinas Military Parade From Bbc Correspondents

Sep 05, 2025 -

Decoding Chinas Military Parade Assessing The Nations Growing Power

Sep 05, 2025

Decoding Chinas Military Parade Assessing The Nations Growing Power

Sep 05, 2025