Lucid Group (LCID): Brokerage Price Targets And Stock Outlook

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Lucid Group (LCID): Brokerage Price Targets and Stock Outlook – Navigating the Electric Vehicle Landscape

Lucid Group (LCID) has captured significant attention in the burgeoning electric vehicle (EV) market. However, navigating the complexities of its stock performance requires understanding the perspectives of financial analysts and the broader market trends. This article delves into the current brokerage price targets for LCID stock and provides insights into the overall outlook for the company.

Understanding the Brokerage Price Target Landscape

Brokerage firms regularly issue price targets for publicly traded companies like Lucid. These targets represent the analysts' estimations of a stock's fair value within a specific timeframe, often 12-18 months. It's crucial to remember that these are just predictions, not guarantees. Several factors influence these projections, including:

- Production and Delivery Numbers: Lucid's ability to meet its production goals and deliver vehicles to customers significantly impacts its valuation. Any production bottlenecks or delays can negatively affect the price target.

- Financial Performance: Profitability and revenue growth are key metrics influencing analyst sentiment. Lucid's path to profitability, including its operating expenses and margins, will heavily influence future price targets.

- Competitive Landscape: The EV market is fiercely competitive, with established players like Tesla and emerging rivals vying for market share. Lucid's ability to differentiate itself and maintain a competitive edge is crucial.

- Technological Advancements: Innovation in battery technology, charging infrastructure, and autonomous driving capabilities will play a vital role in shaping Lucid's future and influencing price targets.

- Macroeconomic Factors: Broader economic conditions, including interest rates, inflation, and consumer spending, can impact investor sentiment and ultimately influence stock prices.

A Closer Look at Recent Price Targets:

While price targets fluctuate constantly based on new information and analyst revisions, reviewing the consensus among various brokerage firms provides a valuable overview. (Note: Always consult up-to-date financial news sources for the most current price target information. This data is subject to rapid change.) You can find this information readily available on major financial news websites and brokerage platforms. Look for reports summarizing analyst ratings and price targets.

Factors Affecting Lucid's Stock Outlook:

Beyond the immediate price targets, several key factors will shape Lucid's long-term outlook:

- Expansion Plans: Lucid's strategy for expanding its manufacturing capacity and global reach will be critical for its future growth.

- Model Diversification: Introducing new vehicle models and expanding its product line will help attract a wider customer base and reduce reliance on a single product.

- Charging Infrastructure Investment: Investing in and partnering with charging infrastructure providers will enhance the customer experience and increase adoption of Lucid vehicles.

- Technological Innovation: Continuing to innovate and develop cutting-edge EV technologies is essential for maintaining a competitive advantage.

Investing in LCID: A Cautious Approach

Investing in the stock market, particularly in a volatile sector like electric vehicles, carries inherent risks. Lucid's stock is considered a high-growth, high-risk investment. Before making any investment decisions, it's crucial to conduct thorough due diligence, consider your risk tolerance, and potentially consult with a qualified financial advisor. Never invest more than you can afford to lose.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves risk, and past performance is not indicative of future results.

Keywords: Lucid Group, LCID, stock, price target, electric vehicle, EV, brokerage, investment, stock market, financial news, analyst rating, stock outlook, EV market, Tesla, competition, production, revenue, profitability.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Lucid Group (LCID): Brokerage Price Targets And Stock Outlook. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Trumps Autumn Strategy Aggressive Power Plays Against Democrats

Sep 03, 2025

Trumps Autumn Strategy Aggressive Power Plays Against Democrats

Sep 03, 2025 -

Drafting Quinshon Judkins A Fantasy Football Strategy Guide

Sep 03, 2025

Drafting Quinshon Judkins A Fantasy Football Strategy Guide

Sep 03, 2025 -

Longtime New York Representative Jerry Nadler Retiring From Congress

Sep 03, 2025

Longtime New York Representative Jerry Nadler Retiring From Congress

Sep 03, 2025 -

Book Details Camillas Teenager Assault Prevention

Sep 03, 2025

Book Details Camillas Teenager Assault Prevention

Sep 03, 2025 -

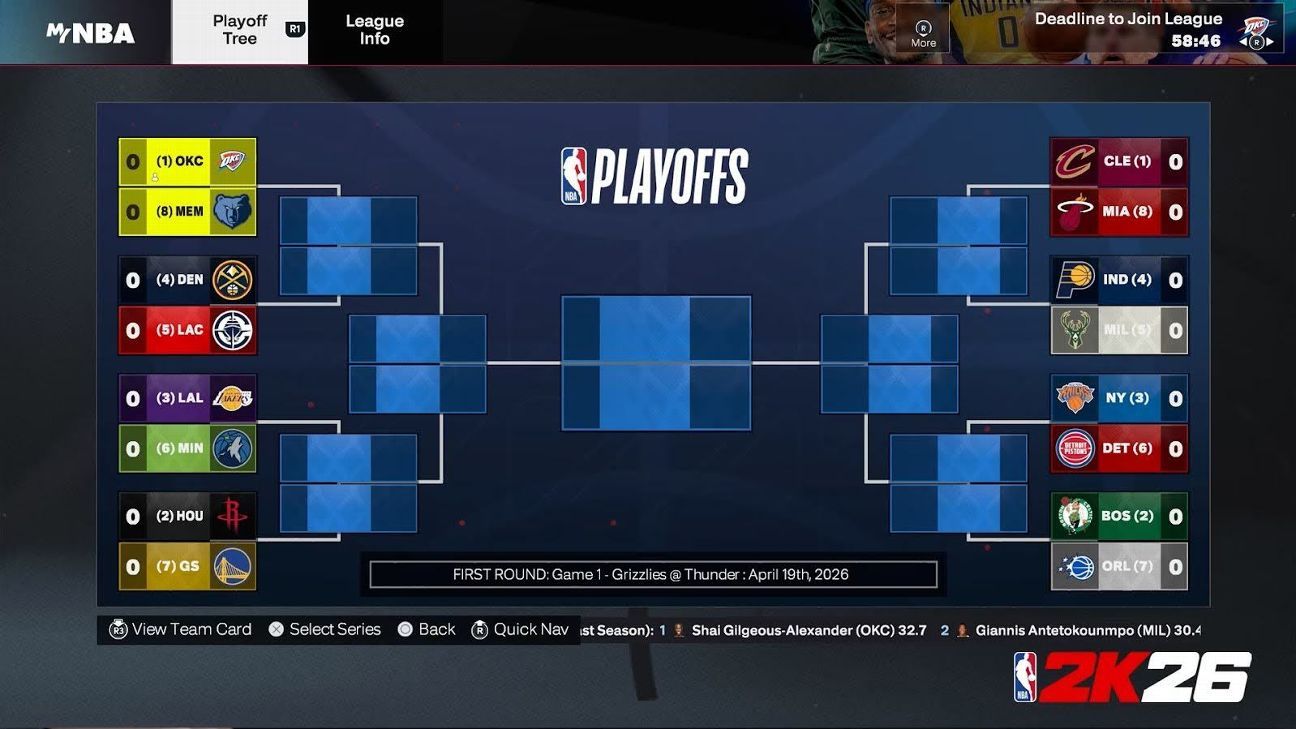

2 K Games Reveals My Nba And My Gm Enhancements For Nba 2 K26

Sep 03, 2025

2 K Games Reveals My Nba And My Gm Enhancements For Nba 2 K26

Sep 03, 2025

Latest Posts

-

Metal Eden Cgi Trailer A First Look At Gameplay

Sep 03, 2025

Metal Eden Cgi Trailer A First Look At Gameplay

Sep 03, 2025 -

Labours Asylum Plan And The Latest Developments At Number 10

Sep 03, 2025

Labours Asylum Plan And The Latest Developments At Number 10

Sep 03, 2025 -

Is Metal Eden Worth Playing A Critical Fps Review

Sep 03, 2025

Is Metal Eden Worth Playing A Critical Fps Review

Sep 03, 2025 -

Humanitarian Crisis Deepens Families And Children Flee Gaza Citys Growing Conflict

Sep 03, 2025

Humanitarian Crisis Deepens Families And Children Flee Gaza Citys Growing Conflict

Sep 03, 2025 -

Playing The 1 3 Billion Powerball In Sc Debit Card Purchases And Lottery Rules

Sep 03, 2025

Playing The 1 3 Billion Powerball In Sc Debit Card Purchases And Lottery Rules

Sep 03, 2025