Keurig Dr Pepper's Massive $18 Billion+ Acquisition And Subsequent Company Division

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Keurig Dr Pepper's $18 Billion+ Acquisition Spree: A Corporate Restructuring Story

Keurig Dr Pepper (KDP), a beverage giant, shocked the industry with its aggressive acquisition strategy, culminating in a massive $18 billion+ spending spree. This unprecedented move, however, wasn't just about growth; it led to a significant company restructuring, dividing its vast portfolio and reshaping the competitive landscape of the beverage industry. This article delves into the details of KDP's acquisitions, the subsequent restructuring, and the implications for the future.

The Acquisitions: A Strategic Juggernaut

KDP's acquisition spree wasn't haphazard. It was a carefully orchestrated plan to expand its market share and diversify its product portfolio. The company targeted key players in various beverage segments, securing control over popular brands and distribution networks. While the exact breakdown of the $18 billion+ figure isn't publicly detailed in a single, easily accessible report across all acquisitions, significant acquisitions included brands that broadened their reach into both the hot and cold beverage markets. This strategic move significantly strengthened their position against major competitors like Coca-Cola and PepsiCo. The acquisitions significantly boosted KDP's brand portfolio, adding both established powerhouses and promising newcomers.

The Restructuring: A Necessary Evolution

The sheer scale of these acquisitions necessitated a significant restructuring within Keurig Dr Pepper. Simply integrating so many diverse brands and operations presented a monumental challenge. This restructuring involved:

- Streamlining Operations: KDP focused on eliminating redundancies, improving efficiencies, and optimizing supply chains across its expanded portfolio. This included consolidating manufacturing facilities and distribution networks.

- Brand Portfolio Management: The massive portfolio required a strategic reassessment of each brand's positioning, target market, and growth potential. Some brands were integrated into existing KDP lines, while others received independent attention and marketing strategies.

- Organizational Realignment: KDP restructured its internal organization to better manage its expanded operations and accommodate the influx of new talent and expertise. This likely involved changes to leadership roles and departmental structures.

Impact on the Beverage Industry

KDP's aggressive acquisition and restructuring strategy has had a profound impact on the competitive landscape of the beverage industry. This includes:

- Increased Market Share: KDP's acquisitions have significantly boosted its market share, putting increased pressure on its competitors.

- Innovation and Product Diversification: The integration of various brands has led to increased innovation and a more diverse product portfolio, offering consumers a wider range of choices.

- Supply Chain Consolidation: KDP's moves have potentially led to consolidation within the beverage supply chain, impacting suppliers and distributors.

Future Outlook: Challenges and Opportunities

While KDP's strategy has been largely successful so far, the company faces ongoing challenges. Successfully integrating such a large number of acquisitions requires careful management, and maintaining efficient operations across a vast and diverse portfolio remains a key concern. However, the company's diversified product portfolio and strengthened market position offer significant opportunities for future growth and profitability. KDP will need to continue innovating and adapting to evolving consumer preferences to maintain its competitive edge.

Conclusion:

Keurig Dr Pepper's $18 billion+ acquisition spree and subsequent restructuring represents a bold and ambitious strategy aimed at reshaping the beverage industry. While the long-term consequences remain to be seen, the company's actions have already significantly altered the competitive landscape and promise exciting developments in the years to come. Further analysis of KDP’s financial reports and industry commentary will provide a clearer picture of the long-term success of this strategic restructuring. Keep an eye on KDP – this is a company to watch.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Keurig Dr Pepper's Massive $18 Billion+ Acquisition And Subsequent Company Division. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Womens Suffrage And The Save Act A Legacy Of Fighting For Voting Rights On Womens Equality Day 2025

Aug 27, 2025

Womens Suffrage And The Save Act A Legacy Of Fighting For Voting Rights On Womens Equality Day 2025

Aug 27, 2025 -

A Journey Through Time The Evolution Of Playful Prints In Fashion

Aug 27, 2025

A Journey Through Time The Evolution Of Playful Prints In Fashion

Aug 27, 2025 -

Ecuador Cartel Victims Hide From Us Investigations

Aug 27, 2025

Ecuador Cartel Victims Hide From Us Investigations

Aug 27, 2025 -

Scotland Faces Water Supply Crisis Amidst Critically Low River Levels

Aug 27, 2025

Scotland Faces Water Supply Crisis Amidst Critically Low River Levels

Aug 27, 2025 -

Mushroom Poisoning Survivors Harrowing Account Of Multiple Murders

Aug 27, 2025

Mushroom Poisoning Survivors Harrowing Account Of Multiple Murders

Aug 27, 2025

Latest Posts

-

Artwork Looted By Nazis 80 Years Ago Rediscovered An Estate Agents Unexpected Find

Aug 28, 2025

Artwork Looted By Nazis 80 Years Ago Rediscovered An Estate Agents Unexpected Find

Aug 28, 2025 -

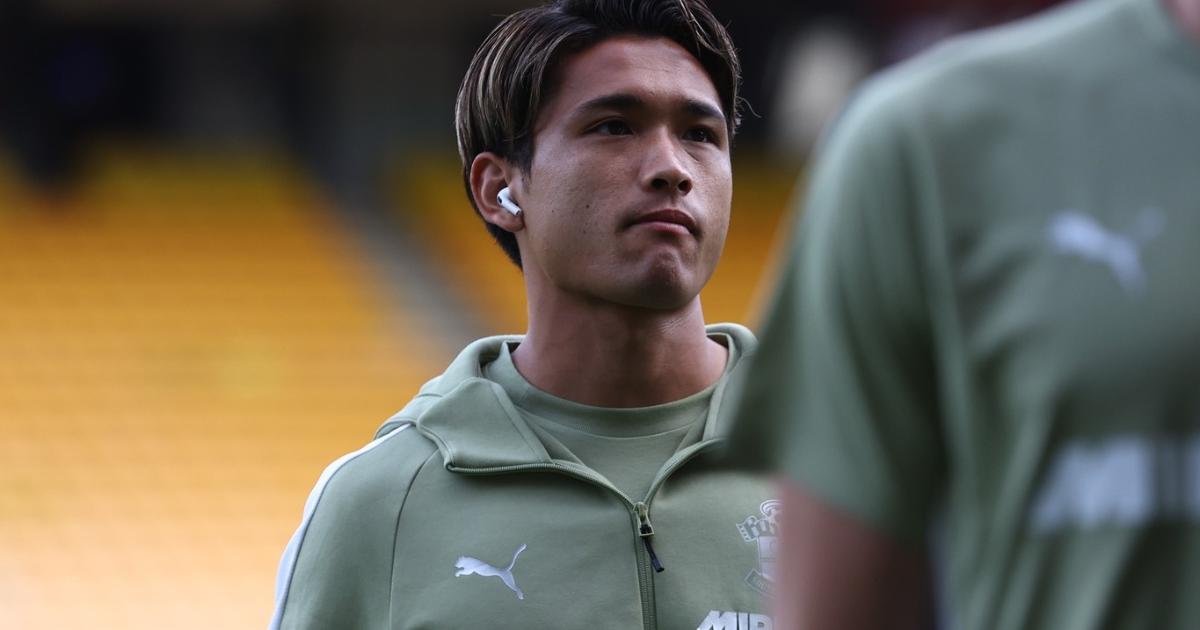

Matsukis Saints Future A Worldie In The Making

Aug 28, 2025

Matsukis Saints Future A Worldie In The Making

Aug 28, 2025 -

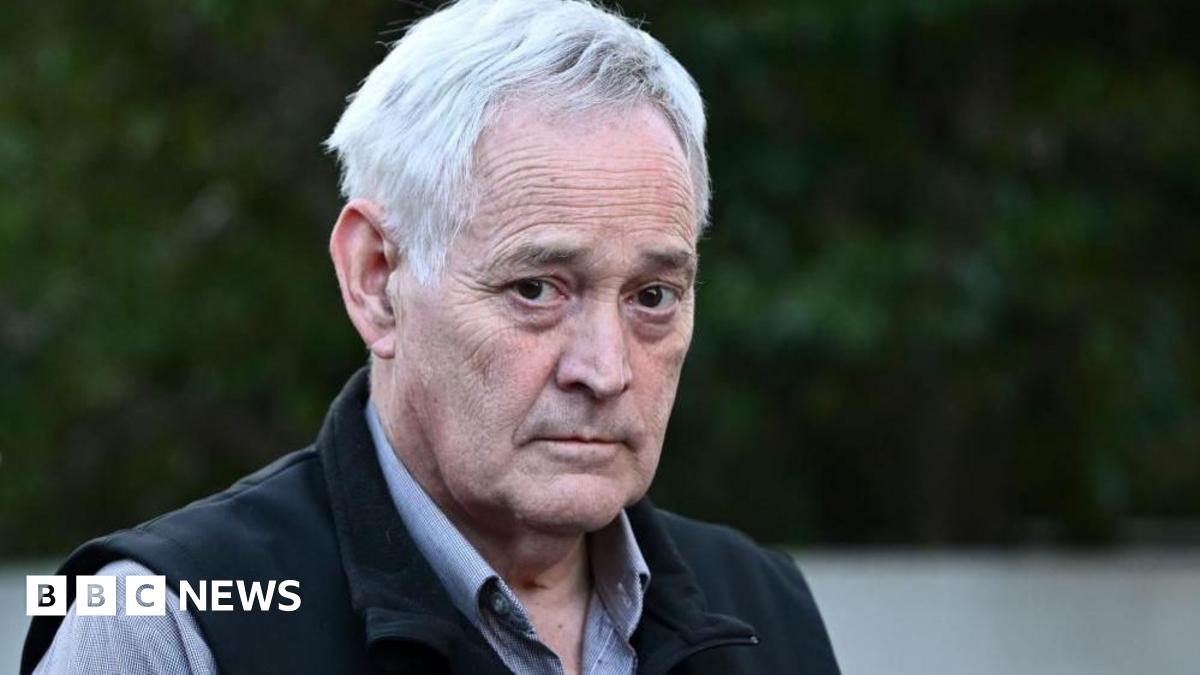

Trial Testimony Actor John Alford Allegedly Abused Girls

Aug 28, 2025

Trial Testimony Actor John Alford Allegedly Abused Girls

Aug 28, 2025 -

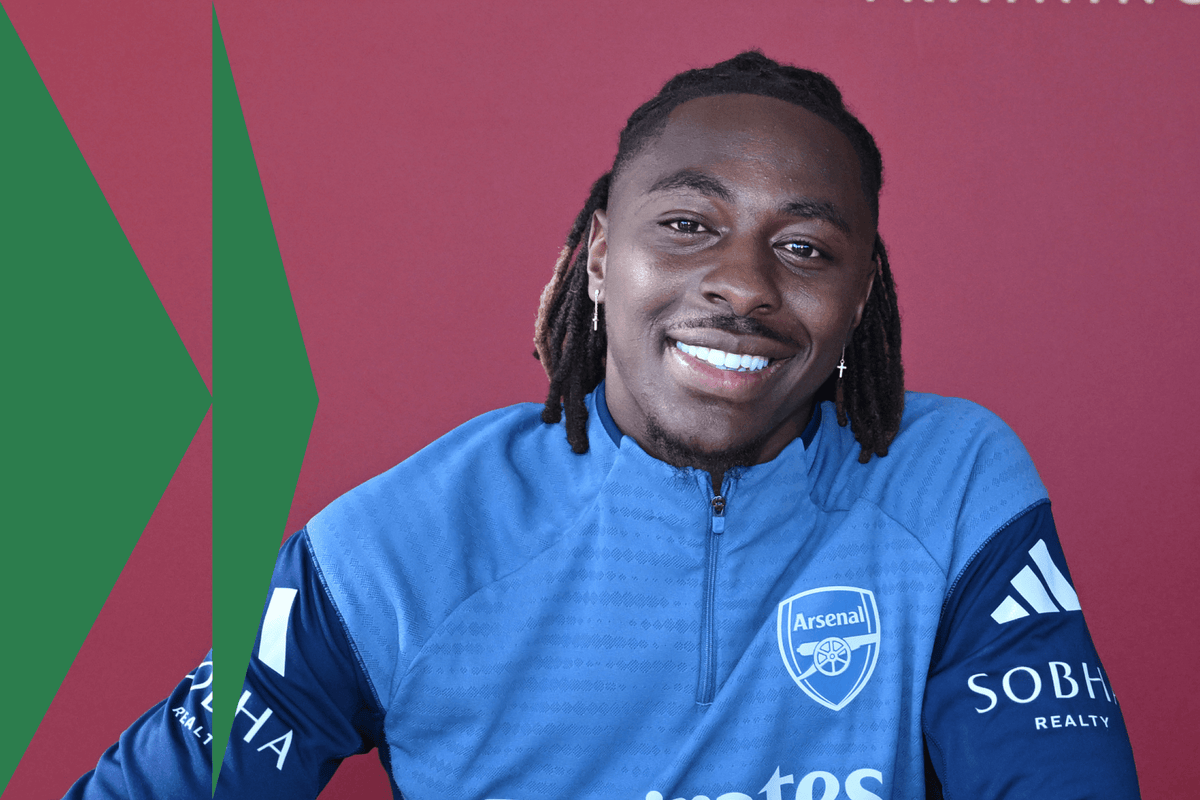

Eberechi Ezes Arsenal Transfer Speculation What We Know

Aug 28, 2025

Eberechi Ezes Arsenal Transfer Speculation What We Know

Aug 28, 2025 -

Southamptons Matsuki Worldie Potential And Future Prospects

Aug 28, 2025

Southamptons Matsuki Worldie Potential And Future Prospects

Aug 28, 2025