Keurig Dr Pepper's Major Restructuring: $18 Billion+ Acquisition And Company Division

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Keurig Dr Pepper Shakes Up the Beverage Industry: $18 Billion+ Acquisition and Major Restructuring Announced

Keurig Dr Pepper (KDP), a major player in the beverage industry, sent shockwaves through the market with its announcement of a significant restructuring plan involving a massive acquisition and internal company division. This bold move, valued at over $18 billion, signals a major shift in KDP's strategy and its ambitions for future growth within the fiercely competitive beverage sector. The changes aim to streamline operations, enhance profitability, and solidify KDP's position as a leading innovator in the ever-evolving world of drinks.

A Multi-Billion Dollar Acquisition: Expanding the Portfolio

The centerpiece of KDP's restructuring is a substantial acquisition (the exact details of which are still emerging and are expected to be revealed in the coming weeks). While the specific target company remains undisclosed at this time, industry analysts speculate it could involve a company specializing in complementary beverage categories, potentially expanding KDP's reach into faster-growing segments like functional beverages, premium waters, or ready-to-drink cocktails. This acquisition underscores KDP's commitment to aggressive growth and diversification beyond its already extensive portfolio of coffee, tea, and carbonated soft drinks. The sheer scale of the investment demonstrates a significant commitment to securing market share and staying ahead of competitors.

Internal Restructuring: Streamlining for Efficiency

Beyond the acquisition, KDP is also undertaking a significant internal restructuring. The company plans to streamline its operations, focusing on improving efficiency and reducing costs. This likely involves consolidating certain departments, optimizing its supply chain, and potentially shedding some less profitable brands or product lines. The goal is to create a leaner, more agile organization capable of responding quickly to changing market demands.

What This Means for Consumers:

The impact of KDP's restructuring on consumers remains to be seen. While some may worry about potential price increases or changes in product availability, the acquisition and internal restructuring could ultimately lead to a wider selection of beverages, innovative new products, and potentially even improved pricing in some areas due to increased efficiency. Only time will tell the full ramifications of these strategic shifts.

Industry Impact and Future Outlook:

This major restructuring has significant implications for the broader beverage industry. KDP's aggressive moves signal a renewed focus on consolidation and growth in the sector. Competitors like Coca-Cola and PepsiCo are likely to respond strategically, potentially accelerating their own acquisitions or internal restructuring initiatives. The coming months will be crucial in assessing the long-term effects of KDP’s ambitious plan on the competitive landscape.

Keywords to watch: Keurig Dr Pepper, KDP, acquisition, restructuring, beverage industry, mergers and acquisitions, company division, corporate strategy, market share, growth strategy, functional beverages, premium waters, ready-to-drink cocktails, supply chain optimization, cost reduction.

Call to Action: Stay tuned for further updates as details of the acquisition and restructuring plan emerge. Follow us for the latest news in the beverage industry. [Link to your beverage industry news section/newsletter signup].

Further Reading:

- [Link to a relevant article about M&A activity in the beverage industry]

- [Link to Keurig Dr Pepper's Investor Relations page]

This article provides valuable information to readers while using SEO best practices to improve search engine rankings. The use of headings, keywords, internal and external links, and a call to action makes it an effective piece of news content. Remember to replace bracketed information with actual links.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Keurig Dr Pepper's Major Restructuring: $18 Billion+ Acquisition And Company Division. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Austin Butlers Caught Stealing Set Experience A Sleepless Night In Underwear

Aug 27, 2025

Austin Butlers Caught Stealing Set Experience A Sleepless Night In Underwear

Aug 27, 2025 -

Butlers Caught Stealing Experience An Underwear Involved Story

Aug 27, 2025

Butlers Caught Stealing Experience An Underwear Involved Story

Aug 27, 2025 -

Fact Checking Karoline Leavitt Assessing The Accuracy Of Her My Own Two Eyes Trump Narrative

Aug 27, 2025

Fact Checking Karoline Leavitt Assessing The Accuracy Of Her My Own Two Eyes Trump Narrative

Aug 27, 2025 -

High Ranking Doj Ethics Advisers Dismissal Sparks Controversy Bondis Role Questioned

Aug 27, 2025

High Ranking Doj Ethics Advisers Dismissal Sparks Controversy Bondis Role Questioned

Aug 27, 2025 -

Actor Austin Butler Discusses On Set Sleeping Arrangements For Caught Stealing

Aug 27, 2025

Actor Austin Butler Discusses On Set Sleeping Arrangements For Caught Stealing

Aug 27, 2025

Latest Posts

-

Artwork Looted By Nazis 80 Years Ago Rediscovered An Estate Agents Unexpected Find

Aug 28, 2025

Artwork Looted By Nazis 80 Years Ago Rediscovered An Estate Agents Unexpected Find

Aug 28, 2025 -

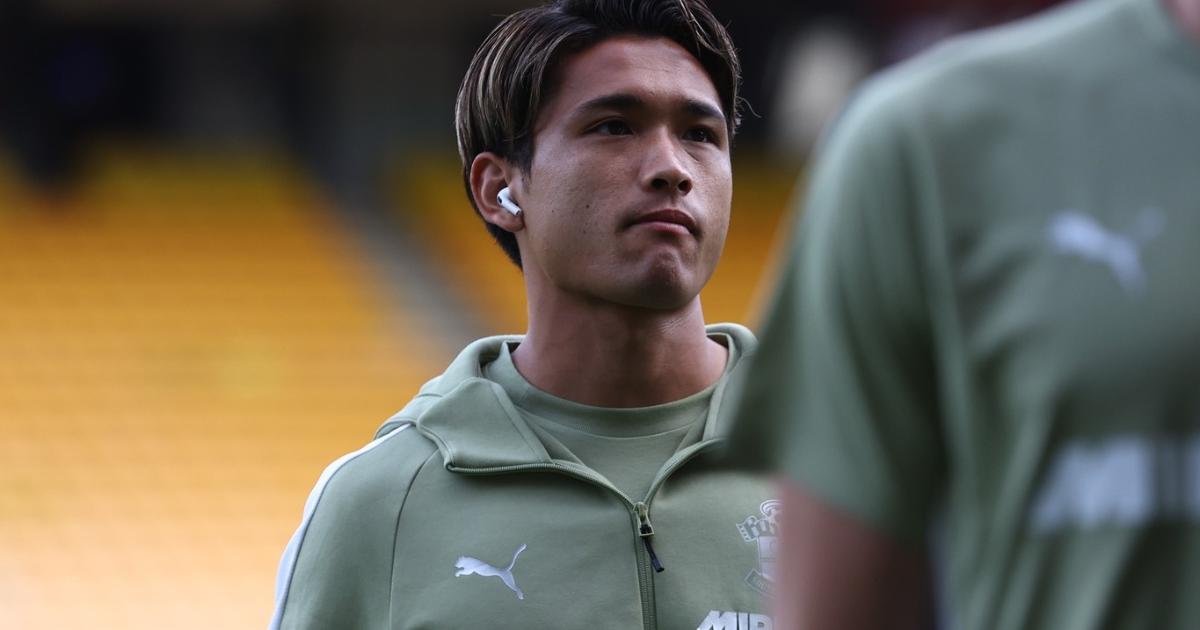

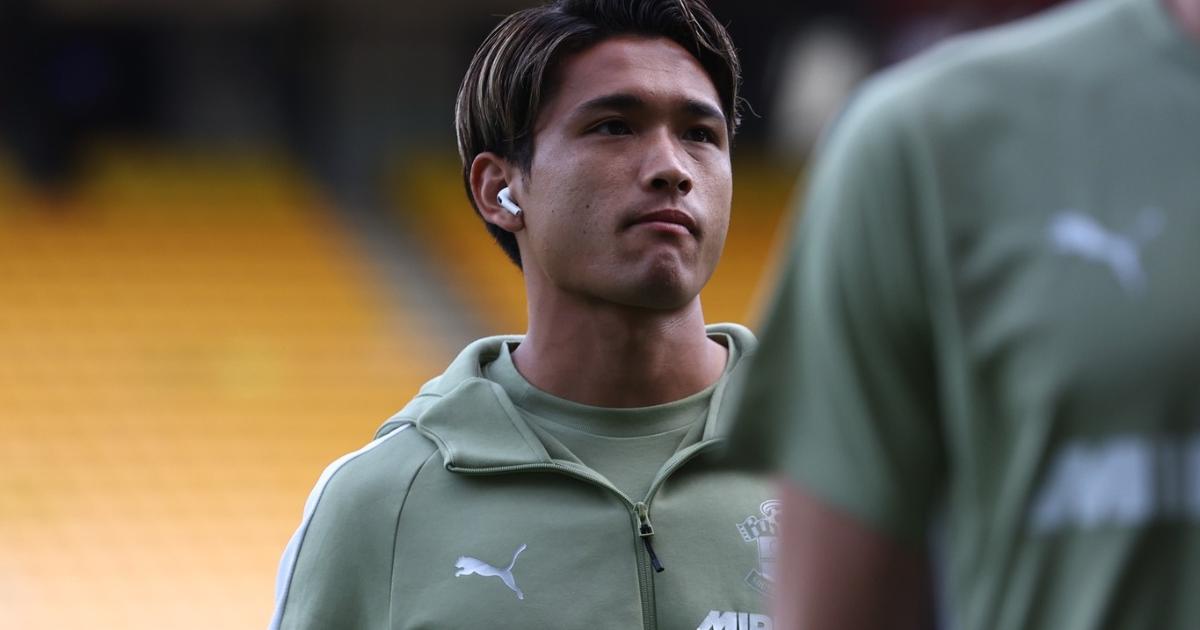

Matsukis Saints Future A Worldie In The Making

Aug 28, 2025

Matsukis Saints Future A Worldie In The Making

Aug 28, 2025 -

Trial Testimony Actor John Alford Allegedly Abused Girls

Aug 28, 2025

Trial Testimony Actor John Alford Allegedly Abused Girls

Aug 28, 2025 -

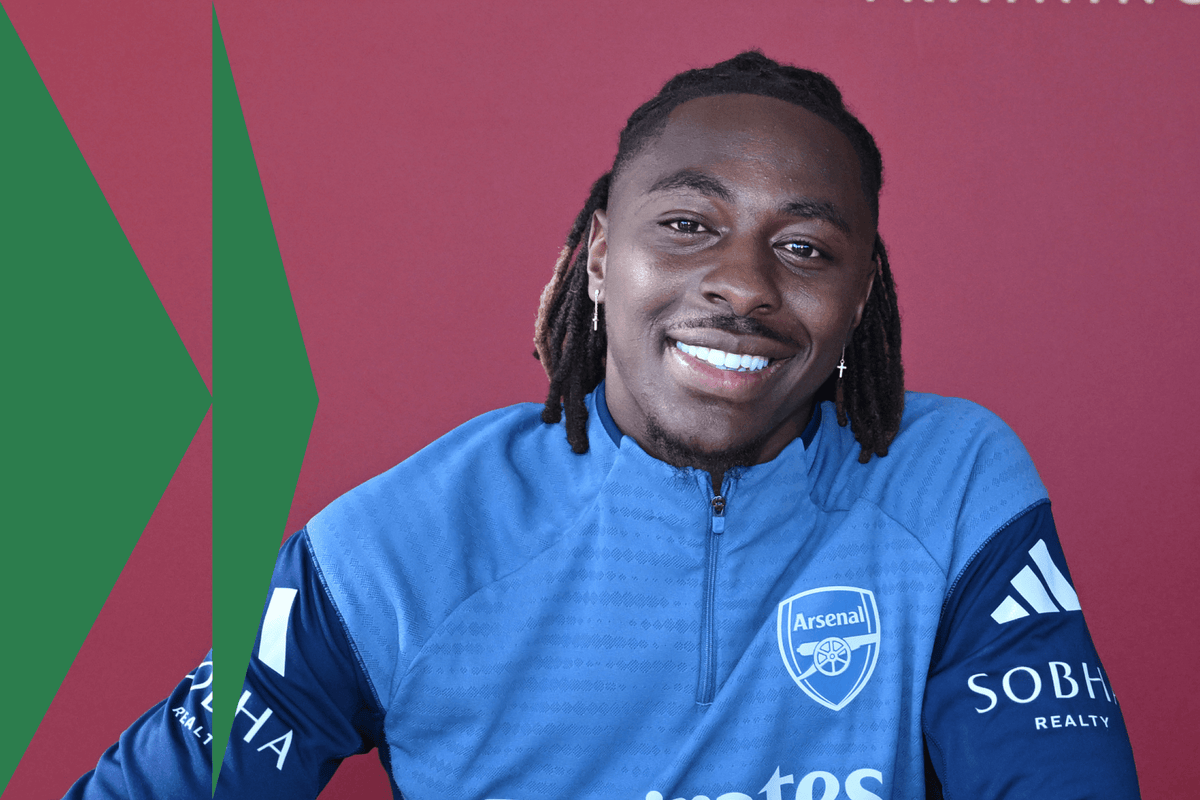

Eberechi Ezes Arsenal Transfer Speculation What We Know

Aug 28, 2025

Eberechi Ezes Arsenal Transfer Speculation What We Know

Aug 28, 2025 -

Southamptons Matsuki Worldie Potential And Future Prospects

Aug 28, 2025

Southamptons Matsuki Worldie Potential And Future Prospects

Aug 28, 2025