June Inflation: U.S. Consumer Prices Rise In Line With Forecasts

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

June Inflation: U.S. Consumer Prices Rise as Predicted, Keeping Fed on Tightrope

Inflation in the United States remained stubbornly persistent in June, rising in line with economists' forecasts and keeping the Federal Reserve's path forward uncertain. The Consumer Price Index (CPI) data, released this morning by the Bureau of Labor Statistics (BLS), showed a modest increase, fueling ongoing debate about the effectiveness of the central bank's aggressive interest rate hikes.

The headline CPI increased by 0.2% in June, following a 0.1% rise in May. This translates to a 3% year-over-year increase, slightly lower than the 4% increase seen in the previous year but still significantly above the Federal Reserve's 2% target. This persistent inflation, despite recent interest rate increases, continues to challenge policymakers.

Core Inflation Remains a Concern

While the headline CPI offers a broad view of inflation, the core CPI – which excludes volatile food and energy prices – provides a clearer picture of underlying inflationary pressures. The core CPI also rose by 0.2% in June, marking a 4.8% year-over-year increase. This relatively high core inflation indicates that underlying price pressures remain strong and are not easily quelled by interest rate hikes.

What this means for consumers: The sustained inflation means that the cost of everyday goods and services continues to rise. While the rate of increase has slowed compared to previous months, consumers are still feeling the pinch, particularly when it comes to groceries and housing costs. Experts predict continued upward pressure on prices in certain sectors.

The Fed's Response: A Tightrope Walk

The latest inflation figures place the Federal Reserve in a difficult position. While the slight slowdown in the headline CPI might suggest that their aggressive interest rate hikes are having some effect, the persistent core inflation suggests that more action may be needed. The Fed is walking a tightrope, attempting to cool inflation without triggering a recession. The central bank’s next move, expected in late July, will be closely watched by investors and consumers alike.

Possible scenarios include:

- Another interest rate hike: If the Fed believes inflation remains a significant threat, another rate increase is likely. This could further dampen economic growth and potentially increase unemployment.

- A pause in rate hikes: If the data suggests inflation is nearing the Fed’s target, a pause would allow the central bank to assess the impact of previous rate hikes.

- A combination of approaches: The Fed could opt for a smaller rate hike or adjust other monetary policy tools to fine-tune its approach.

Looking Ahead: Uncertainty Remains

The future trajectory of inflation remains uncertain. Geopolitical factors, supply chain disruptions, and energy prices continue to play a significant role. While the June CPI data offered a slight reprieve, experts warn against complacency. The Federal Reserve will need to carefully monitor upcoming economic indicators to determine its next course of action and maintain price stability.

For further information on inflation and the Federal Reserve's policies, you can consult resources like:

This situation continues to unfold. Stay informed by regularly checking reputable news sources for updates on inflation and economic developments.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on June Inflation: U.S. Consumer Prices Rise In Line With Forecasts. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

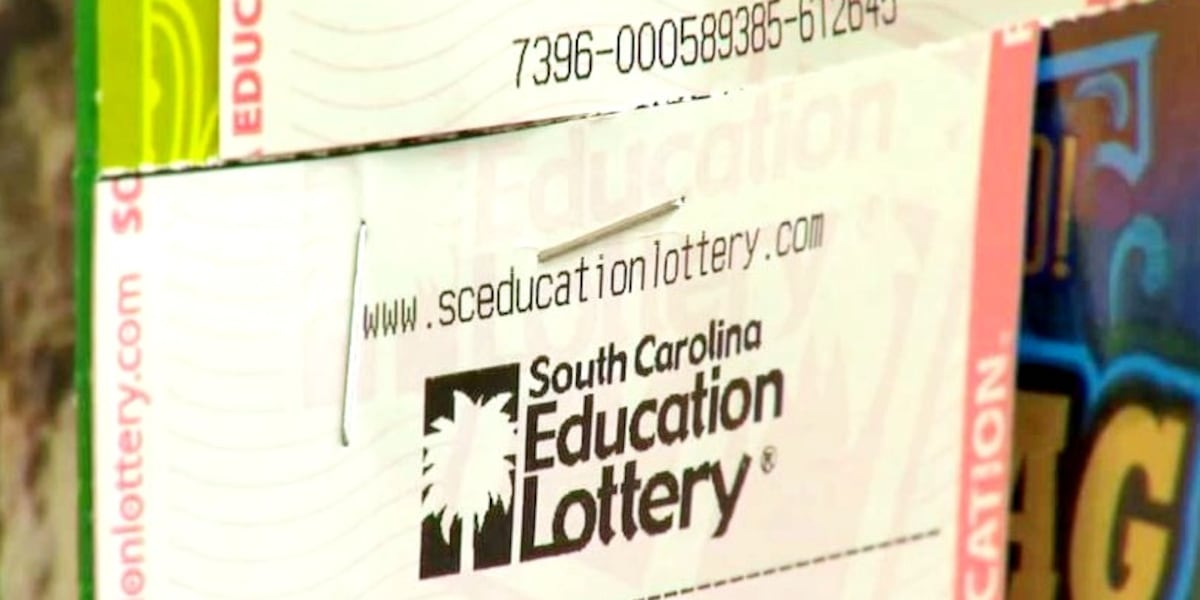

She Won The Lottery Twice Virginia Resident Claims Second 1 Million Prize

Aug 21, 2025

She Won The Lottery Twice Virginia Resident Claims Second 1 Million Prize

Aug 21, 2025 -

Winning Lottery Ticket Sold In Darlington A 200 K Jackpot

Aug 21, 2025

Winning Lottery Ticket Sold In Darlington A 200 K Jackpot

Aug 21, 2025 -

Woman Fights For Compensation Following In Flight Sexual Assault

Aug 21, 2025

Woman Fights For Compensation Following In Flight Sexual Assault

Aug 21, 2025 -

Chelsea Clintons Powerful Image A Measured Response To Trumps Disruption

Aug 21, 2025

Chelsea Clintons Powerful Image A Measured Response To Trumps Disruption

Aug 21, 2025 -

Darlington Resident Claims 200 000 Lottery Jackpot Have You Checked Your Ticket

Aug 21, 2025

Darlington Resident Claims 200 000 Lottery Jackpot Have You Checked Your Ticket

Aug 21, 2025

Latest Posts

-

Big Lottery Win For Gloucester Woman Scratcher Ticket Pays Off

Aug 21, 2025

Big Lottery Win For Gloucester Woman Scratcher Ticket Pays Off

Aug 21, 2025 -

87 Year Old Country Music Stars Show Cancelled Following Accident

Aug 21, 2025

87 Year Old Country Music Stars Show Cancelled Following Accident

Aug 21, 2025 -

From 20s Jackpot To 1 Million Scratch Off One Womans Incredible Lottery Journey

Aug 21, 2025

From 20s Jackpot To 1 Million Scratch Off One Womans Incredible Lottery Journey

Aug 21, 2025 -

Councils Explore Legal Options Against Asylum Hotel Use

Aug 21, 2025

Councils Explore Legal Options Against Asylum Hotel Use

Aug 21, 2025 -

Gloucester Womans Lucky Day 1 Million Lottery Win

Aug 21, 2025

Gloucester Womans Lucky Day 1 Million Lottery Win

Aug 21, 2025