June CPI Report Confirms Projected Rise In U.S. Consumer Prices

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

June CPI Report Confirms Projected Rise in U.S. Consumer Prices: Inflation Remains a Concern

The June Consumer Price Index (CPI) report, released today by the Bureau of Labor Statistics (BLS), confirmed economists' projections of a continued rise in U.S. consumer prices. While the increase wasn't as dramatic as some feared, the persistent inflation continues to pose a significant challenge to the Federal Reserve and the overall U.S. economy. The report underscores the ongoing struggle to balance economic growth with price stability.

Headline Inflation Remains Elevated

The headline CPI, which measures the overall change in consumer prices, rose by 0.2% in June, following a 0.1% increase in May. This translates to a year-over-year increase of 3%, slightly lower than the 4% increase reported in May, but still significantly above the Federal Reserve's 2% target. This persistent, albeit moderating, inflation continues to impact household budgets and purchasing power across the nation.

Core Inflation Shows Stubborn Resistance

More concerning to policymakers is the core CPI, which excludes volatile food and energy prices. The core CPI increased by 0.2% in June, representing a year-over-year increase of 4.8%. This stubborn persistence of core inflation suggests that underlying price pressures remain strong and are not simply driven by temporary fluctuations in energy costs. This is a key indicator that the Federal Reserve will need to carefully consider in its future monetary policy decisions.

What Drove the Increase?

Several factors contributed to the June CPI increase. Shelter costs continued to be a significant driver, reflecting the ongoing tightness in the housing market. Used car prices also saw a slight uptick, reversing a recent downward trend. While energy prices saw a slight decrease, the impact was offset by increases in other areas. The report highlights the complexity of inflation and the interconnectedness of various economic sectors.

The Fed's Response and Future Outlook

The Federal Reserve has been aggressively raising interest rates to combat inflation. This latest CPI report will likely influence their decision at the next Federal Open Market Committee (FOMC) meeting. While the moderation in headline inflation might suggest a pause in rate hikes, the persistent core inflation could lead them to continue their tightening monetary policy. The future path of inflation remains uncertain, depending on factors like global economic conditions, energy prices, and wage growth. Analysts remain divided on whether the Fed's actions will successfully bring inflation down to its target without triggering a significant economic downturn.

Understanding the Implications:

- Impact on Consumers: Persistent inflation erodes purchasing power, forcing consumers to make difficult choices about spending and saving. This can lead to reduced consumer confidence and potentially slower economic growth.

- Impact on Businesses: Businesses face increased costs for raw materials and labor, potentially leading to higher prices for goods and services, creating a self-reinforcing cycle.

- Impact on the Federal Reserve: The Fed faces the challenging task of balancing the need to control inflation with the risk of triggering a recession. Finding the right monetary policy response will be crucial in the coming months.

Conclusion:

The June CPI report paints a mixed picture. While the headline inflation number showed some moderation, the persistent core inflation remains a significant concern. The Federal Reserve will continue to monitor economic data closely as they navigate the delicate balance between fighting inflation and maintaining economic stability. The coming months will be crucial in determining the trajectory of inflation and the effectiveness of the Fed's monetary policy. Stay informed and consult with financial professionals for personalized advice.

Keywords: June CPI, CPI report, inflation, consumer prices, U.S. economy, Federal Reserve, monetary policy, core inflation, headline inflation, economic growth, interest rates, FOMC, BLS, Bureau of Labor Statistics.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on June CPI Report Confirms Projected Rise In U.S. Consumer Prices. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Noel Clarke Loses Libel Case Judge Rules In Favour Of The Guardian

Aug 24, 2025

Noel Clarke Loses Libel Case Judge Rules In Favour Of The Guardian

Aug 24, 2025 -

Cfp Champion Prediction The Case For Penn State

Aug 24, 2025

Cfp Champion Prediction The Case For Penn State

Aug 24, 2025 -

Targets Online Shopping Strategy Lessons Learned From The Walmart Competition

Aug 24, 2025

Targets Online Shopping Strategy Lessons Learned From The Walmart Competition

Aug 24, 2025 -

Rhs Students Academic Success A Look At Recent Honors Recipients

Aug 24, 2025

Rhs Students Academic Success A Look At Recent Honors Recipients

Aug 24, 2025 -

Intuit Stock Takes A Hit Subpar Mail Chimp And Turbo Tax Results Fuel Investor Concerns

Aug 24, 2025

Intuit Stock Takes A Hit Subpar Mail Chimp And Turbo Tax Results Fuel Investor Concerns

Aug 24, 2025

Latest Posts

-

Lotto Texas And Powerball Winning Numbers Texas Lottery August 18 2025

Aug 25, 2025

Lotto Texas And Powerball Winning Numbers Texas Lottery August 18 2025

Aug 25, 2025 -

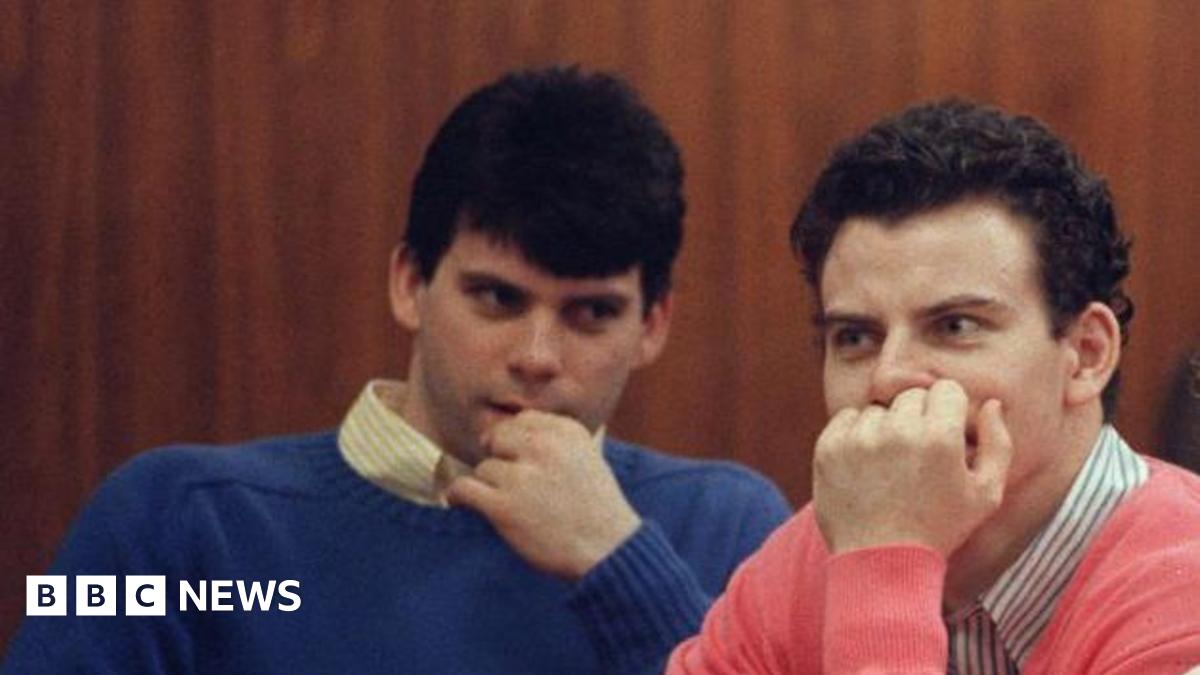

Menendez Brothers A Comprehensive Look At Their Crimes And Imprisonment

Aug 25, 2025

Menendez Brothers A Comprehensive Look At Their Crimes And Imprisonment

Aug 25, 2025 -

Parents Anxiety Mounts As Septa Cuts Disrupt Kids School Travel

Aug 25, 2025

Parents Anxiety Mounts As Septa Cuts Disrupt Kids School Travel

Aug 25, 2025 -

Chappell Roans Fairytale Set A Highlight Of Reading Festival

Aug 25, 2025

Chappell Roans Fairytale Set A Highlight Of Reading Festival

Aug 25, 2025 -

Chargers 53 Man Roster Projection Preseason Impact Of Najee Harris And The Rb Room

Aug 25, 2025

Chargers 53 Man Roster Projection Preseason Impact Of Najee Harris And The Rb Room

Aug 25, 2025