June CPI Report Confirms Expected Rise In U.S. Consumer Prices

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

June CPI Report Confirms Expected Rise in U.S. Consumer Prices: Inflation Remains a Concern

The June Consumer Price Index (CPI) report, released today, confirmed economists' predictions of a continued rise in U.S. consumer prices. While the increase wasn't as dramatic as some feared, it further solidifies concerns about persistent inflation and its impact on the American economy. The report underscores the ongoing challenges faced by the Federal Reserve as it navigates a delicate balancing act between controlling inflation and avoiding a recession.

Key Findings from the June CPI Report:

The headline CPI increased by 0.2% in June, following a 0.1% rise in May. This marks a slight deceleration compared to previous months but still represents a persistent upward trend. The year-over-year increase stands at 3%, down from 4% in May, but still significantly above the Federal Reserve's 2% target.

-

Core CPI: Excluding volatile food and energy prices, the core CPI rose by 0.2% for the month and 4.8% year-over-year. This persistence in core inflation suggests underlying price pressures remain strong.

-

Food Prices: Food prices continued their upward trajectory, contributing significantly to the overall inflation figure. Rising grocery costs continue to strain household budgets across the country.

-

Energy Prices: Energy prices, while fluctuating, remain a factor influencing the overall CPI. The impact of global energy markets continues to ripple through the U.S. economy.

What the Report Means for the Federal Reserve:

The June CPI report provides further evidence that the Federal Reserve's efforts to combat inflation, including interest rate hikes, are having a gradual impact. However, the persistence of core inflation suggests the fight is far from over. Economists are now closely watching for signs of further deceleration in inflation before the Fed potentially pauses its rate-hiking cycle. The possibility of another rate hike at the upcoming Federal Open Market Committee (FOMC) meeting remains a strong possibility, depending on the upcoming economic data.

Impact on Consumers and the Economy:

The ongoing inflationary pressures continue to impact consumers, particularly lower-income households. Rising prices for essential goods and services are squeezing household budgets and limiting consumer spending. This could potentially lead to a slowdown in economic growth, adding complexity to the economic outlook. Businesses are also grappling with higher input costs, impacting profit margins and potentially leading to job losses.

Looking Ahead:

The coming months will be crucial in assessing the effectiveness of the Federal Reserve's monetary policy. Further economic data, including employment reports and future CPI releases, will provide valuable insights into the trajectory of inflation. Market analysts will closely scrutinize these reports to gauge the likelihood of further interest rate hikes and their potential impact on the overall economy. Understanding inflation's effect on investment strategies is also a key concern for many financial professionals. [Link to relevant financial news source]

Related Terms: Inflation, CPI, Consumer Price Index, Federal Reserve, Interest Rates, Monetary Policy, Economic Growth, Recession, FOMC, Household Budgets, Core CPI.

Call to Action: Stay informed about the latest economic developments by subscribing to our newsletter for regular updates on inflation and other key economic indicators. [Link to newsletter signup]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on June CPI Report Confirms Expected Rise In U.S. Consumer Prices. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Otas 8th Grand Slam Two Run Game Within Reach

Aug 17, 2025

Otas 8th Grand Slam Two Run Game Within Reach

Aug 17, 2025 -

The 27th Television Academy Hall Of Fame Celebrating Excellence Through Portraits

Aug 17, 2025

The 27th Television Academy Hall Of Fame Celebrating Excellence Through Portraits

Aug 17, 2025 -

Global Prayers For Peace Amidst Ukraine Crisis

Aug 17, 2025

Global Prayers For Peace Amidst Ukraine Crisis

Aug 17, 2025 -

Exploring The New Lo L Champion Zaahen

Aug 17, 2025

Exploring The New Lo L Champion Zaahen

Aug 17, 2025 -

World Of Outlaws 2024 Donny Schatzs Confirmed Race Schedule

Aug 17, 2025

World Of Outlaws 2024 Donny Schatzs Confirmed Race Schedule

Aug 17, 2025

Latest Posts

-

Dev The Future Of Bot And Booster Mitigation In 2025

Aug 17, 2025

Dev The Future Of Bot And Booster Mitigation In 2025

Aug 17, 2025 -

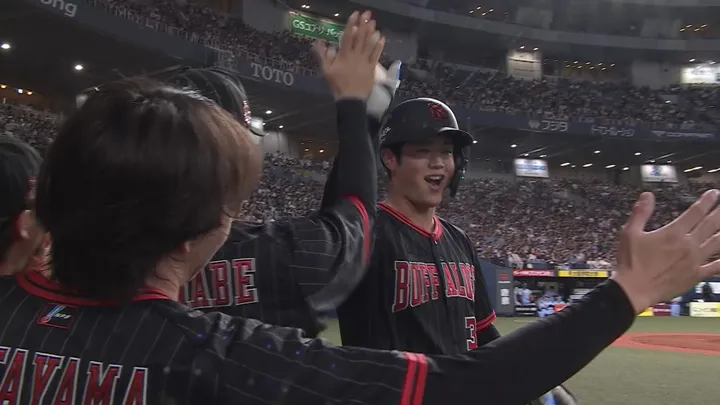

Orixs Keita Nakagawa Two Run Homer Extends Buffaloes Lead

Aug 17, 2025

Orixs Keita Nakagawa Two Run Homer Extends Buffaloes Lead

Aug 17, 2025 -

Topshops High Street Return Challenges And Opportunities

Aug 17, 2025

Topshops High Street Return Challenges And Opportunities

Aug 17, 2025 -

Denmark Train Accident Tanker Collision Causes Derailment One Death

Aug 17, 2025

Denmark Train Accident Tanker Collision Causes Derailment One Death

Aug 17, 2025 -

Game Tying Blast Nakagawas Ninth Homer Leads Orix Buffaloes

Aug 17, 2025

Game Tying Blast Nakagawas Ninth Homer Leads Orix Buffaloes

Aug 17, 2025