June CPI Data Released: U.S. Inflation Remains Elevated

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

June CPI Data Released: U.S. Inflation Remains Elevated, Sparking Concerns

Headline: June CPI Data Released: U.S. Inflation Remains Elevated, Sparking Concerns

Meta Description: The June Consumer Price Index (CPI) data is in, and inflation remains stubbornly high. Learn about the key takeaways, market reactions, and what this means for the future of the U.S. economy.

The June Consumer Price Index (CPI) data, released earlier this week, showed that inflation in the United States remains stubbornly elevated, fueling concerns about the Federal Reserve's ongoing fight against rising prices. While the headline inflation number showed a slight slowdown compared to previous months, the underlying data revealed a persistent upward pressure on prices, leaving economists and investors grappling with the implications for the economy.

Key Takeaways from the June CPI Report:

-

Headline Inflation Slows, but Remains High: The overall CPI increased by 3% year-over-year in June, down slightly from May's 4% increase. However, this figure still significantly exceeds the Federal Reserve's 2% target inflation rate. This slowing rate offers a glimmer of hope, but the battle is far from over.

-

Core Inflation Persists: Core inflation, which excludes volatile food and energy prices, rose by 0.2% for the month and 4.8% year-over-year. This persistent increase in core inflation indicates that price pressures are entrenched across a broad range of goods and services. This is a particularly worrying sign for the Fed.

-

Shelter Costs Remain a Major Driver: Shelter costs continue to be a significant contributor to inflation, reflecting rising rents and home prices. This sector's persistent strength suggests that inflation may prove more difficult to tame than initially anticipated.

-

Food Prices Show Some Moderation: While still elevated, food prices showed a slight decrease in June compared to the previous month. This offers some small relief, but the overall cost of food remains a significant burden for many households.

Market Reactions and Economic Implications:

The release of the June CPI data sent ripples through financial markets. Stock prices experienced a mixed reaction, with some sectors outperforming others depending on their sensitivity to interest rate changes. The bond market also reacted, with yields moving slightly higher as investors considered the implications for future interest rate hikes by the Federal Reserve.

The persistent inflation poses a significant challenge for the Federal Reserve. While the recent slowdown in headline inflation is encouraging, the stubbornly high core inflation rate suggests that further interest rate hikes may be necessary to cool down the economy and bring inflation back to the target level. This could potentially lead to a slowdown in economic growth or even a recession, prompting careful consideration by policymakers.

Looking Ahead:

The upcoming months will be crucial in determining the trajectory of inflation. Economists will be closely monitoring future CPI reports, as well as other economic indicators, to assess the effectiveness of the Federal Reserve's monetary policy. The continued strength of the labor market and robust consumer spending remain key factors that could influence future inflation trends.

What this means for you: The continued high inflation means that consumers are likely to continue feeling the pinch at the grocery store and when paying for rent or mortgages. It's important to budget carefully and explore ways to save money where possible.

Further Reading:

Call to Action: Stay informed about economic developments by regularly checking reputable news sources and government websites. Understanding inflation's impact on your finances can help you make informed decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on June CPI Data Released: U.S. Inflation Remains Elevated. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Will Rain End New Hampshires Drought Watch The Video Forecast

Sep 06, 2025

Will Rain End New Hampshires Drought Watch The Video Forecast

Sep 06, 2025 -

Former Top Doj Ethics Adviser Alleges Retaliation After Firing By Pam Bondi

Sep 06, 2025

Former Top Doj Ethics Adviser Alleges Retaliation After Firing By Pam Bondi

Sep 06, 2025 -

Inside David Bowies Final Work A London Musical Unveiled

Sep 06, 2025

Inside David Bowies Final Work A London Musical Unveiled

Sep 06, 2025 -

Strong Storms Possible In Kentucky Tonight Weather Alert Issued

Sep 06, 2025

Strong Storms Possible In Kentucky Tonight Weather Alert Issued

Sep 06, 2025 -

Trumps Possession Of Gold Fifa Trophy A Replica For The Winning Team

Sep 06, 2025

Trumps Possession Of Gold Fifa Trophy A Replica For The Winning Team

Sep 06, 2025

Latest Posts

-

Sri Lanka Tour Of Zimbabwe 2025 2nd T20 I Live Stream Teams And Match Details

Sep 06, 2025

Sri Lanka Tour Of Zimbabwe 2025 2nd T20 I Live Stream Teams And Match Details

Sep 06, 2025 -

Bringing Up Bates Family Speaks Out On Erins Postpartum Health Crisis

Sep 06, 2025

Bringing Up Bates Family Speaks Out On Erins Postpartum Health Crisis

Sep 06, 2025 -

Fashion World Pays Respects A Farewell To Giorgio Armani

Sep 06, 2025

Fashion World Pays Respects A Farewell To Giorgio Armani

Sep 06, 2025 -

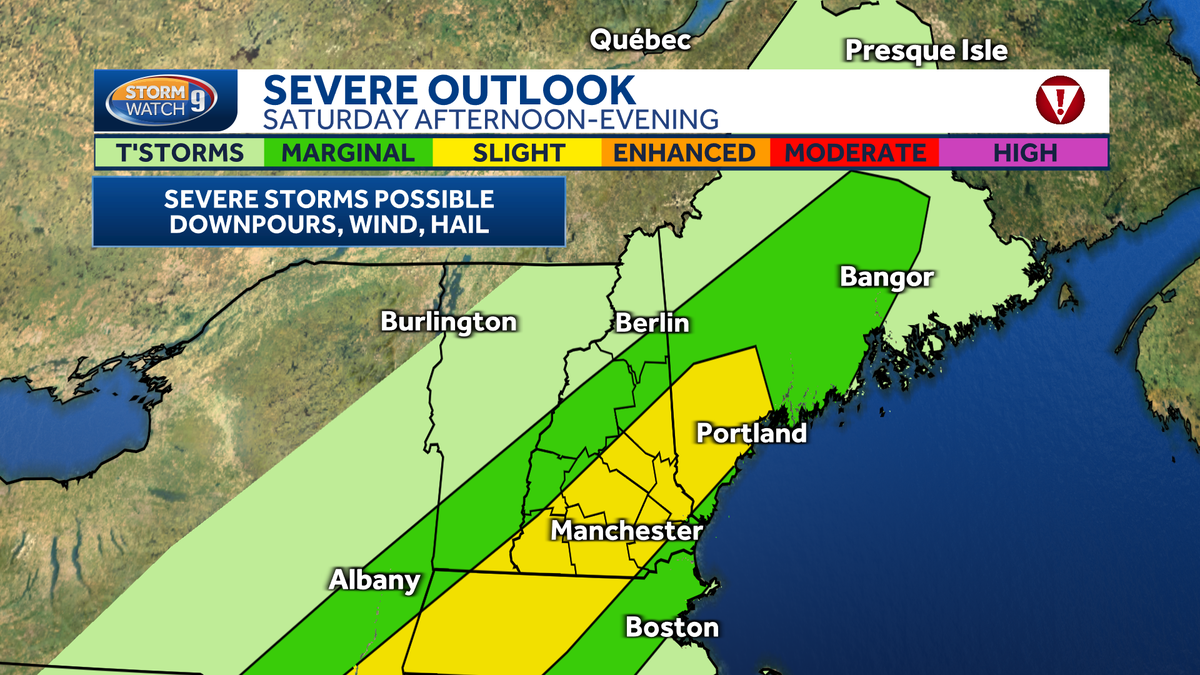

New Hampshire Weather Strong Thunderstorm Risk Saturday

Sep 06, 2025

New Hampshire Weather Strong Thunderstorm Risk Saturday

Sep 06, 2025 -

Maestro Of Fashion The Industry Mourns Giorgio Armani

Sep 06, 2025

Maestro Of Fashion The Industry Mourns Giorgio Armani

Sep 06, 2025