Is Lucid Stock (LCID) A Buy? Stifel Says No, Cuts Price Target

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Is Lucid Stock (LCID) a Buy? Stifel's Downgrade Sends Ripples Through the EV Market

Lucid Group (LCID) stock took a hit recently after investment firm Stifel Nicolaus downgraded its rating and slashed its price target. This move has reignited the debate among investors: is Lucid stock a buy, or should you steer clear? Let's delve into the details and explore the factors influencing this significant shift in market sentiment.

Stifel's Rationale: A Cautious Outlook for Lucid

Stifel's decision to downgrade Lucid wasn't arbitrary. Analysts cited several key concerns, including slower-than-anticipated production ramp-up and increased competition within the burgeoning electric vehicle (EV) market. The firm lowered its price target from $11 to a mere $8, reflecting a significantly more pessimistic outlook for the company's near-term prospects. This underscores the challenges Lucid faces in scaling its operations and establishing a strong foothold against established EV giants like Tesla and rising newcomers.

Production Hurdles and the Impact on LCID Stock

One of the major factors contributing to Stifel's bearish stance is Lucid's production challenges. While the company has showcased impressive technology and a luxurious product line, translating that into consistent, high-volume production has proven more difficult than anticipated. Meeting production targets is crucial for any automaker, and Lucid's struggles in this area are directly impacting investor confidence and the LCID stock price. This isn't unique to Lucid; many EV startups face similar scaling issues.

Intense Competition in the EV Landscape

The electric vehicle market is rapidly evolving and becoming increasingly competitive. Established players are aggressively expanding their product lines and investing heavily in research and development. Startups are also emerging, adding to the pressure on companies like Lucid. This fierce competition necessitates a robust production capacity and a compelling marketing strategy to capture market share – areas where Lucid is currently facing challenges, according to Stifel's assessment.

Should You Buy Lucid Stock (LCID)? A Balanced Perspective

While Stifel's downgrade presents a bearish outlook, it's crucial to consider the bigger picture. Lucid's technology is undeniably impressive, and the demand for luxury EVs remains strong. The company’s long-term potential still holds appeal for some investors. However, the immediate challenges concerning production and competition are significant and cannot be ignored.

Before making any investment decisions, it's vital to conduct thorough due diligence. Consider the following:

- Analyze the financial reports: Scrutinize Lucid's financial statements to understand its financial health and growth trajectory.

- Assess the competitive landscape: Evaluate the competitive threats and Lucid's strategic response.

- Consider your risk tolerance: Investing in LCID involves considerable risk, given the company's stage of development and market volatility.

Beyond Stifel: Diversifying Your Research

It's essential to avoid basing investment decisions solely on one analyst's opinion. Consult multiple financial news sources and analyst reports to get a more comprehensive and balanced perspective. Websites like and provide a wealth of information on LCID and the broader EV market.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Investing in the stock market involves significant risk, and you could lose money.

In Conclusion: The recent downgrade from Stifel raises legitimate concerns about Lucid's short-term prospects. However, the long-term potential of the company remains a subject of debate. Thorough research and a careful assessment of your own risk tolerance are crucial before making any investment decisions regarding Lucid stock (LCID).

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Is Lucid Stock (LCID) A Buy? Stifel Says No, Cuts Price Target. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Record Breaking Powerball Find Out When The Next Drawing Is

Sep 03, 2025

Record Breaking Powerball Find Out When The Next Drawing Is

Sep 03, 2025 -

New Public Art Huge Light Ball Illuminates Liverpool One

Sep 03, 2025

New Public Art Huge Light Ball Illuminates Liverpool One

Sep 03, 2025 -

No More Peak Fares Scot Rails Permanent Fare Restructuring

Sep 03, 2025

No More Peak Fares Scot Rails Permanent Fare Restructuring

Sep 03, 2025 -

Shock Jock Howard Sterns Radio Return In Jeopardy After Family Tragedy

Sep 03, 2025

Shock Jock Howard Sterns Radio Return In Jeopardy After Family Tragedy

Sep 03, 2025 -

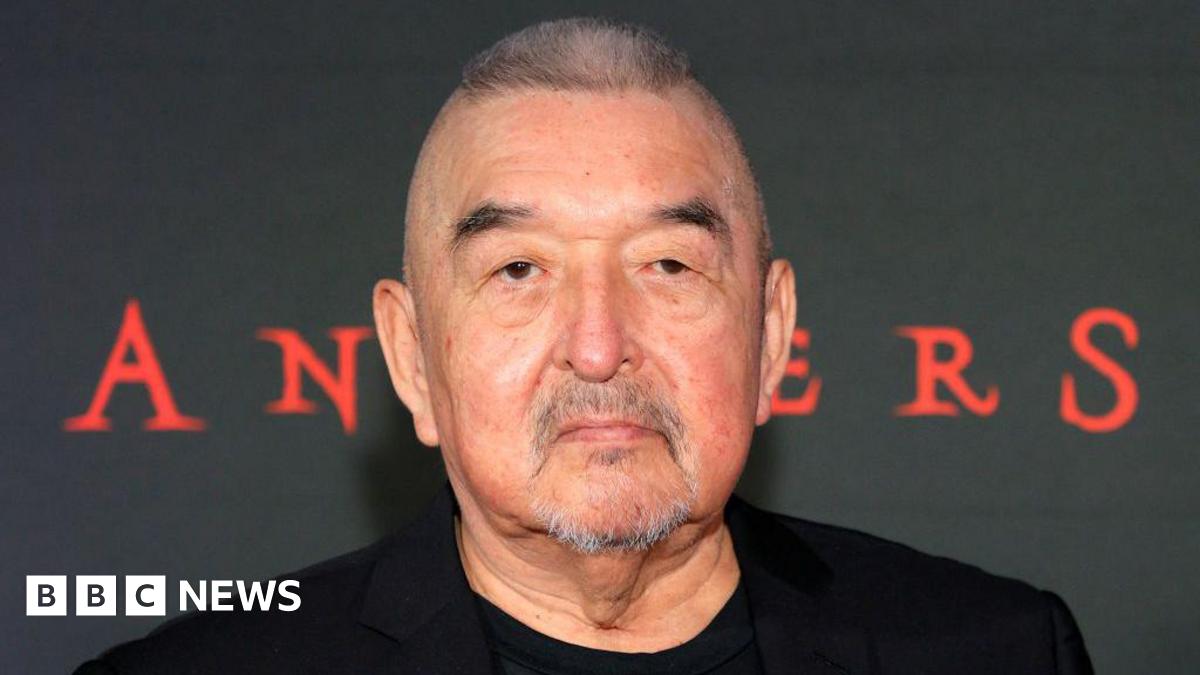

Actor Graham Greene Dead At 73 Remembering His Iconic Role In Dances With Wolves

Sep 03, 2025

Actor Graham Greene Dead At 73 Remembering His Iconic Role In Dances With Wolves

Sep 03, 2025

Latest Posts

-

Tributes Pour In Following Death Of Graham Greene Dances With Wolves Actor At 73

Sep 03, 2025

Tributes Pour In Following Death Of Graham Greene Dances With Wolves Actor At 73

Sep 03, 2025 -

Beijing Steels Itself For Major Military Parade Details And Significance

Sep 03, 2025

Beijing Steels Itself For Major Military Parade Details And Significance

Sep 03, 2025 -

Uk Politics No 10 Shuffle And Labours Asylum Crackdown

Sep 03, 2025

Uk Politics No 10 Shuffle And Labours Asylum Crackdown

Sep 03, 2025 -

Liverpool One Unveils Spectacular New Light Installation

Sep 03, 2025

Liverpool One Unveils Spectacular New Light Installation

Sep 03, 2025 -

Controversial Santa Barbara Hospital Worker Video Surfaces

Sep 03, 2025

Controversial Santa Barbara Hospital Worker Video Surfaces

Sep 03, 2025