Intuit Stock Plummets: Disappointing Outlook Follows Weak MailChimp And TurboTax Performance

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Intuit Stock Plummets: Disappointing Outlook Follows Weak MailChimp and TurboTax Performance

Intuit (INTU), the financial software giant behind TurboTax and QuickBooks, saw its stock price take a significant dive following the release of its disappointing Q3 2024 earnings report. The announcement, released [Date of Release], revealed weaker-than-expected performance from key products, particularly Mailchimp and TurboTax, sending shockwaves through the market and leaving investors concerned about the company's future trajectory. The resulting stock plummet highlights the challenges Intuit faces in navigating a changing economic landscape and increasing competition.

Weak Performance Across Key Products

The underwhelming earnings report pinpointed several areas of concern. Mailchimp, the marketing automation platform acquired by Intuit in 2021, significantly underperformed expectations. Revenue growth for Mailchimp fell short of analyst predictions, raising questions about Intuit's strategic integration and the platform's ability to compete with established players like Mailchimp's competitors such as Constant Contact and HubSpot.

This underperformance was compounded by a less-than-stellar showing from TurboTax, the company's flagship tax preparation software. While still a significant revenue generator, TurboTax's growth failed to meet internal projections. This sluggish performance could be attributed to several factors, including increased competition, shifting consumer behavior, and perhaps, the lingering impact of past controversies surrounding TurboTax's tax preparation practices.

Disappointing Outlook Casts a Shadow

Beyond the disappointing Q3 results, Intuit's outlook for the remainder of the fiscal year further fueled the stock's decline. The company's guidance for Q4 2024 fell below analyst consensus estimates, indicating a continued struggle to meet market expectations. This cautious outlook underscores the challenges Intuit faces in maintaining its growth momentum in an increasingly complex and competitive market.

What This Means for Investors

The significant drop in Intuit's stock price reflects investor concerns about the company's ability to deliver on its promises. Several analysts have already downgraded their ratings on INTU stock, citing the weak performance and uncertain outlook. This situation presents a complex scenario for investors, demanding a careful assessment of the company's long-term prospects and the potential for recovery.

Analyzing the Factors Contributing to the Decline:

- Increased Competition: Intuit faces fierce competition in all its major market segments. This competitive pressure is squeezing margins and slowing growth.

- Economic Uncertainty: The current economic climate, marked by inflation and recessionary fears, is impacting consumer spending and potentially delaying tax preparation and marketing investments.

- Integration Challenges: The integration of acquired businesses, particularly Mailchimp, has proven more challenging than anticipated, affecting performance and hindering synergies.

- Regulatory Scrutiny: Past controversies related to TurboTax continue to cast a shadow on the company's reputation and potentially impact consumer trust.

Looking Ahead: Potential for Recovery?

While the current situation is undoubtedly concerning, Intuit is not without potential for recovery. The company possesses strong brand recognition, a loyal customer base, and a history of innovation. However, successfully navigating the challenges ahead requires a strategic reassessment, potentially including adjustments to its product portfolio, enhanced marketing strategies, and a renewed focus on customer experience. Only time will tell if Intuit can successfully address these challenges and regain investor confidence. Investors are advised to monitor the company's performance closely and consult with financial advisors before making any investment decisions.

Keywords: Intuit, INTU, Stock, Plummets, Mailchimp, TurboTax, Earnings Report, Q3 2024, Financial Software, Disappointing Outlook, Stock Market, Investment, Competition, Economic Uncertainty, Revenue, Growth, Analyst Predictions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Intuit Stock Plummets: Disappointing Outlook Follows Weak MailChimp And TurboTax Performance. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

783 Million Nih Grant Freeze Supreme Court Sides With Trump

Aug 24, 2025

783 Million Nih Grant Freeze Supreme Court Sides With Trump

Aug 24, 2025 -

Consumer Prices Increase As Predicted June Inflation Data Released For The U S

Aug 24, 2025

Consumer Prices Increase As Predicted June Inflation Data Released For The U S

Aug 24, 2025 -

Rhs Students Garner Top Academic Awards

Aug 24, 2025

Rhs Students Garner Top Academic Awards

Aug 24, 2025 -

The Trendiest Jewelry Diamond Facial Tools And Lipstick Pendants

Aug 24, 2025

The Trendiest Jewelry Diamond Facial Tools And Lipstick Pendants

Aug 24, 2025 -

Supreme Court Ruling Trumps Hold On 783 Million In Nih Funding Upheld

Aug 24, 2025

Supreme Court Ruling Trumps Hold On 783 Million In Nih Funding Upheld

Aug 24, 2025

Latest Posts

-

Crystal Palace Vs Nottingham Forest Chris Suttons Premier League Prediction

Aug 24, 2025

Crystal Palace Vs Nottingham Forest Chris Suttons Premier League Prediction

Aug 24, 2025 -

Outrage In The Pga Golfers Rule Breach Ignites Fury Among Competitors

Aug 24, 2025

Outrage In The Pga Golfers Rule Breach Ignites Fury Among Competitors

Aug 24, 2025 -

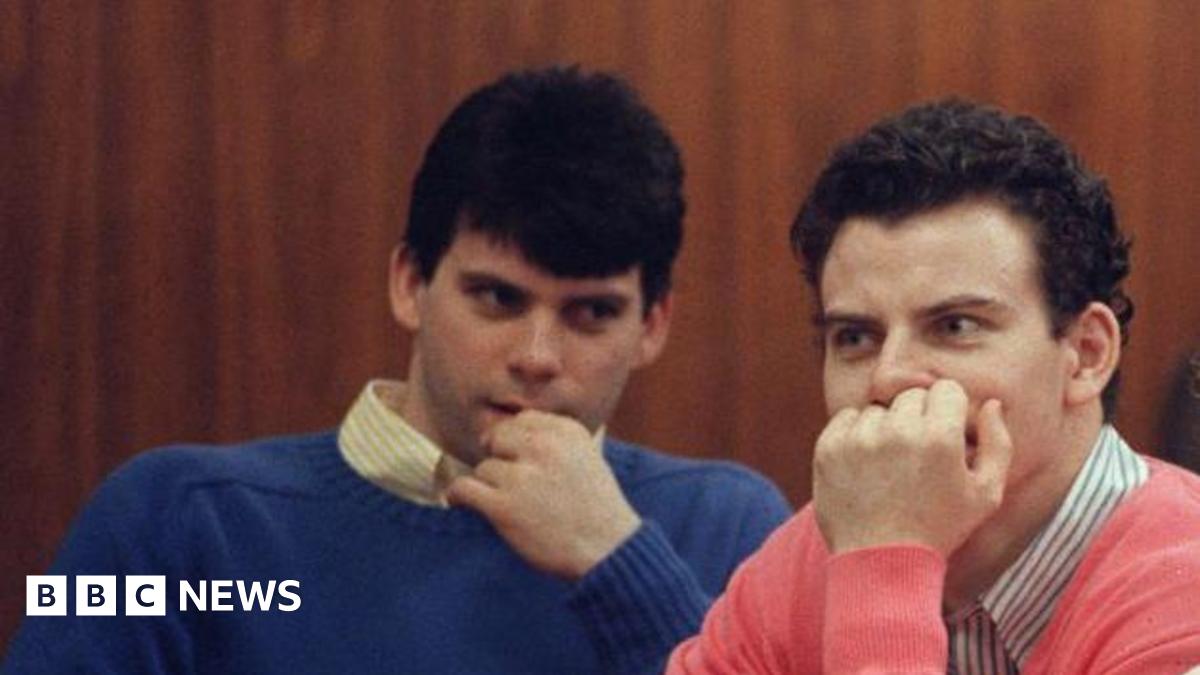

The Menendez Brothers Case Updates On Their Imprisonment And Future Parole Hearings

Aug 24, 2025

The Menendez Brothers Case Updates On Their Imprisonment And Future Parole Hearings

Aug 24, 2025 -

What Is A Black Moon Explanation And Weekend Predictions

Aug 24, 2025

What Is A Black Moon Explanation And Weekend Predictions

Aug 24, 2025 -

Pressure On Martin As Rangers Play St Mirren Everton Stadium Opens To Fans

Aug 24, 2025

Pressure On Martin As Rangers Play St Mirren Everton Stadium Opens To Fans

Aug 24, 2025