Intuit Fiscal 2026 Guidance: Revenue Growth And Margin Expansion

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Intuit's Fiscal 2026 Guidance: Strong Revenue Growth and Margin Expansion Forecasted

Intuit, the leading provider of financial management and tax preparation software, recently released its fiscal 2026 guidance, painting a picture of robust revenue growth and significant margin expansion. This announcement sent positive ripples through the market, solidifying Intuit's position as a financial technology powerhouse and sparking considerable investor interest. Let's delve into the key takeaways from Intuit's projections and what they mean for the company's future.

Key Highlights of Intuit's Fiscal 2026 Guidance:

Intuit's forecast projects substantial growth across its key product lines, fueled by continued innovation and strong demand for its cloud-based solutions. The company anticipates:

-

Significant Revenue Growth: Intuit projects substantial year-over-year revenue growth, driven by increased customer adoption and expansion within existing customer bases. Specific figures were provided in their official press release, [link to Intuit press release]. This growth is expected across all segments, including its flagship products like TurboTax and QuickBooks.

-

Margin Expansion: Beyond revenue growth, Intuit also expects a notable expansion in operating margins. This signals improved efficiency and profitability, suggesting strong cost management and successful implementation of strategic initiatives. The company attributes this to optimized operational strategies and a focus on high-margin offerings.

-

Continued Investment in Innovation: A crucial aspect of Intuit's strategy is sustained investment in research and development. This commitment to innovation is essential for maintaining a competitive edge in the ever-evolving financial technology landscape. They plan to continue developing AI-powered features and expanding their product offerings to meet the changing needs of consumers and businesses.

Driving Factors Behind the Positive Outlook:

Several factors contribute to Intuit's optimistic forecast for fiscal 2026:

-

Strong Demand for Cloud-Based Solutions: The increasing adoption of cloud-based financial management tools is a significant tailwind. Intuit's robust cloud infrastructure and user-friendly interface are key differentiators in this competitive market.

-

Successful Product Launches and Acquisitions: Intuit's consistent launch of new products and strategic acquisitions have expanded its market reach and product portfolio, further driving revenue growth.

Implications for Investors and the Fintech Industry:

Intuit's fiscal 2026 guidance provides a compelling case for continued investment in the company. The projected revenue growth and margin expansion indicate strong financial health and potential for long-term shareholder value. This also underscores the broader trend of growth within the fintech industry, highlighting the increasing demand for innovative financial management solutions.

Looking Ahead:

While the forecast is optimistic, it's important to acknowledge potential challenges. Intuit faces ongoing competition from other fintech companies, and economic uncertainty could impact consumer spending. However, the company's strong brand recognition, loyal customer base, and continued investment in innovation position it well to navigate these challenges.

Call to Action: For detailed financial information and the full fiscal 2026 guidance, visit the official Intuit investor relations website [link to Intuit investor relations]. Stay informed about industry trends by subscribing to our newsletter [link to your newsletter signup].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Intuit Fiscal 2026 Guidance: Revenue Growth And Margin Expansion. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

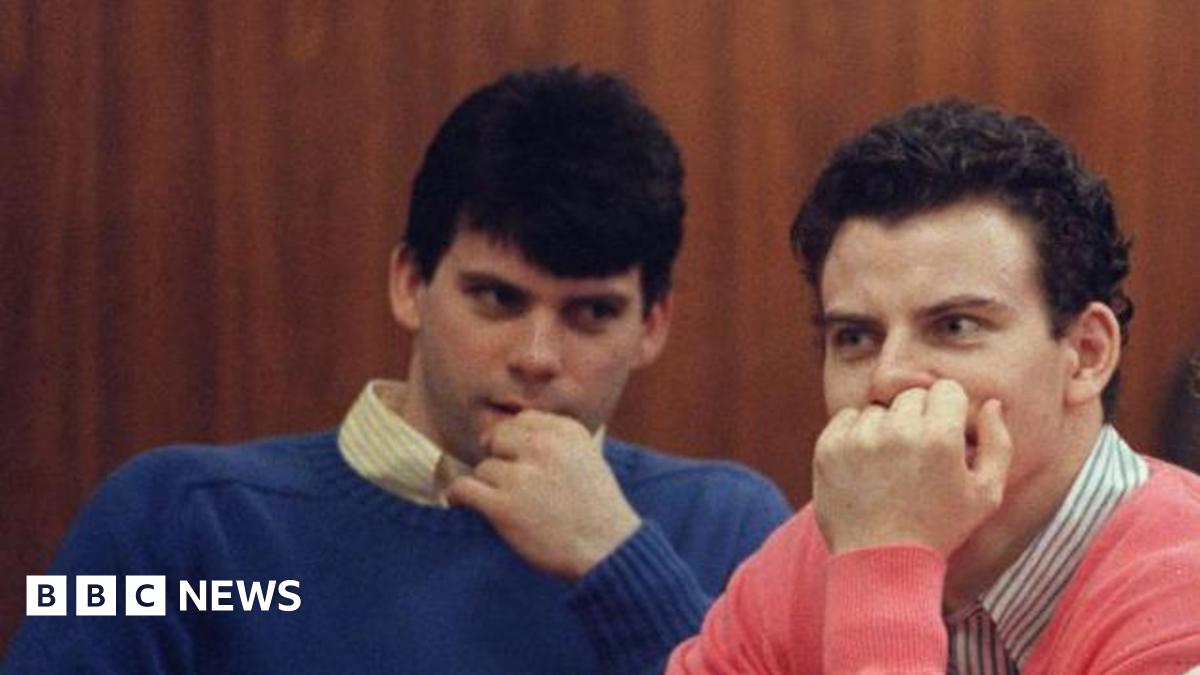

Menendez Brothers Key Facts Legal Battles And The Path To Potential Release

Aug 24, 2025

Menendez Brothers Key Facts Legal Battles And The Path To Potential Release

Aug 24, 2025 -

Toneys Pre Ronaldo Match Dig At Saudi Leadership Sparks Controversy

Aug 24, 2025

Toneys Pre Ronaldo Match Dig At Saudi Leadership Sparks Controversy

Aug 24, 2025 -

Luxury Meets Sparkle Diamond Facials And Lipstick Pendant Jewelry

Aug 24, 2025

Luxury Meets Sparkle Diamond Facials And Lipstick Pendant Jewelry

Aug 24, 2025 -

Will Penn State Reach A Top 2 Regular Season Record Expert Analysis

Aug 24, 2025

Will Penn State Reach A Top 2 Regular Season Record Expert Analysis

Aug 24, 2025 -

Revealed Billionaire Entrepreneur Lucy Guos Rigorous Daily Routine

Aug 24, 2025

Revealed Billionaire Entrepreneur Lucy Guos Rigorous Daily Routine

Aug 24, 2025

Ilford Restaurant Arson Five Injured In Suspected Attack

Ilford Restaurant Arson Five Injured In Suspected Attack