Inflation Update: U.S. Consumer Prices Increase In June, Meeting Expectations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Inflation Update: U.S. Consumer Prices Rise in June, Meeting Analyst Expectations

Headline: Inflation Holds Steady in June, but Concerns Remain Amidst Rising Interest Rates

The U.S. consumer price index (CPI) for June 2024 rose by 0.2%, matching economists' forecasts and signaling a persistent, albeit somewhat moderated, inflation rate. While the increase aligns with predictions, it continues to fuel debate about the Federal Reserve's monetary policy and its impact on the American economy. This latest data point underscores the ongoing complexities of navigating the current economic landscape.

What the CPI Data Reveals

The 0.2% increase in June follows a 0.1% rise in May, indicating a relatively stable inflation trajectory. However, the core CPI, which excludes volatile food and energy prices, also rose by 0.2%, suggesting underlying inflationary pressures remain. This core inflation figure is closely watched by policymakers as a key indicator of broader economic health. Year-over-year, the CPI increased by 3.0%, slightly down from the 3.1% reported in May. While this represents a deceleration from the peak inflation rates seen in 2022, it still remains above the Federal Reserve's 2% target.

Analyzing the Contributing Factors

Several factors contributed to the June CPI increase. Shelter costs, a significant component of the index, continued their upward trend, reflecting persistent tightness in the housing market. Used car prices also saw a slight uptick, reversing a recent decline. Conversely, energy prices experienced a slight decrease, providing some offsetting relief.

- Housing Costs: The persistent rise in rent and homeowner's equivalent rent continues to be a major driver of inflation. Experts attribute this to factors such as limited housing supply and strong rental demand. [Link to related article on housing market trends]

- Energy Prices: Fluctuations in global energy markets continue to impact inflation. The recent slight decrease in energy prices offers a temporary reprieve but remains subject to geopolitical volatility. [Link to external source on global energy markets]

- Used Car Prices: The slight increase in used car prices could be attributed to several factors including increased demand and supply chain constraints.

The Federal Reserve's Response and Market Outlook

The June CPI data is unlikely to significantly alter the Federal Reserve's current course. While the central bank has signaled a potential pause in interest rate hikes, the persistent inflation remains a concern. Many economists predict that interest rates will likely remain elevated for an extended period to ensure inflation continues to cool towards the target rate.

The implications for consumers are significant. Sustained inflation erodes purchasing power, impacting household budgets and potentially slowing consumer spending. Businesses, too, face challenges in managing costs and maintaining profitability in an inflationary environment.

Looking Ahead:

The coming months will be crucial in determining the trajectory of inflation. Continued monitoring of the CPI and other economic indicators is essential for both policymakers and consumers. Further analysis is needed to understand the long-term effects of the current inflation rate and the effectiveness of the Federal Reserve's monetary policy. The next CPI release will be closely scrutinized for any indication of further changes.

Call to Action: Stay informed about economic developments by subscribing to our newsletter for regular updates and analysis. [Link to Newsletter Signup]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Inflation Update: U.S. Consumer Prices Increase In June, Meeting Expectations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Wirtschaftswachstum Unter Trump Fakten Und Prognosen

Aug 30, 2025

Wirtschaftswachstum Unter Trump Fakten Und Prognosen

Aug 30, 2025 -

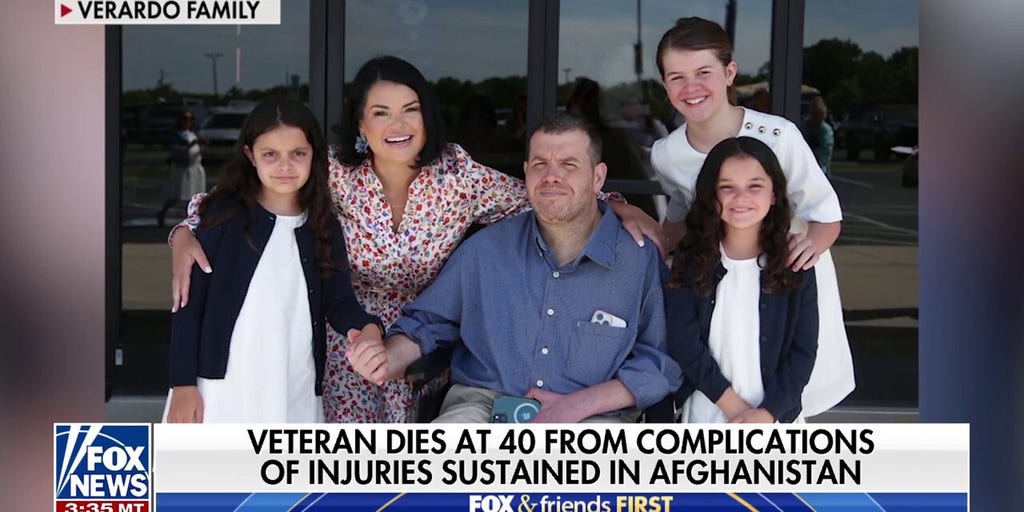

Trumps Tribute Celebrating The Life And Sacrifice Of An American Hero

Aug 30, 2025

Trumps Tribute Celebrating The Life And Sacrifice Of An American Hero

Aug 30, 2025 -

Trumps Approval Plummets Cnn Data Points To Crucial Issue

Aug 30, 2025

Trumps Approval Plummets Cnn Data Points To Crucial Issue

Aug 30, 2025 -

Ostapenkos Comments To Townsend Spark Outrage Naomi Osakas Powerful Response

Aug 30, 2025

Ostapenkos Comments To Townsend Spark Outrage Naomi Osakas Powerful Response

Aug 30, 2025 -

Tommy Paul Vs Nuno Borges Us Open Match Preview Betting Analysis And Predictions

Aug 30, 2025

Tommy Paul Vs Nuno Borges Us Open Match Preview Betting Analysis And Predictions

Aug 30, 2025