Inflation Remains Steady: US Consumer Prices Up In June

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Inflation Remains Steady: US Consumer Prices Tick Up in June, Fueling Economic Debate

Inflation in the United States remained stubbornly persistent in June, offering little respite for consumers grappling with higher costs and fueling ongoing debate amongst economists about the Federal Reserve's next move. The Consumer Price Index (CPI), a key measure of inflation, rose 0.2% last month, according to the Bureau of Labor Statistics (BLS), matching economists' expectations and following a similar 0.1% increase in May. This seemingly small increase, however, represents a persistent upward trend that continues to impact household budgets across the nation.

The steady inflation figures paint a complex picture for the US economy. While the rate hasn't surged dramatically, it remains significantly above the Federal Reserve's 2% target, indicating that the fight against inflation is far from over. This sustained pressure on prices is prompting renewed discussions about the future trajectory of interest rates.

Core Inflation Remains a Concern

While the headline CPI figure showed a modest increase, a closer look reveals persistent inflationary pressures. Core inflation, which excludes volatile food and energy prices, rose 0.3% in June, slightly higher than anticipated. This suggests underlying inflationary pressures are still present within the economy, a key concern for policymakers. The persistence of core inflation underscores the challenges the Fed faces in achieving its price stability goal.

- Food prices contributed to the overall CPI increase, rising 0.2% in June. This follows several months of relatively high food costs, impacting household budgets significantly.

- Energy prices, on the other hand, saw a slight decline of 0.1%, offering a temporary reprieve for consumers. However, this fluctuation is considered temporary by many analysts.

- Shelter costs, a major component of the CPI, continued to rise, highlighting the ongoing pressure on housing affordability across the US. This sector continues to be a significant driver of inflation.

What Does This Mean for the Federal Reserve?

The June CPI data adds another layer of complexity to the Federal Reserve's decision-making process. While some economists argue that the relatively stable inflation rate justifies a pause in interest rate hikes, others remain concerned about the persistent core inflation and advocate for continued tightening monetary policy. The Fed's next move will likely depend on upcoming economic data releases and further assessments of inflation's trajectory. .

Looking Ahead: Uncertainty Remains

The path of inflation remains uncertain. While some sectors are showing signs of cooling, others, such as housing, continue to exhibit persistent price increases. The impact of recent interest rate hikes is also still unfolding, making it challenging to predict the future direction of inflation with certainty.

Consumers should continue to monitor their spending habits and budget carefully in light of the persistent inflationary pressures. Understanding inflation's impact on your finances is crucial for navigating the current economic climate. .

In conclusion, the June CPI data underscores the ongoing challenges faced by the US economy in combating inflation. The persistence of core inflation, coupled with rising food and shelter costs, suggests that the fight against inflation is far from over, leaving both policymakers and consumers with considerable uncertainty about the road ahead.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Inflation Remains Steady: US Consumer Prices Up In June. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Artists Protest Mass Boycott Shakes Victorious Music Festival

Aug 26, 2025

Artists Protest Mass Boycott Shakes Victorious Music Festival

Aug 26, 2025 -

Asylum System Reform Government Announces Major Changes To Appeals

Aug 26, 2025

Asylum System Reform Government Announces Major Changes To Appeals

Aug 26, 2025 -

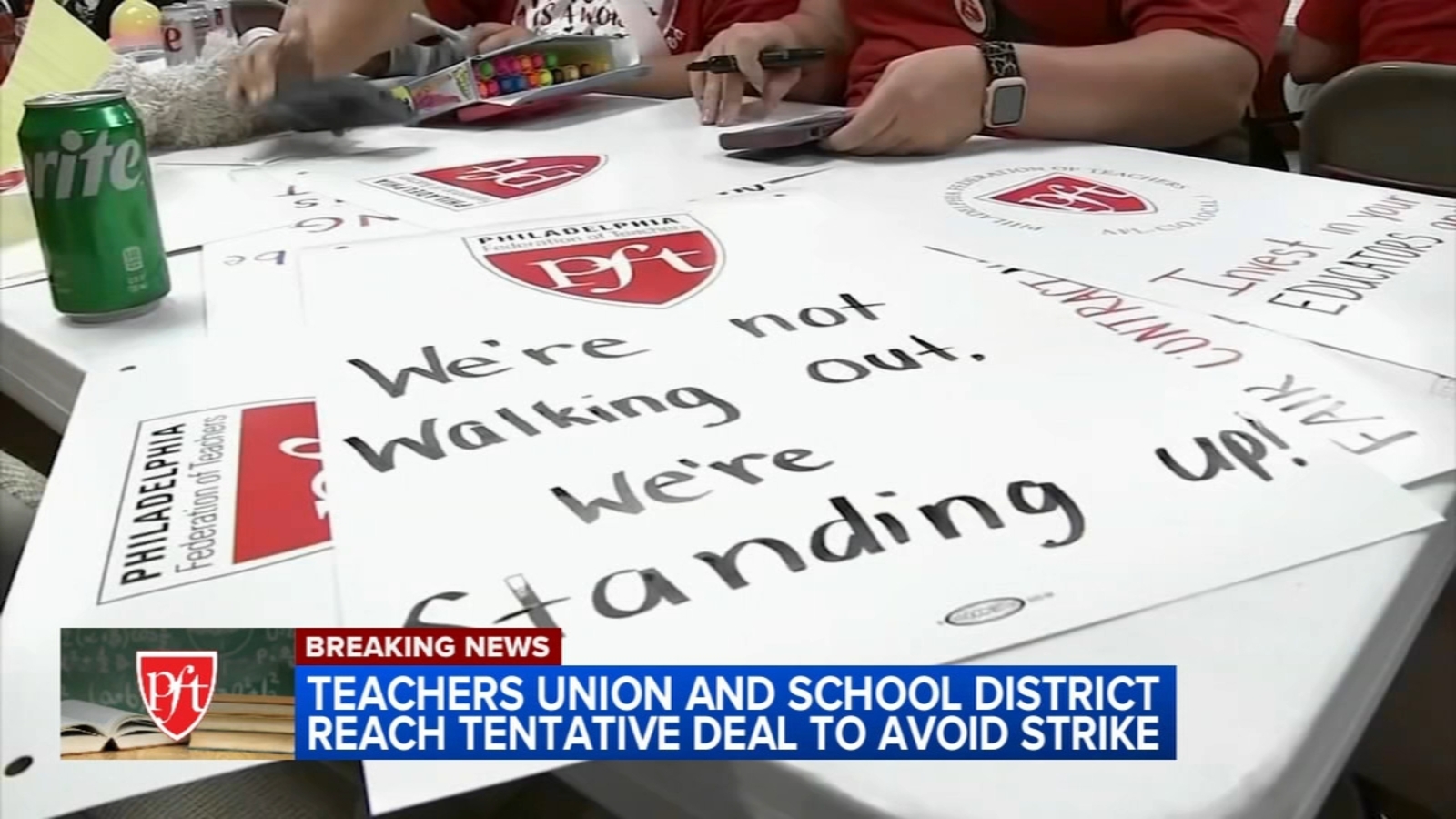

Tentative Contract Deal Reached Between Philadelphia Teachers Union And School District

Aug 26, 2025

Tentative Contract Deal Reached Between Philadelphia Teachers Union And School District

Aug 26, 2025 -

Blake Lively Explosive New Texts Surface

Aug 26, 2025

Blake Lively Explosive New Texts Surface

Aug 26, 2025 -

Nyt Connections Hints And Answers August 25th Puzzle 806

Aug 26, 2025

Nyt Connections Hints And Answers August 25th Puzzle 806

Aug 26, 2025

Latest Posts

-

Decoding Melania Trumps Post Presidency Public Profile

Aug 26, 2025

Decoding Melania Trumps Post Presidency Public Profile

Aug 26, 2025 -

Cnns Data Analysis The Issue Fueling Anti Trump Sentiment

Aug 26, 2025

Cnns Data Analysis The Issue Fueling Anti Trump Sentiment

Aug 26, 2025 -

Best Labor Day Weekend 2025 Getaways And Activities

Aug 26, 2025

Best Labor Day Weekend 2025 Getaways And Activities

Aug 26, 2025 -

Impacto En El Cine Espanol Veronica Echegui Muere A Los 42 Anos Reacciones Y Cobertura En Vivo

Aug 26, 2025

Impacto En El Cine Espanol Veronica Echegui Muere A Los 42 Anos Reacciones Y Cobertura En Vivo

Aug 26, 2025 -

Roddicks Bold Rybakina Prediction Us Open Analysis And Sabalenkas Win

Aug 26, 2025

Roddicks Bold Rybakina Prediction Us Open Analysis And Sabalenkas Win

Aug 26, 2025