Inflation Remains Elevated: June's U.S. Consumer Price Data Explained

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Inflation Remains Elevated: June's U.S. Consumer Price Data Explained

Inflation continues to be a persistent concern for American households, with June's Consumer Price Index (CPI) data revealing a stubborn rise in prices, though at a slower pace than in recent months. The report, released by the Bureau of Labor Statistics (BLS), provides crucial insights into the ongoing battle against inflation and its impact on the U.S. economy. Understanding this data is vital for consumers, businesses, and policymakers alike.

Headline Numbers: A Closer Look at June's CPI

The headline figure showed a 3% year-over-year increase in the CPI for June, slightly lower than the 4% increase reported in May. While this slowdown is encouraging, it still sits significantly above the Federal Reserve's 2% inflation target. This indicates that despite recent efforts, inflation remains a persistent challenge. The month-over-month increase was a more modest 0.2%, suggesting a possible cooling trend. However, it’s crucial to analyze the details beyond the headline numbers.

Key Drivers of Persistent Inflation

Several factors contributed to June's elevated inflation figures:

-

Shelter Costs: Housing remains a significant driver of inflation. Rent increases continue to outpace wage growth for many Americans, contributing to the overall CPI increase. This is a persistent issue that is expected to continue impacting inflation figures for several months to come.

-

Sticky Services Inflation: While goods inflation has generally cooled, services inflation, particularly in areas like healthcare and education, remains stubbornly high. This highlights the complexity of taming inflation, as it's not just about the cost of goods but also the cost of essential services.

-

Energy Prices: Although energy prices showed some moderation in June, they remain volatile and continue to exert upward pressure on overall inflation. Fluctuations in global energy markets continue to impact consumer prices.

-

Food Prices: Food prices, another critical component of the CPI, also contributed to the overall increase. While some food prices have stabilized, others, like certain fruits and vegetables, experienced price increases due to factors such as weather patterns and supply chain disruptions.

What Does This Mean for Consumers?

The persistent inflation means that consumers continue to face higher costs for everyday goods and services. This impacts purchasing power and household budgets, forcing many to make difficult choices between necessities. Understanding where inflation hits hardest – such as shelter and food – allows consumers to better budget and prioritize spending.

The Federal Reserve's Response and Outlook

The Federal Reserve (Fed) closely monitors the CPI data to inform its monetary policy decisions. While the June report showed a slight slowdown, it’s unlikely to significantly alter the Fed’s current course. Further interest rate hikes remain a possibility, aimed at cooling down the economy and bringing inflation closer to its target. The Fed's future actions will depend heavily on upcoming economic data, including employment figures and inflation expectations.

Conclusion: Inflation's Ongoing Impact and Future Predictions

While the June CPI data showed a modest easing of inflation, the battle is far from over. Persistent inflation continues to impact American households and the broader economy. The factors driving inflation, such as housing and services costs, require a multifaceted approach to address effectively. The coming months will be crucial in determining whether this represents a sustained cooling trend or a temporary reprieve. Continued monitoring of economic indicators, such as the Producer Price Index (PPI) and employment data, will be vital to fully understanding the direction of inflation in the near future. Stay informed and adapt your financial strategies accordingly.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Inflation Remains Elevated: June's U.S. Consumer Price Data Explained. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

How Many Rings Scientists Determine Sycamore Gap Trees Age

Sep 05, 2025

How Many Rings Scientists Determine Sycamore Gap Trees Age

Sep 05, 2025 -

Smartphone Habit While Pooping May Significantly Increase Hemorrhoid Risk Research

Sep 05, 2025

Smartphone Habit While Pooping May Significantly Increase Hemorrhoid Risk Research

Sep 05, 2025 -

Duchess Of Kent Dies At 92 Buckingham Palace Announces Passing

Sep 05, 2025

Duchess Of Kent Dies At 92 Buckingham Palace Announces Passing

Sep 05, 2025 -

Brother Weases Unexpected Departure Fans React Online

Sep 05, 2025

Brother Weases Unexpected Departure Fans React Online

Sep 05, 2025 -

September 3 2025 West Virginia Lottery Results Powerball And Lotto America

Sep 05, 2025

September 3 2025 West Virginia Lottery Results Powerball And Lotto America

Sep 05, 2025

Latest Posts

-

Online Outpouring After Beloved Brother Wease Announces Exit

Sep 06, 2025

Online Outpouring After Beloved Brother Wease Announces Exit

Sep 06, 2025 -

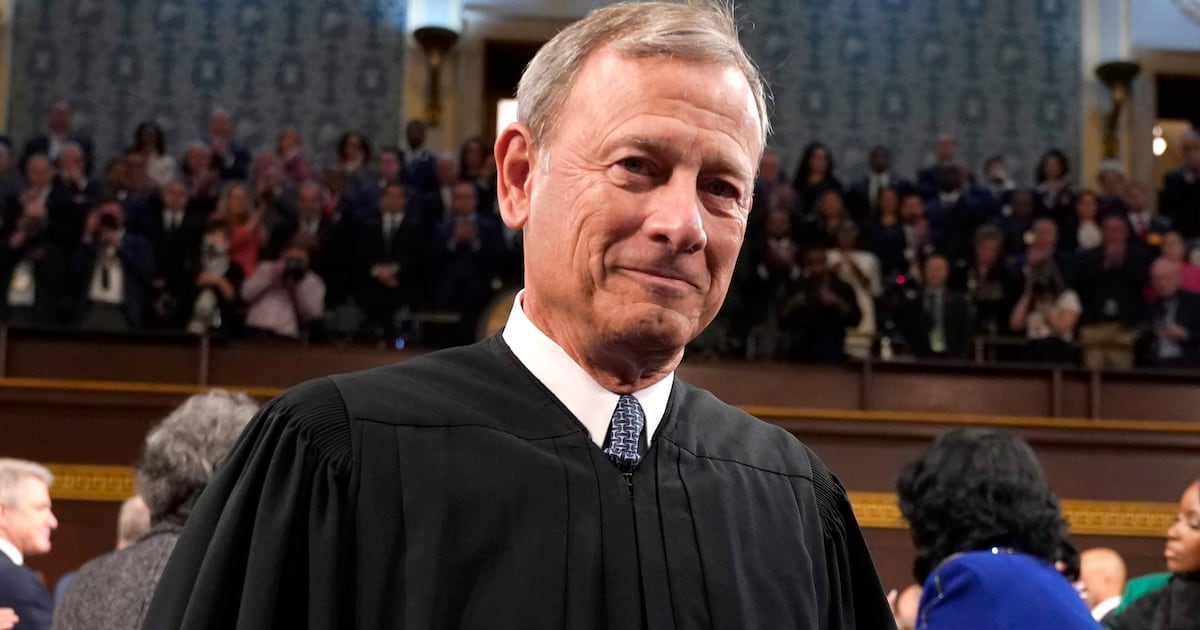

Leaked Documents Detail Chief Justice Roberts Supreme Court Agenda

Sep 06, 2025

Leaked Documents Detail Chief Justice Roberts Supreme Court Agenda

Sep 06, 2025 -

The End Of An Era Brother Weases Farewell To Rochester Radio

Sep 06, 2025

The End Of An Era Brother Weases Farewell To Rochester Radio

Sep 06, 2025 -

Illegal Sports Streaming Giant Streameast Shut Down In Major Crackdown

Sep 06, 2025

Illegal Sports Streaming Giant Streameast Shut Down In Major Crackdown

Sep 06, 2025 -

Riba Stirling Prize Nomination The Restoration Of Big Bens Elizabeth Tower

Sep 06, 2025

Riba Stirling Prize Nomination The Restoration Of Big Bens Elizabeth Tower

Sep 06, 2025