Inflation Remains Consistent: June's U.S. Consumer Price Index Figures

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Inflation Remains Consistent: June's U.S. Consumer Price Index Figures Offer Little Relief

Inflation in the United States showed little change in June, offering limited respite for consumers struggling with persistently high prices. The latest Consumer Price Index (CPI) report, released by the Bureau of Labor Statistics (BLS), revealed a stubbornly persistent inflation rate, keeping pressure on the Federal Reserve to continue its fight against rising costs. This news comes as a disappointment to many hoping for a more significant slowdown in price increases.

June's CPI: A Snapshot of Stagnant Inflation

The headline CPI for June remained relatively flat compared to May, increasing by just 0.2%. This mirrors the 0.1% increase seen in May, indicating a plateau rather than a significant decline. While this small increase might seem minimal, it's crucial to remember the cumulative effect of months of consistent price hikes. The year-over-year increase, however, remains substantial at 3.0%, highlighting the ongoing challenges for consumers.

Key Factors Contributing to Persistent Inflation

Several factors continue to contribute to the persistent inflation. These include:

-

Shelter Costs: Housing remains a major driver of inflation, with shelter costs continuing to climb significantly. This reflects both rising rental prices and the ongoing impact of previous increases in home prices. [Link to external article about rising rental costs]

-

Energy Prices: While energy prices have moderated somewhat, they remain elevated compared to pre-pandemic levels. Fluctuations in global energy markets continue to impact domestic prices. [Link to an external article about global energy markets]

-

Food Prices: Food prices remain stubbornly high, adding considerable strain on household budgets. Supply chain disruptions and increased production costs continue to exert upward pressure on grocery bills. [Link to external article about food price inflation]

The Federal Reserve's Response: More Rate Hikes Possible?

The persistent inflation figures are likely to influence the Federal Reserve's upcoming monetary policy decisions. While the central bank has signaled a potential pause in interest rate hikes, the lack of significant progress in curbing inflation could lead them to reconsider this stance. Many economists believe that further rate increases might be necessary to bring inflation down to the Fed's 2% target. [Link to Federal Reserve website]

What This Means for Consumers

For consumers, the persistent inflation means continued pressure on household budgets. Careful financial planning and budgeting are crucial to navigate these challenging economic times. Consider exploring strategies to reduce expenses and maximize income. [Link to internal article about budgeting tips]

Looking Ahead: A Path to Lower Inflation?

While the June CPI figures offer little immediate relief, there are some potential signs of hope. Supply chain issues are gradually easing, and some commodity prices are starting to decline. However, the path to lower inflation is likely to be gradual and uneven. Continued monitoring of economic indicators and government policy will be crucial in understanding the future trajectory of inflation in the United States. Stay informed and adapt your financial strategies accordingly.

Call to Action: Subscribe to our newsletter for regular updates on economic news and insights that can help you manage your finances effectively. [Link to newsletter signup]

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Inflation Remains Consistent: June's U.S. Consumer Price Index Figures. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Fantasy Football Rookie Report Week 2 Croskey Merritts Impact

Sep 12, 2025

Fantasy Football Rookie Report Week 2 Croskey Merritts Impact

Sep 12, 2025 -

Ho 99 O9s Tomorrow We Escape A Critical Review

Sep 12, 2025

Ho 99 O9s Tomorrow We Escape A Critical Review

Sep 12, 2025 -

Harry Arrives At Clarence House Amidst King Charles Meeting Reports

Sep 12, 2025

Harry Arrives At Clarence House Amidst King Charles Meeting Reports

Sep 12, 2025 -

Clarence House Meeting Reports Of Harry And King Charles Meeting Confirmed

Sep 12, 2025

Clarence House Meeting Reports Of Harry And King Charles Meeting Confirmed

Sep 12, 2025 -

Protecting Our Agricultural Heritage Senator Burnetts Crusade

Sep 12, 2025

Protecting Our Agricultural Heritage Senator Burnetts Crusade

Sep 12, 2025

Latest Posts

-

Bbc Exposes Israels Gaza Evacuation Aid Sites Amidst Resident Defiance

Sep 12, 2025

Bbc Exposes Israels Gaza Evacuation Aid Sites Amidst Resident Defiance

Sep 12, 2025 -

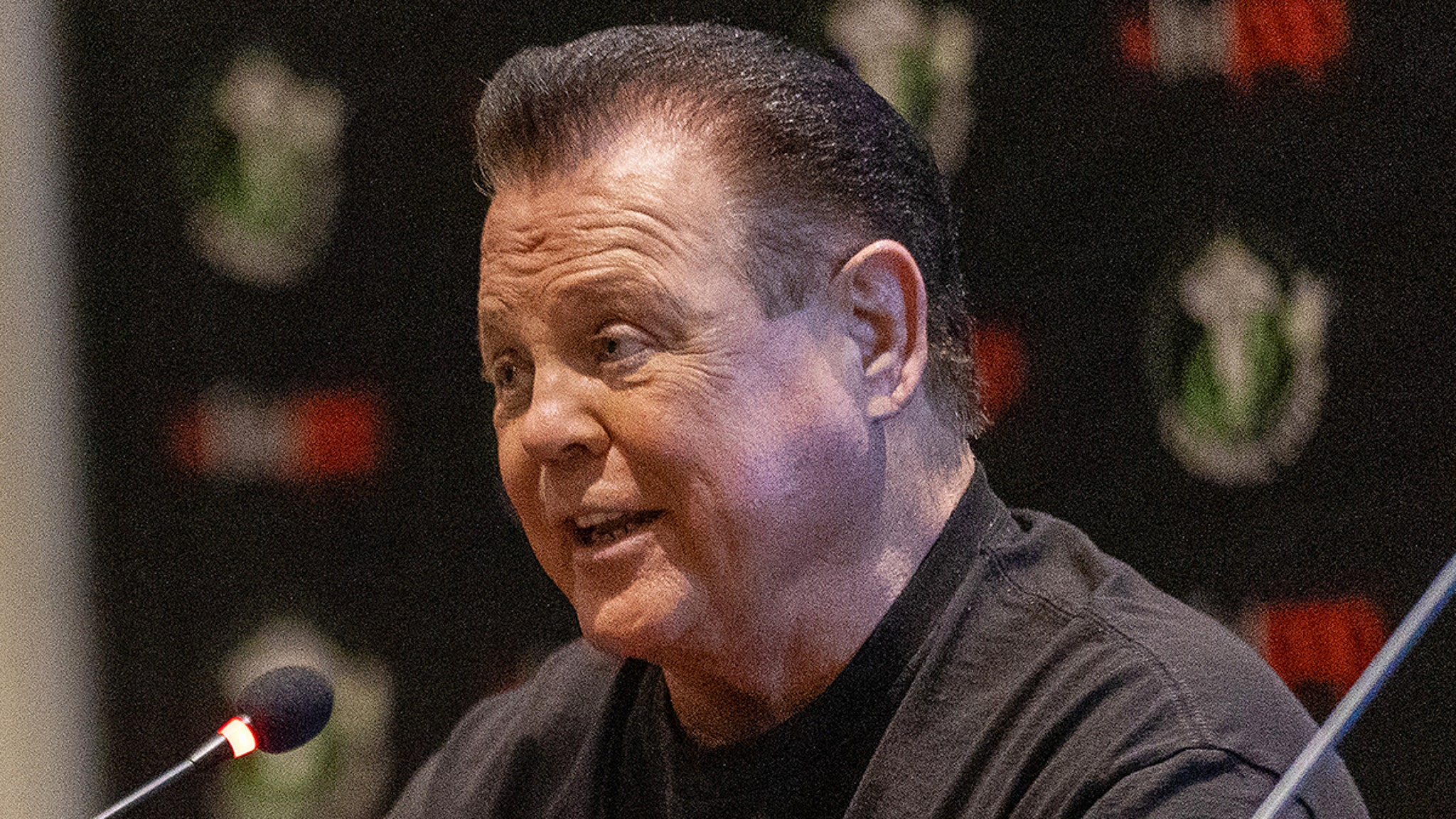

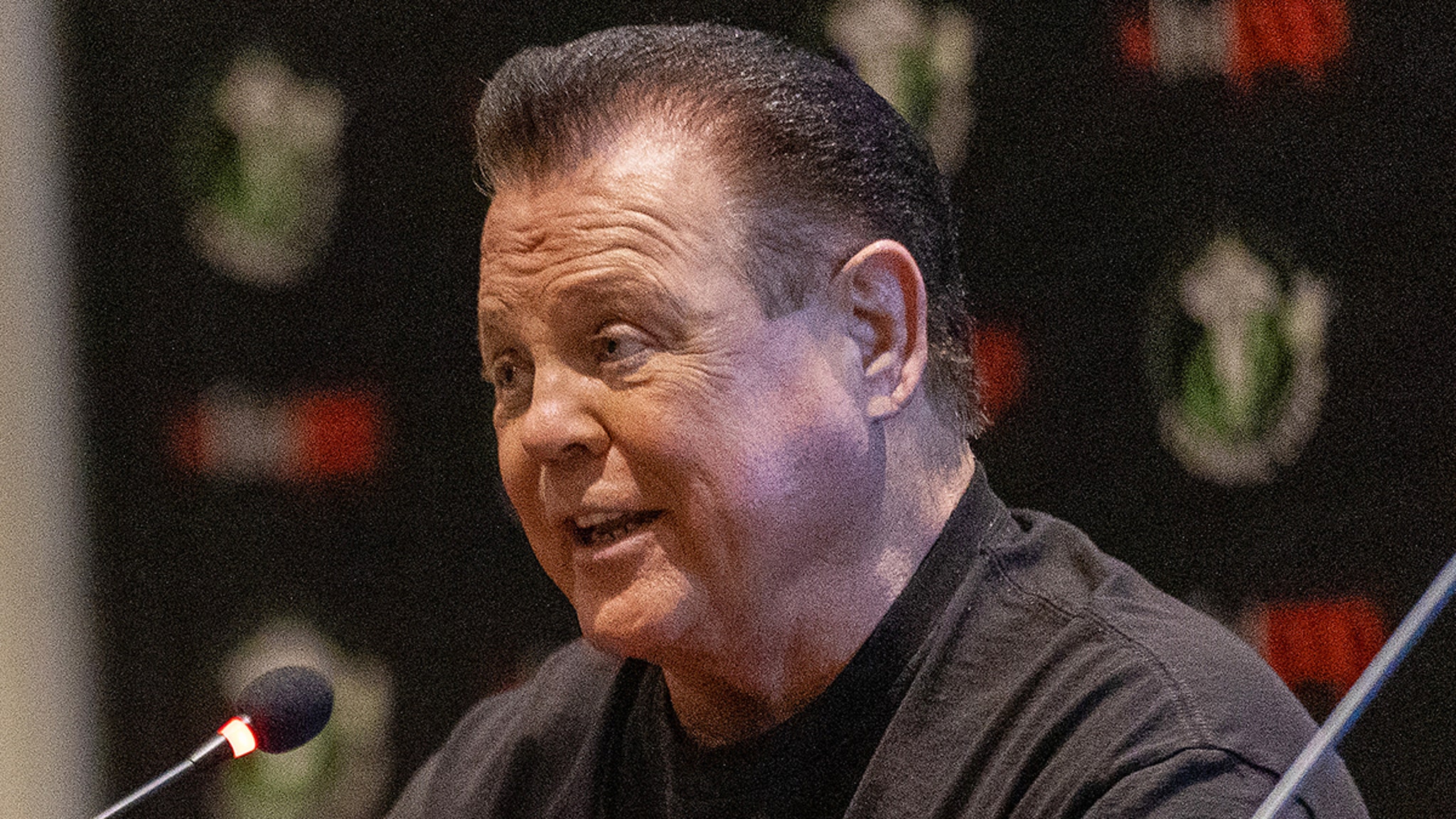

Jerry Lawlers Stroke Recovery Progress And Well Wishes

Sep 12, 2025

Jerry Lawlers Stroke Recovery Progress And Well Wishes

Sep 12, 2025 -

Controversy Erupts Over Proposed Charlie Kirk Statue In Capitol Building

Sep 12, 2025

Controversy Erupts Over Proposed Charlie Kirk Statue In Capitol Building

Sep 12, 2025 -

Virada No Horizonte Tres Feitos Recentes Inspiram O Atletico Mg

Sep 12, 2025

Virada No Horizonte Tres Feitos Recentes Inspiram O Atletico Mg

Sep 12, 2025 -

Jerry Lawler Wwe Hall Of Famers Stroke And Road To Recovery

Sep 12, 2025

Jerry Lawler Wwe Hall Of Famers Stroke And Road To Recovery

Sep 12, 2025