Inflation Remains Consistent: June's U.S. Consumer Price Index

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Inflation Remains Consistent: June's U.S. Consumer Price Index Holds Steady

Inflation in the United States showed a surprising resilience in June, with the Consumer Price Index (CPI) remaining largely unchanged, offering a mixed bag for consumers and economists alike. The report, released by the Bureau of Labor Statistics (BLS), reveals a continued battle against rising prices, even as the Federal Reserve's aggressive interest rate hikes aim to cool the economy. This unexpected consistency raises questions about the future trajectory of inflation and the effectiveness of current monetary policy.

June CPI: A Snapshot of Stability (and Stagnation)

The June CPI data revealed a 0.2% increase compared to May, mirroring the previous month's rise. While this represents a slight uptick, it’s significantly lower than the substantial increases seen earlier in 2022 and the beginning of 2023. The year-over-year increase remains at 3%, a considerable decrease from the peak inflation rates experienced last year but still above the Federal Reserve's 2% target.

This seemingly stable figure, however, masks underlying complexities. While some sectors saw price decreases, others continued their upward trend.

Key Factors Influencing June's CPI:

-

Energy Prices: Energy prices remained relatively stable in June, contributing to the overall consistent CPI. However, volatility in the global energy market continues to pose a risk for future price fluctuations. This underlines the importance of diversifying energy sources and improving energy efficiency. [Link to relevant article on energy market volatility]

-

Food Prices: Food prices experienced a slight increase, continuing to burden household budgets. This persistent pressure on food costs emphasizes the ongoing challenges faced by low-income families and the need for targeted support programs. [Link to article on food insecurity in the US]

-

Shelter Costs: Shelter costs, a significant component of the CPI, continue to contribute significantly to inflation. Rising rent and home prices are likely to maintain upward pressure on the CPI in the coming months. [Link to article discussing the housing market]

-

Used Car Prices: Interestingly, used car prices, a previous major driver of inflation, showed a slight decrease in June. This suggests a potential easing of pressure in this specific sector, but it's too early to declare a trend.

What This Means for Consumers and the Economy:

The consistent CPI reading presents a complex scenario. While the lack of a significant surge is positive, the persistent inflation above the Fed's target raises concerns. This could lead to continued interest rate hikes, potentially slowing economic growth and impacting employment.

For consumers, the ongoing inflation means careful budgeting and financial planning are still crucial. Rising prices, particularly for essential goods like food and housing, continue to squeeze household budgets.

Looking Ahead: Uncertainty Remains

The Federal Reserve will closely monitor the coming months' CPI data to inform its monetary policy decisions. While June's report offers a temporary respite from accelerating inflation, the underlying pressures remain. The next few months will be crucial in determining whether inflation is truly moderating or simply pausing before another surge. Experts predict a range of outcomes, highlighting the uncertainty surrounding the future economic outlook. [Link to a reputable economic forecasting site]

Call to Action: Stay informed about economic developments by regularly checking reputable sources like the Bureau of Labor Statistics and following financial news outlets. Understanding the complexities of inflation is crucial for making informed financial decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Inflation Remains Consistent: June's U.S. Consumer Price Index. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Jennifer Lopez Defies Criticism In Stunning La Outfit After Roast

Aug 31, 2025

Jennifer Lopez Defies Criticism In Stunning La Outfit After Roast

Aug 31, 2025 -

Eppings Development Dispute And Rayner Inquiry A Double Blow For Local Politics

Aug 31, 2025

Eppings Development Dispute And Rayner Inquiry A Double Blow For Local Politics

Aug 31, 2025 -

Full Lineup Every Haunted House At Halloween Horror Nights Orlando 2025

Aug 31, 2025

Full Lineup Every Haunted House At Halloween Horror Nights Orlando 2025

Aug 31, 2025 -

Controversy Erupts Trumps 5 Billion Foreign Aid Cancellation

Aug 31, 2025

Controversy Erupts Trumps 5 Billion Foreign Aid Cancellation

Aug 31, 2025 -

Halloween Horror Nights 34 A Look At Universal Orlandos New Season

Aug 31, 2025

Halloween Horror Nights 34 A Look At Universal Orlandos New Season

Aug 31, 2025

Latest Posts

-

Political Pressure Mounts Starmer Seeks Clear Distinction From Reform

Sep 03, 2025

Political Pressure Mounts Starmer Seeks Clear Distinction From Reform

Sep 03, 2025 -

Listen To Metal Eden Now On Spotify Apple Music And More

Sep 03, 2025

Listen To Metal Eden Now On Spotify Apple Music And More

Sep 03, 2025 -

Metal Eden New Music Out Now Across All Streaming Services

Sep 03, 2025

Metal Eden New Music Out Now Across All Streaming Services

Sep 03, 2025 -

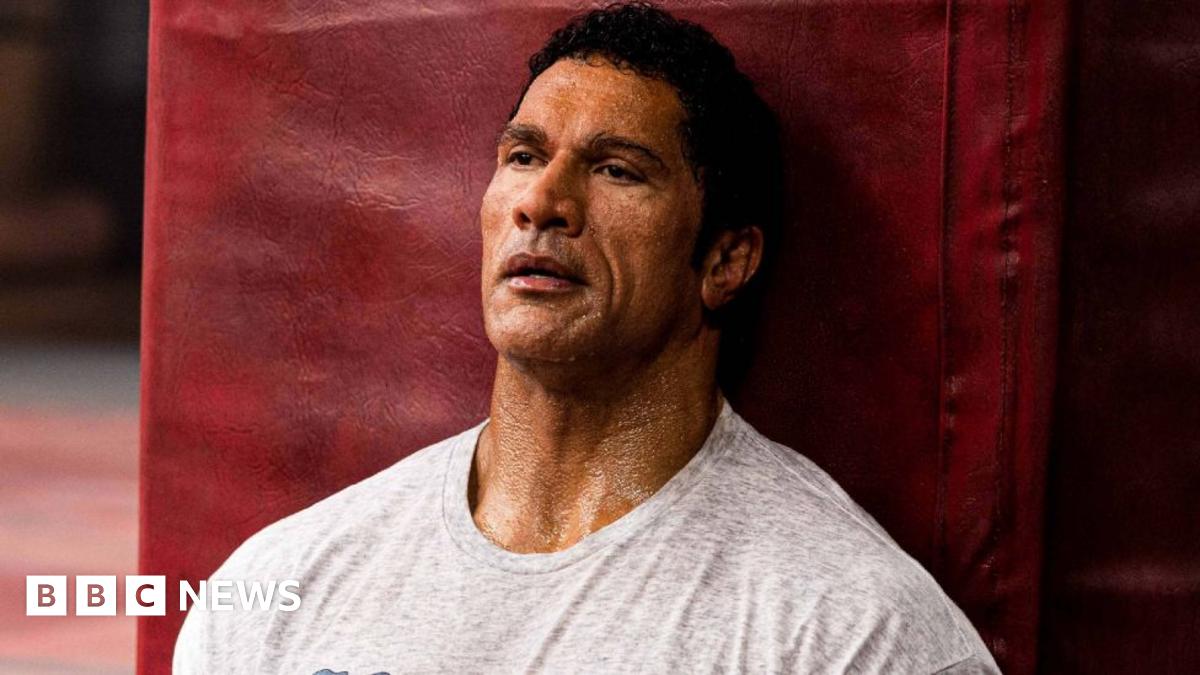

Oscar Contender Dwayne Johnsons Transformation For The Smashing Machine Role

Sep 03, 2025

Oscar Contender Dwayne Johnsons Transformation For The Smashing Machine Role

Sep 03, 2025 -

Longtime Congressman Jerry Nadlers Decision No Reelection Bid In New York

Sep 03, 2025

Longtime Congressman Jerry Nadlers Decision No Reelection Bid In New York

Sep 03, 2025