Inflation Holds Steady: U.S. Consumer Prices Up In June, Meeting Expectations

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Inflation Holds Steady: U.S. Consumer Prices Up in June, Meeting Expectations

Headline: Inflation Remains Stable in June, Providing Some Relief Amidst Economic Uncertainty

Introduction: The U.S. consumer price index (CPI) for June, released this morning, showed a modest increase, holding steady at [insert percentage increase here]% year-over-year. This figure aligns with economists' predictions and offers a small sigh of relief amidst ongoing concerns about inflation's impact on the American economy. While the numbers are relatively stable, the battle against inflation is far from over, and the Federal Reserve's next moves remain a key area of focus.

Key Takeaways from the June CPI Report:

-

Inflation remains relatively stable: The 0.2% monthly increase and the [insert percentage increase here]% year-over-year increase in the CPI demonstrate a sustained, albeit slow, cooling of inflation. This contrasts with the higher rates seen earlier in 2023. This stability suggests that the Federal Reserve's interest rate hikes, aimed at curbing inflation, may be starting to show some impact.

-

Energy prices show signs of moderation: While still elevated compared to pre-pandemic levels, energy prices showed a slight decrease in June. This downward trend in energy costs is a positive sign, contributing to the overall stability in the CPI. However, volatility in global energy markets remains a significant risk factor.

-

Food prices remain a concern: Despite a slight easing, food prices continue to be a significant contributor to inflation. Consumers are still experiencing higher grocery bills, placing a strain on household budgets. Experts are closely watching agricultural trends and global supply chains for signs of further price increases.

What This Means for Consumers and the Economy:

The relatively stable inflation figures offer a glimmer of hope for consumers struggling with rising prices. While inflation hasn't vanished, the slower pace of increases provides some breathing room. However, it's crucial to remember that this doesn't signify the end of inflationary pressures. Many economists believe that inflation will remain elevated for some time, potentially impacting consumer spending and economic growth.

The Federal Reserve's Next Steps:

The June CPI report will undoubtedly influence the Federal Reserve's upcoming decisions regarding interest rates. While the stable inflation numbers might suggest a pause or a smaller rate hike, the Fed will likely continue monitoring economic data closely before making any definitive announcements. A premature shift in monetary policy could risk reigniting inflation. Many experts anticipate continued vigilance from the central bank.

Looking Ahead: Challenges and Uncertainties:

Several challenges remain in the fight against inflation. Global economic uncertainty, geopolitical tensions, and supply chain disruptions all pose risks to future price stability. Closely monitoring these factors will be crucial in predicting the future trajectory of inflation.

Conclusion:

While the June CPI report provides a temporary respite, it's important to maintain a realistic perspective. The battle against inflation is ongoing, and continued monitoring of economic indicators and Federal Reserve actions is crucial. Consumers and businesses alike should remain vigilant and adapt their financial strategies accordingly. The coming months will be key in determining whether this stability is a trend or a temporary lull. Stay informed about economic developments to make the best financial decisions. Learn more about inflation by visiting [link to a reputable source on inflation, e.g., the Bureau of Labor Statistics website].

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Inflation Holds Steady: U.S. Consumer Prices Up In June, Meeting Expectations. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Uk Fines For 4chan Legal Team Announces Non Compliance

Aug 24, 2025

Uk Fines For 4chan Legal Team Announces Non Compliance

Aug 24, 2025 -

Immigration Raid Protecting Your Rights As An Immigrant Or Bystander

Aug 24, 2025

Immigration Raid Protecting Your Rights As An Immigrant Or Bystander

Aug 24, 2025 -

Severe Weather Alert Orlando And Central Florida Stormy Weekend Ahead

Aug 24, 2025

Severe Weather Alert Orlando And Central Florida Stormy Weekend Ahead

Aug 24, 2025 -

Can Penn State Win The College Football Playoff A Data Driven Analysis

Aug 24, 2025

Can Penn State Win The College Football Playoff A Data Driven Analysis

Aug 24, 2025 -

U S Consumer Price Index Increases June Inflation Data Released

Aug 24, 2025

U S Consumer Price Index Increases June Inflation Data Released

Aug 24, 2025

Latest Posts

-

August 23 2025 Winning Numbers For Texas Powerball And Lotto Texas

Aug 25, 2025

August 23 2025 Winning Numbers For Texas Powerball And Lotto Texas

Aug 25, 2025 -

Crystal Palace Vs Nottingham Forest Your Live Premier League Guide

Aug 25, 2025

Crystal Palace Vs Nottingham Forest Your Live Premier League Guide

Aug 25, 2025 -

Beat Bobby Flay Why Carmy Berzatto Wouldnt Survive According To Bobby Flay

Aug 25, 2025

Beat Bobby Flay Why Carmy Berzatto Wouldnt Survive According To Bobby Flay

Aug 25, 2025 -

Crystal Palace Nottingham Forest Match Preview And Prediction By Chris Sutton

Aug 25, 2025

Crystal Palace Nottingham Forest Match Preview And Prediction By Chris Sutton

Aug 25, 2025 -

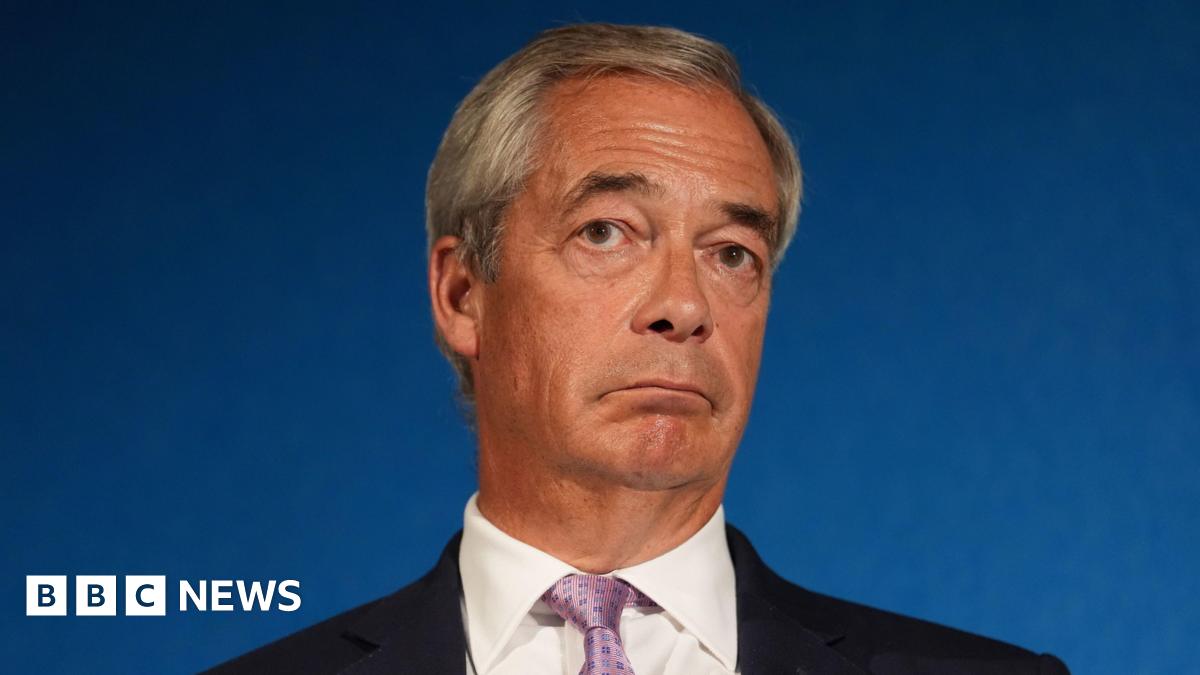

Deportations Pledged Farages Tough Stance On Small Boat Asylum Seekers

Aug 25, 2025

Deportations Pledged Farages Tough Stance On Small Boat Asylum Seekers

Aug 25, 2025