Inflation Holds Steady: U.S. Consumer Prices See Expected June Increase

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Inflation Holds Steady: U.S. Consumer Prices See Expected June Increase

Headline: Inflation Remains Stable in June, Offering a Glimmer of Hope for Consumers

Introduction: The U.S. consumer price index (CPI) rose 0.2% in June, matching economists' expectations and offering a potential sign that inflation may finally be cooling down. While still elevated compared to pre-pandemic levels, the steady increase suggests the Federal Reserve's aggressive interest rate hikes are starting to have the desired effect on taming inflation. This follows May's similarly modest 0.1% increase, painting a picture of a gradually slowing, but not yet vanquished, inflationary threat.

Key Data Points:

- Headline CPI: A 0.2% increase in June, mirroring May's growth and aligning with market forecasts. This marks a significant slowdown compared to the higher increases seen earlier in 2023.

- Core CPI (excluding volatile food and energy prices): The core CPI, a key indicator watched closely by the Federal Reserve, also rose 0.2% in June. This continued moderation suggests underlying inflationary pressures may be easing.

- Year-over-year inflation: While the monthly increase was modest, year-over-year inflation remains elevated, clocking in at 3%. This highlights the lingering impact of previous price increases. However, it represents a substantial decrease from the peak inflation rates seen in 2022.

What Does This Mean for Consumers?

The steady inflation numbers offer a small measure of relief for consumers struggling with persistently high prices. While prices are still elevated, the slowing rate of increase suggests some easing of the financial strain felt across the country. However, it's crucial to remember that inflation remains above the Federal Reserve's 2% target.

Federal Reserve Response and Future Outlook:

The Federal Reserve is closely monitoring these numbers to determine its next steps regarding interest rate policy. While the recent stability is encouraging, the central bank is likely to remain cautious, considering the persistence of elevated inflation. Further interest rate hikes remain a possibility, depending on future economic data. Economists are divided on the likelihood of additional increases, with some predicting a pause in rate hikes while others foresee one or two more increases before the end of the year. The ongoing debate emphasizes the complexity of predicting future inflation trends.

Factors Contributing to the Slowdown:

Several factors likely contributed to the slowdown in inflation. These include:

- Easing supply chain pressures: While not fully resolved, global supply chain disruptions have lessened, leading to more stable prices for some goods.

- Decreasing energy prices: Energy costs have shown some decline, contributing to the overall moderation in inflation.

- Shifting consumer spending patterns: Changes in consumer behavior, such as reduced spending on certain goods and services, may also be playing a role.

Looking Ahead: The relatively stable inflation figures in June provide a degree of optimism, but it's crucial to maintain a cautious perspective. The fight against inflation is far from over, and future data releases will be critical in determining the long-term trajectory of prices. Continued monitoring of economic indicators, such as employment figures and consumer spending, will be crucial in assessing the overall health of the economy and guiding future policy decisions. Further analysis from leading economic institutions will offer more detailed insights into the implications of these latest figures.

Call to Action: Stay informed about economic developments by regularly checking reputable news sources and government websites for updated data and analysis. Understanding economic trends is crucial for making informed financial decisions.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Inflation Holds Steady: U.S. Consumer Prices See Expected June Increase. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Paramount Renewal Reversal Popular Show Gets The Axe

Aug 28, 2025

Paramount Renewal Reversal Popular Show Gets The Axe

Aug 28, 2025 -

Police Investigate Mans Unsolicited Remarks To Girls In Epping

Aug 28, 2025

Police Investigate Mans Unsolicited Remarks To Girls In Epping

Aug 28, 2025 -

Trumps 4 Trillion Debt Reduction Claim Fact Checking The Tariff Impact

Aug 28, 2025

Trumps 4 Trillion Debt Reduction Claim Fact Checking The Tariff Impact

Aug 28, 2025 -

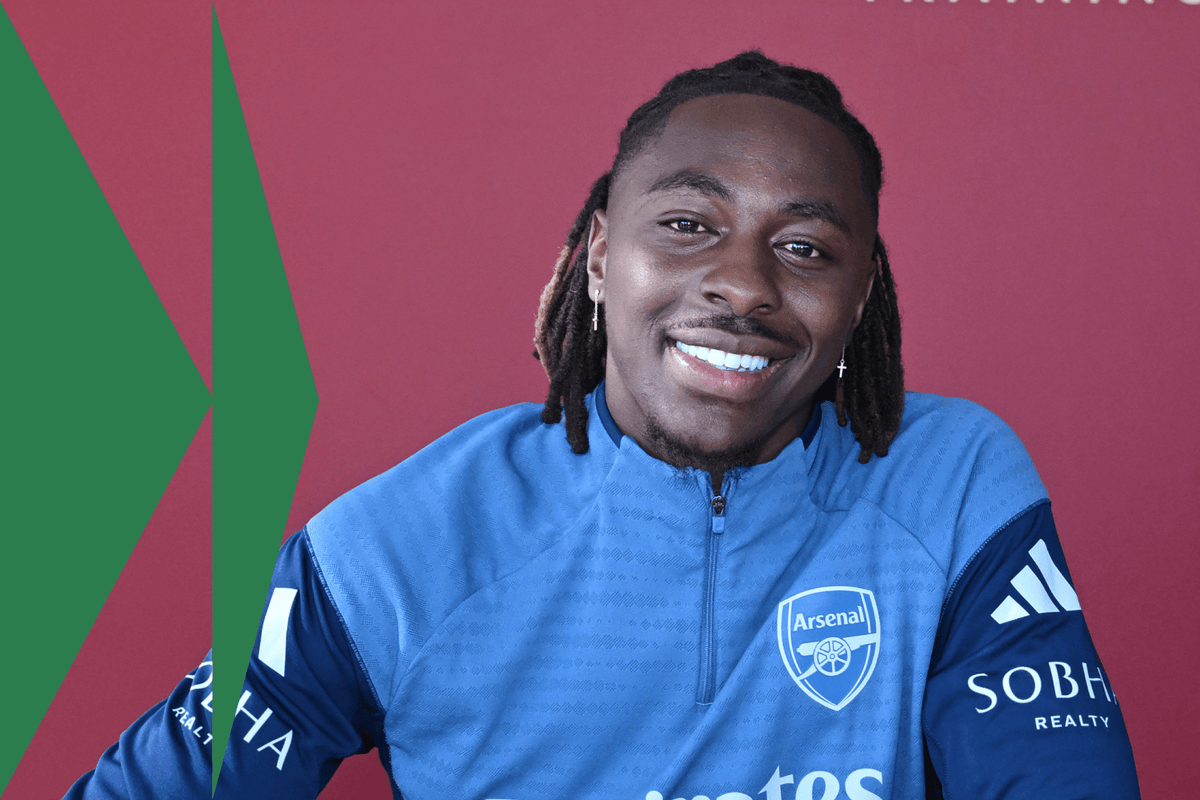

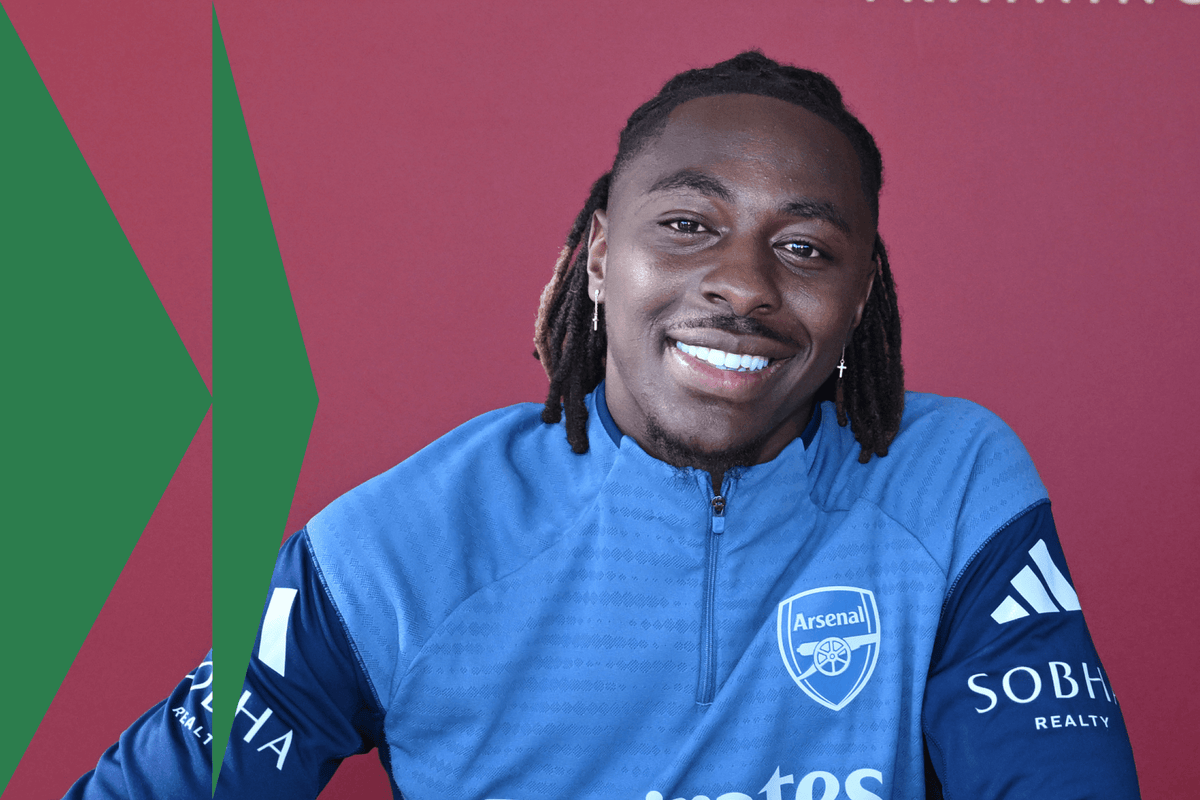

Eberechi Eze Arsenal Transfer Latest News And Updates

Aug 28, 2025

Eberechi Eze Arsenal Transfer Latest News And Updates

Aug 28, 2025 -

Carabao Cup Southamptons Dominant 3 0 Victory Over Norwich

Aug 28, 2025

Carabao Cup Southamptons Dominant 3 0 Victory Over Norwich

Aug 28, 2025

Latest Posts

-

Eberechi Eze To Arsenal Fee Contract Details And Transfer Timeline

Aug 28, 2025

Eberechi Eze To Arsenal Fee Contract Details And Transfer Timeline

Aug 28, 2025 -

Toxic As Hell Devon Walkers Explosive Snl Exit And Accusations

Aug 28, 2025

Toxic As Hell Devon Walkers Explosive Snl Exit And Accusations

Aug 28, 2025 -

Powerful Haboob Pummels Phoenix Dust Storm Brings Damage Airport Delays And Power Outages

Aug 28, 2025

Powerful Haboob Pummels Phoenix Dust Storm Brings Damage Airport Delays And Power Outages

Aug 28, 2025 -

Saison Compromise Jaquez Vf B Stuttgart Souffre D Une Fracture Du Nez

Aug 28, 2025

Saison Compromise Jaquez Vf B Stuttgart Souffre D Une Fracture Du Nez

Aug 28, 2025 -

Analysis Karoline Leavitts Trump Claim And Its Implications

Aug 28, 2025

Analysis Karoline Leavitts Trump Claim And Its Implications

Aug 28, 2025