Inflation Holds Steady: June CPI Shows Expected Increase In U.S.

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Inflation Holds Steady: June CPI Shows Expected Increase in U.S.

Inflation in the United States remained relatively stable in June, offering a cautious sigh of relief for consumers and policymakers alike. The Consumer Price Index (CPI) rose by 0.2% for the month, matching economists' predictions and following a similar 0.1% increase in May. While this signifies a continued, albeit slower, pace of inflation compared to the scorching rates of 2022, the fight against rising prices is far from over.

This latest CPI report, released by the Bureau of Labor Statistics (BLS), provides a snapshot of the ongoing economic battle. While the headline number suggests stability, a closer look reveals nuanced trends that require careful consideration.

Key Takeaways from the June CPI Report:

-

Core Inflation Persistent: While the overall CPI increase was modest, core inflation – which excludes volatile food and energy prices – saw a slightly higher increase of 0.3%. This indicates that underlying inflationary pressures remain present within the economy. This persistence of core inflation is a key concern for the Federal Reserve.

-

Energy Prices Fluctuate: Energy prices contributed significantly to the overall CPI increase in previous months. In June, however, energy prices showed less volatility, suggesting some stabilization in this critical sector. However, this could be temporary, and energy market fluctuations remain a significant risk factor.

-

Food Prices Remain Elevated: Food prices continue to represent a significant burden for many households. While the rate of increase slowed somewhat in June, food inflation remains a persistent concern and a key driver of overall inflation for lower-income families. [Link to BLS Food Price Data]

-

Shelter Costs Still High: Shelter costs, which encompass rent and homeownership expenses, remain a major contributor to inflation. This sector shows persistent upward pressure, reflecting the ongoing housing market challenges across the United States. [Link to Article on Housing Market Trends]

What This Means for Consumers and the Economy:

The relatively stable inflation figures in June offer a glimmer of hope, suggesting the aggressive interest rate hikes implemented by the Federal Reserve over the past year might be starting to have the desired effect. However, the persistence of core inflation and high shelter costs indicate that the battle against inflation is far from won.

Consumers can expect to continue navigating a challenging economic environment. While the pace of price increases may be slowing, many goods and services remain significantly more expensive than they were just a few years ago. Budgeting carefully and seeking out deals remain crucial strategies for managing household finances during this period.

What's Next for the Federal Reserve?

The Federal Reserve will carefully consider this report, along with other economic indicators, in determining its future monetary policy. While the June CPI report provides some evidence of progress, the persistence of core inflation likely means that further interest rate hikes remain a possibility. The Fed's next move will be closely watched by investors and consumers alike.

In conclusion, the June CPI report presents a mixed bag. While the headline number suggests some stabilization in inflation, persistent core inflation and high shelter costs underscore the ongoing challenges. The fight against inflation is likely to continue, requiring both careful monetary policy from the Federal Reserve and continued vigilance from American households. Stay tuned for further updates and analysis as more economic data becomes available.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Inflation Holds Steady: June CPI Shows Expected Increase In U.S.. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Travel Disruption Expected Londons Tube Faces Strike Action

Sep 09, 2025

Travel Disruption Expected Londons Tube Faces Strike Action

Sep 09, 2025 -

Total Lunar Eclipse In The Uk When And How To See The Blood Moon

Sep 09, 2025

Total Lunar Eclipse In The Uk When And How To See The Blood Moon

Sep 09, 2025 -

Development Threatens One Of The Worlds Most Sacred Sites

Sep 09, 2025

Development Threatens One Of The Worlds Most Sacred Sites

Sep 09, 2025 -

Cabinet Shuffle Burnham Expresses Concerns Following Rayner Exit

Sep 09, 2025

Cabinet Shuffle Burnham Expresses Concerns Following Rayner Exit

Sep 09, 2025 -

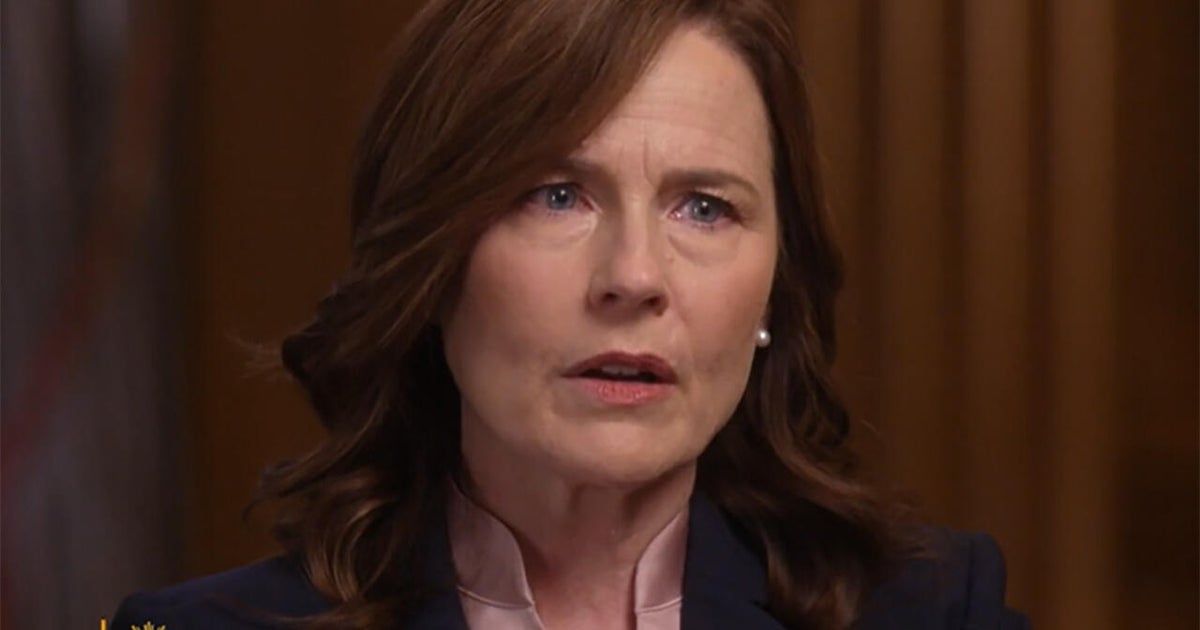

Amy Coney Barrett Defends Supreme Court Decisions Amid Trump Power Concerns

Sep 09, 2025

Amy Coney Barrett Defends Supreme Court Decisions Amid Trump Power Concerns

Sep 09, 2025

Latest Posts

-

Best Dressed At The 2025 Mtv Video Music Awards Red Carpet Fashion

Sep 09, 2025

Best Dressed At The 2025 Mtv Video Music Awards Red Carpet Fashion

Sep 09, 2025 -

Alcaraz Defeats Sinner In Us Open Final Reclaims World No 1

Sep 09, 2025

Alcaraz Defeats Sinner In Us Open Final Reclaims World No 1

Sep 09, 2025 -

Kaiser Permanente Nurses Strike Oakland And Roseville Walkout Monday

Sep 09, 2025

Kaiser Permanente Nurses Strike Oakland And Roseville Walkout Monday

Sep 09, 2025 -

World War Ii Bomb Disrupts Construction In Bratislava Leading To Evacuation

Sep 09, 2025

World War Ii Bomb Disrupts Construction In Bratislava Leading To Evacuation

Sep 09, 2025 -

Medal Controversy Great North Run Shows Sunderland Not Newcastle

Sep 09, 2025

Medal Controversy Great North Run Shows Sunderland Not Newcastle

Sep 09, 2025