Inflation Holds Steady: June CPI Data Confirms Expected Rise In U.S. Consumer Prices

Welcome to your ultimate source for breaking news, trending updates, and in-depth stories from around the world. Whether it's politics, technology, entertainment, sports, or lifestyle, we bring you real-time updates that keep you informed and ahead of the curve.

Our team works tirelessly to ensure you never miss a moment. From the latest developments in global events to the most talked-about topics on social media, our news platform is designed to deliver accurate and timely information, all in one place.

Stay in the know and join thousands of readers who trust us for reliable, up-to-date content. Explore our expertly curated articles and dive deeper into the stories that matter to you. Visit Best Website now and be part of the conversation. Don't miss out on the headlines that shape our world!

Table of Contents

Inflation Holds Steady: June CPI Data Confirms Expected Rise in U.S. Consumer Prices

Headline: Inflation Remains Persistent: June CPI Shows Modest Increase, Fueling Ongoing Economic Debate

The U.S. economy continues its dance with inflation, as the latest Consumer Price Index (CPI) data for June revealed a modest increase, largely in line with analyst predictions. While the numbers offer a degree of stability, the persistent upward pressure on prices keeps the Federal Reserve's monetary policy decisions firmly in the spotlight and fuels ongoing debate about the future trajectory of the economy. The release of this crucial economic indicator sent ripples through financial markets, impacting everything from bond yields to stock valuations.

What the June CPI Data Revealed:

The Bureau of Labor Statistics (BLS) reported a 0.2% increase in the CPI for June, following a similar 0.1% rise in May. This translates to a 3% year-over-year increase, slightly lower than the 4% increase seen earlier this year but still significantly above the Federal Reserve's 2% inflation target.

-

Key Contributors to Inflation: The continued rise in prices is attributable to several factors, including persistent increases in shelter costs, which continue to be a major driver of inflation. While energy prices saw a slight decrease, food prices remained stubbornly elevated. Used car prices also contributed, though their impact is diminishing compared to previous months.

-

Core CPI: The core CPI, which excludes volatile food and energy prices, also increased by 0.2% for the month, demonstrating a persistent underlying inflationary pressure within the economy. This underscores the challenge the Fed faces in taming inflation without triggering a significant economic slowdown.

Market Reactions and Economic Outlook:

The relatively steady, albeit still elevated, inflation figures prompted a mixed reaction in the financial markets. While some analysts interpreted the data as a sign of progress in the fight against inflation, others remain cautious, highlighting the continued pressure on consumers and the potential for further interest rate hikes by the Federal Reserve.

The persistent inflation raises several key questions for economists and policymakers:

-

Will the Fed continue raising interest rates? Many analysts believe the June CPI data will likely influence the Federal Reserve's decision at its upcoming meeting. While a pause or a smaller rate hike is now possible, the persistent inflation likely means further tightening of monetary policy remains on the table. Learn more about the {:target="_blank"} on their official website.

-

What impact will sustained inflation have on consumer spending? High inflation erodes purchasing power, potentially leading to a decrease in consumer spending and slowing economic growth. The resilience of consumer spending will be a key factor in determining the overall economic outlook.

-

What's the long-term outlook for inflation? Predicting the future trajectory of inflation remains challenging, with various factors potentially influencing price changes in the coming months and years. Geopolitical events, supply chain disruptions, and changes in consumer demand all play significant roles.

Conclusion:

The June CPI data paints a picture of persistent, albeit slightly moderated, inflation. While the modest increase provides some respite, the underlying inflationary pressures remain a concern, demanding continued vigilance from policymakers and careful consideration by consumers and businesses alike. The coming months will be crucial in determining whether the current trajectory represents a sustained slowdown or merely a temporary pause in the fight against inflation. Stay tuned for further updates and analysis as more economic data becomes available.

Thank you for visiting our website, your trusted source for the latest updates and in-depth coverage on Inflation Holds Steady: June CPI Data Confirms Expected Rise In U.S. Consumer Prices. We're committed to keeping you informed with timely and accurate information to meet your curiosity and needs.

If you have any questions, suggestions, or feedback, we'd love to hear from you. Your insights are valuable to us and help us improve to serve you better. Feel free to reach out through our contact page.

Don't forget to bookmark our website and check back regularly for the latest headlines and trending topics. See you next time, and thank you for being part of our growing community!

Featured Posts

-

Superman Sequel Man Of Tomorrow Flies Into Theaters July 2027

Sep 11, 2025

Superman Sequel Man Of Tomorrow Flies Into Theaters July 2027

Sep 11, 2025 -

Banksys Latest Artwork London High Court Vandalized

Sep 11, 2025

Banksys Latest Artwork London High Court Vandalized

Sep 11, 2025 -

Ethics Advisers Dismissal Sparks Controversy Bondis Explanation Questioned

Sep 11, 2025

Ethics Advisers Dismissal Sparks Controversy Bondis Explanation Questioned

Sep 11, 2025 -

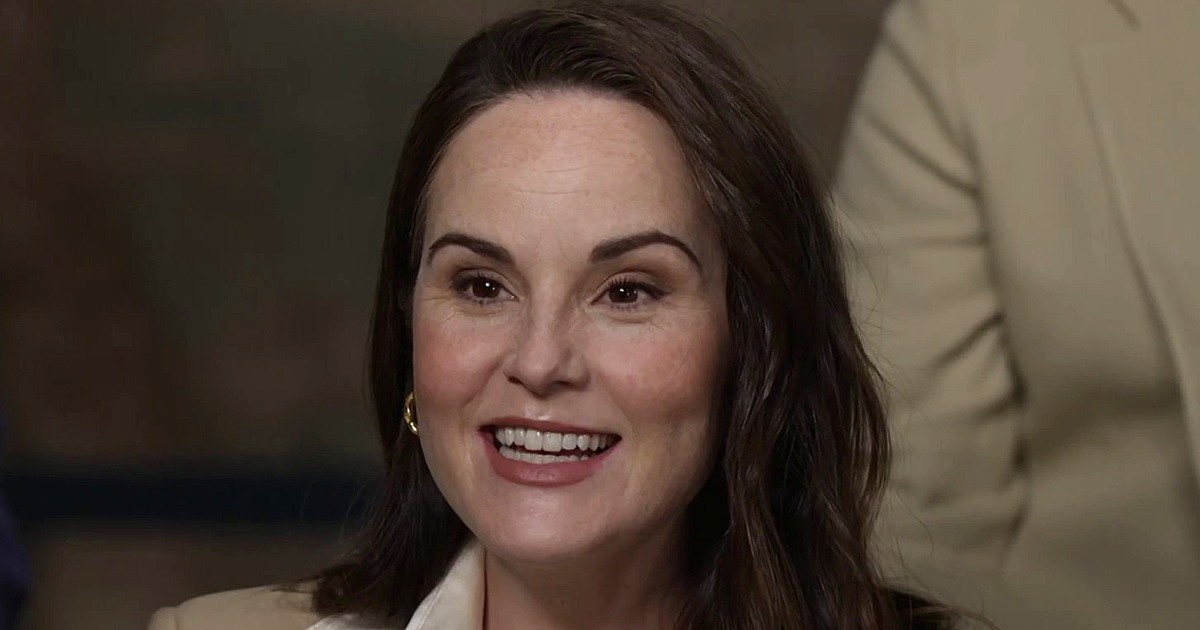

Downton Abbeys Michelle Dockery On Her First Pregnancy Experience

Sep 11, 2025

Downton Abbeys Michelle Dockery On Her First Pregnancy Experience

Sep 11, 2025 -

Westbury White Horse Extent Of England Flag Damage Evaluated

Sep 11, 2025

Westbury White Horse Extent Of England Flag Damage Evaluated

Sep 11, 2025

Latest Posts

-

Quarterly Revenue Miss Sends Synopsys Stock Lower

Sep 11, 2025

Quarterly Revenue Miss Sends Synopsys Stock Lower

Sep 11, 2025 -

The Ben And Jerrys Legacy Founders Speak Out Against Unilever

Sep 11, 2025

The Ben And Jerrys Legacy Founders Speak Out Against Unilever

Sep 11, 2025 -

Rare Opportunity Core Weaves Crwv Stock Market Decline

Sep 11, 2025

Rare Opportunity Core Weaves Crwv Stock Market Decline

Sep 11, 2025 -

Coupe De Cheveux Marion Cotillard Inspiration Et Conseils Pour Reproduire Son Style

Sep 11, 2025

Coupe De Cheveux Marion Cotillard Inspiration Et Conseils Pour Reproduire Son Style

Sep 11, 2025 -

Ben And Jerrys Founders Distance Themselves From Unilever

Sep 11, 2025

Ben And Jerrys Founders Distance Themselves From Unilever

Sep 11, 2025